-

CIT Bank and Simple recently started offering higher yields on the condition that customers make regular contributions to savings. The offers are designed to help the banks avoid rate wars, but some analysts question whether they will appeal to enough consumers.

October 10 -

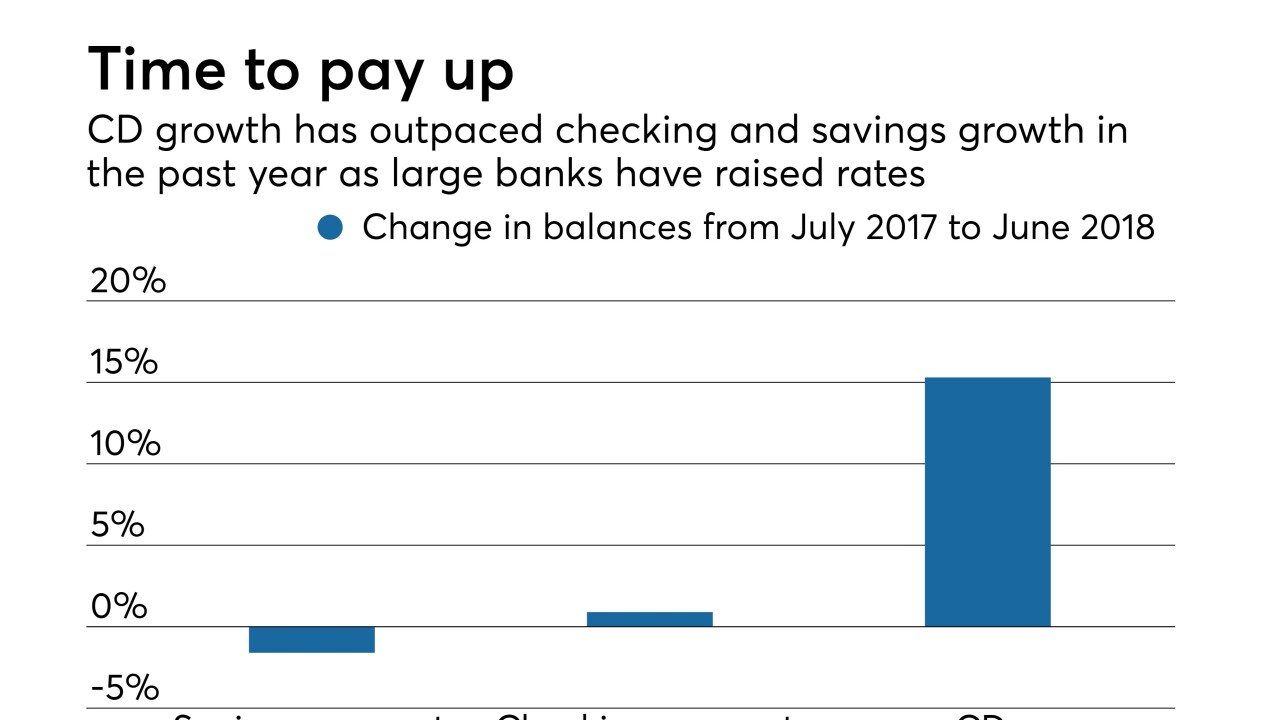

New data from the FDIC shows that banks with less than $10 billion of assets are ceding deposit share to their larger rivals. What can they do to keep pace?

September 25 -

Large retailers want the right to reject rewards cards at the point of sale to avoid higher swipe fees; Germany's financial regulator appoints an auditor to monitor the Deutsche Bank's progress.

September 25 -

Zions is streamlining its 500 deposit products as part of a massive core conversion, and its female executives are leading the effort.

September 23 -

"Normal system upgrade" knocks out SunTrust's online- and mobile-banking ops; "just a matter of time" before Amazon, Google enter mortgages; Wells Fargo looking for Tim Sloan's replacement?; and more from this week's most-read stories.

September 21 -

Carey Halio, who becomes CEO of Goldman Sachs Bank USA next month, wants to sustain its drive for consumer deposits and add products that make it more of a primary bank for customers.

September 17 -

Halio has served as chief financial officer of Goldman Sachs Bank USA for the past four years, and she previously worked in the company’s credit risk division

September 17 -

On Jun. 30, 2018. Dollars in thousands.

September 17 -

A new, 10-part podcast series examining housing blight; JPMorgan’s Jamie Dimon baits President Trump; U.S. Bank returns to small-dollar lending; and more from this week’s most-read stories.

September 14 -

The proposal, required by the regulatory relief package that Congress passed in May, would exempt the healthiest banks from having to count reciprocal deposits as brokered deposits.

September 13 -

The broadening of JPMorgan's Sapphire Reserve brand is emblematic of the niche expansion megabanks must rely on since bank M&A is not an option.

September 13 -

Some are relying on a national, digital strategy. Others say the right balance of costs and growth comes from more traditional means such as targeted branch openings and out-of-market expansion.

September 12 -

The agency said it would not apply the data collection requirement for existing accounts that automatically renew or roll over, such as certificates of deposit or commercial credit cards.

September 10 -

Larger community banks are favoring bigger targets — or relying more on organic growth — to expand.

August 24 -

On Mar. 31, 2018. Dollars in thousands.

August 13 -

BofI has agreed to buy $3 billion of deposits from Nationwide Bank as part of the insurance giant's exit from retail banking. The deal comes three years after BofI bought H&R Block Bank's deposits.

August 3 -

Loan growth accelerated for those in our annual ranking of banks with assets of $10 billion to $50 billion. See which of these 65 regionals are the best performers.

August 1 -

Once a hotbed of activity, the region has reported the fewest bank mergers since the financial crisis.

July 30 -

Year to date Mar. 31, 2018. Dollars in thousands.

July 30 -

The Detroit company is facing stiffer competition in the battle for online deposits, but it has benefited from a key rival's retreat in auto lending

July 26