Digital banking

Digital banking

-

Citing customers’ increased adoption of digital services over the past two years, banks are shrinking their physical presence, while also renovating the locations they keep — but credit unions are bucking the trend.

March 9 -

Liberty Bank and Texas Capital Bank are among those trying to attract new online-only customers while experimenting with technologies to benefit the institutions overall.

March 8 -

Five Star Bank, which is based in a rural part of New York state, has embraced digital lending, banking-as-a-service, real-time payments, bitcoin and more. “Those that don’t innovate don’t survive,” says Chief Administrative Officer Sean Willett.

March 6 -

Russia reverberations, a rebranding, a resignation and more in banking news this week.

March 4 - AB - Technology

The New York bank recently converted 3 million GM Rewards cardholders to its Marcus app, the next phase of its plans to offer more banking services in unexpected places.

March 1 -

The bank’s unified digital plans include personalization and a customized mobile dashboard encompassing all the business a customer does with BofA.

February 25 -

With its $1.1 billion deal for Technisys, the onetime student-loan refinancer adds a banking-core software arm as it pushes beyond deposits and lending.

February 22 -

The tax preparer has a well-recognized brand and wide reach, but needs tech help for its neobank.

February 17 -

Starling Bank Ltd. is weighing plans for a fresh funding round that could value the U.K. challenger at around 2.5 billion pounds ($3.4 billion), according to people familiar with the matter.

February 11 -

Affirm Holdings, known for its buy now/pay later options, beefed up its app as the firm works toward a crypto offering.

January 26 -

The number of U.S. bank branches dropped by a record 2,927 last year as lenders both large and small sought ways to cut costs and keep pace with a digital transformation sweeping the finance industry.

January 21 -

The tax preparation giant is diversifying its services with a digital bank that it hopes will entice customers with no-fee features, cash back rewards and early access to paychecks.

January 20 -

Google has hired former PayPal executive Arnold Goldberg to run its payments division and set a new course for the business after it scrapped a push into banking.

January 19 -

Traditional banks could be forced to add cryptocurrency product offerings in 2022 to compete with fintechs that are taking advantage of blockchain innovations, according to Diogo Mónica, co-founder and president of Anchorage.

January 18 -

A group of community banks and two major trade associations have formed a partnership with and invested in the fintech NYDIG to offer the service on the banks’ mobile apps by midyear. The banks say it will help them generate revenue and retain customers interested in cryptocurrency.

January 18 -

The Los Angeles company, set Thursday to complete a merger with a special-purpose acquisition company and raise more than $3 billion in a stock offering, plans to develop new banking and cryptocurrency-related services this year, CEO Jason Wilk says.

January 6 -

First Premier Bank in South Dakota revamped its online sign-up process to allow customers to name the banker who referred them. This helps bankers overcome their reluctance about digital accounts and lets them start relationships with new customers.

December 30 - AB - Technology

The lender will start by cross-selling Digit's products, then gradually consolidate the two companies' platforms. Meanwhile, Oportun is working to put questions about its collections practices behind it.

December 28 -

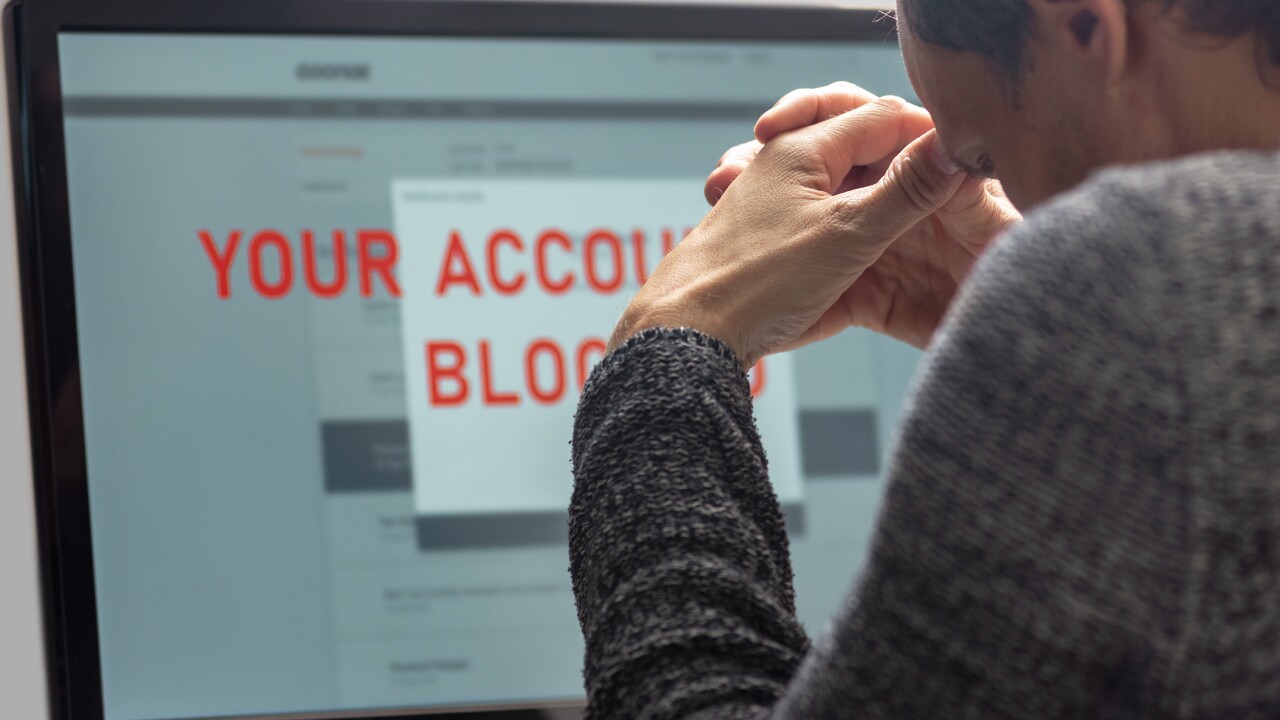

Some established financial technology companies like Robinhood are said to be refusing to accept funds from accounts at young digital-only banks that they say are growing too fast to deter fraud. The companies being blocked respond that it’s an unfair, scattershot approach.

December 20 -

The consumer bureau asked for public feedback about payment platforms as part of a focus on the Silicon Valley giants’ financial services aspirations. But comment letters so far have been dominated by users complaining that they lost money on the big-bank-owned peer-to-peer network.

December 20