Digital banking

Digital banking

-

To improve a declining rating in the annual American Consumer Satisfaction Index, credit unions may have to make hefty investments in technology upgrades, something most of them can't afford.

December 10 -

Sells, American Banker's Digital Banker of the Year for 2020, says he will help the New York fintech startup create digital currency products for banks.

December 9 -

Citigroup looked to the success of Asian super-apps like Ant Financial and Paytm while developing its new checking-account offering with Google.

December 8 -

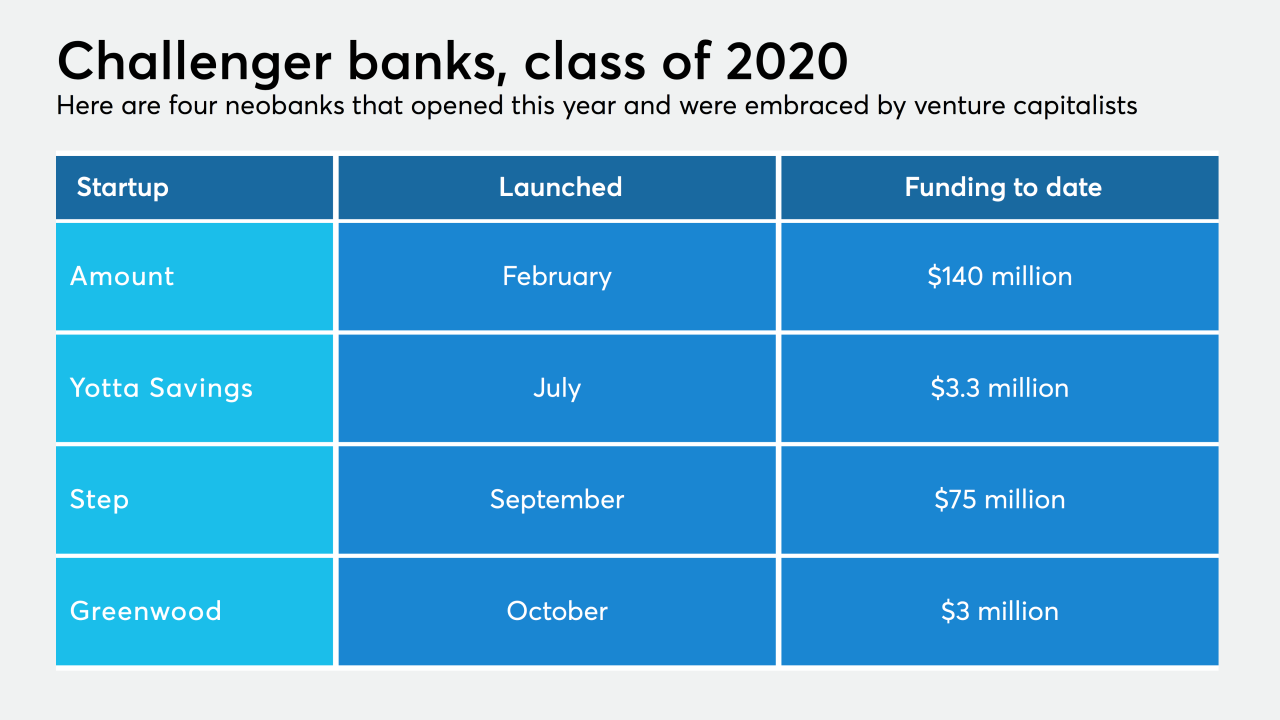

Fintech success stories have encouraged investors to back more startups, but newcomers will be hard-pressed to attract enough customers to compete while keeping expenses down.

December 7 -

The Waterbury, Conn., parent company of Webster Bank joins a fast-expanding list of banks reducing the size of their branch networks to save money and focus on digital capabilities.

December 4 -

Michael Moeser, senior analyst at PaymentsSource, talks to Brandon Thompson, EVP at Green Dot, about the drastic changes its audience has faced over the course of 2020.

December 3 -

The tech firm spun off by Avant, which licenses its lending software to banks, has now raised $140 million this year.

December 2 -

Elizabeth Magennis recently served as the New Jersey company's chief lending officer. ConnectOne also hired Michael O'Malley, a former OnDeck Capital executive, as chief risk officer.

December 1 -

The 5-year-old company, which recently raised $131 million, says its strong growth reflects the timeliness of its mission: helping consumers who live paycheck to paycheck build wealth.

November 25 -

CEO Wendy Cai-Lee says Piermont Bank can do it all for financial technology firms: be their commercial banker, be their banking-as-a-service provider and develop APIs and other cutting-edge products for them.

November 24