Digital banking

Digital banking

-

Saul Van Beurden will have oversight of both technology and information security and will report to CEO Tim Sloan.

January 9 -

Automating the loan application process is a potentially game-changing development that could put more car shoppers in control of which bank or credit union finances their purchase.

January 7 -

Investments in software can speed up decision-making and help traditional lenders better compete with fintechs for creditworthy customers who want their loans quickly.

January 7 -

As consumers continue to migrate to banking apps, it may be tempting for banks to focus solely on improving that channel experience. But doing so would be making the same mistake as focusing only on cards or cash at the point of sale.

January 7 -

The coming year will bring a wave of data-sharing deals between banks and fintechs, increased bank use of automated advice, marked changes to financial jobs as a result of automation, and much more.

January 6 -

As consumers continue to migrate to banking apps, lenders may be tempted to focus solely on improving that channel. But new data suggests consumers aren't abandoning other platforms just yet.

January 4 -

Santander taps JPMorgan Chase exec Colleen Canny to lead retail network; can Trump actually fire Fed's Powell?; will 2019 bring long-awaited reform of Fannie Mae, Freddie Mac?; and more from the past two week's most-read stories.

January 4 -

Readers respond to Wells Fargo's latest fine, weigh Sen. Elizabeth Warren's potential bid for president, consider how banks are preparing for climate change and more.

January 3 -

Banks need to stake out a presence on platforms that have nothing to do with banking.

January 2 -

New CEO John Turner hasn't fully laid out his vision for the future, but it clearly will involve hiring specialized lenders, balancing labor-saving AI with old-fashioned relationship building, and more streamlining.

January 2 -

Bank technologists see the potential for AI in lending, money laundering detection, fraud and other areas. Regulators and bank executives insist on “explainability.”

January 1 -

A Colorado businessman's request for a preliminary injunction to stop the bank from using the name “Erica” has been denied. The overall case could still go to trial, but skeptical comments by the judge suggest BofA will likely prevail.

December 31 -

The year saw anxiety over how banks would respond to record consumer debt, disruptive glitches at TD Bank and SunTrust, ongoing scandal at Wells Fargo, and much, much more.

December 30 -

While these five bankers made headlines this year, not all of them did so for good reasons.

December 25 -

Among the most innovative CEOs of his generation, the former Umpqua chief and Pivotus founder is taking some of his best ideas to a new fintech as an adviser.

December 20 -

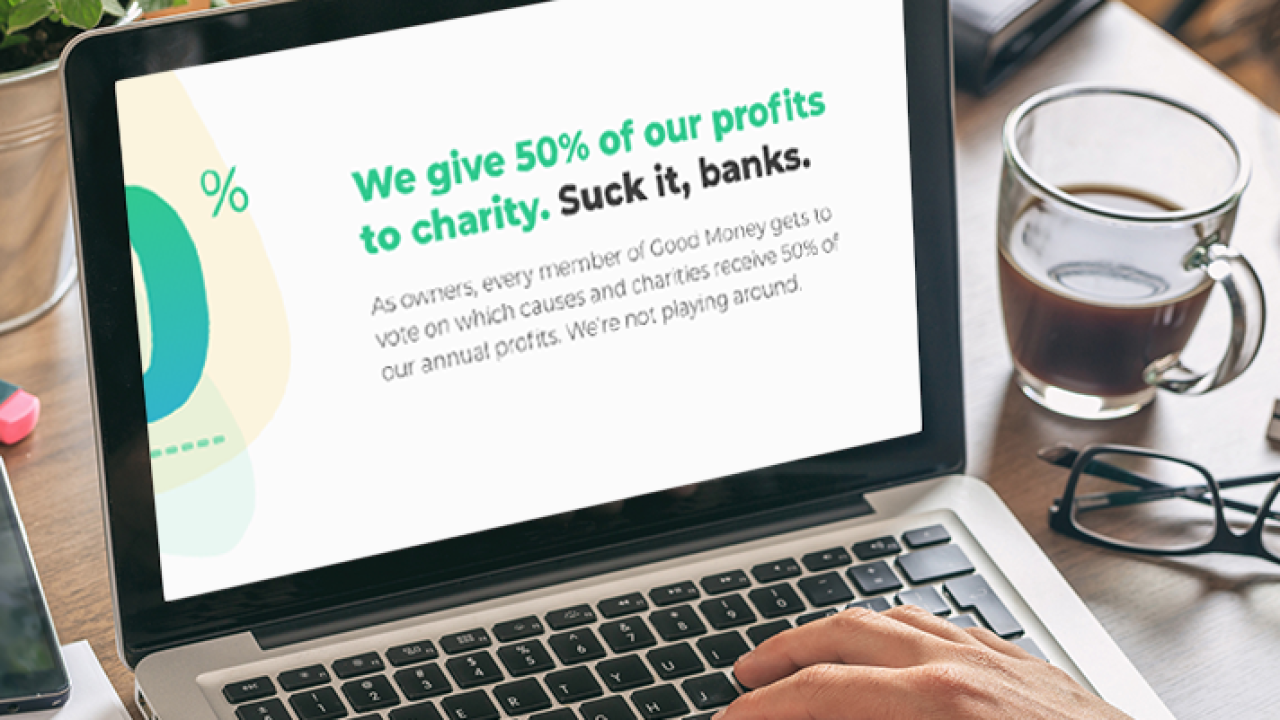

Good Money just raised $30 million and is a year away from launching, but already is raising concerns for its trash-talking of established players.

December 19 -

The industry's technology priorities and budgets are headed for a distinct shift in 2019. What's in: new initiatives in digital banking and analytics. What's not: new initiatives built on blockchain technology.

December 19 -

The industry’s technology priorities and budgets are headed for a distinct shift in 2019. What’s in: new initiatives in digital banking and analytics. What’s not: new initiatives built on blockchain technology.

December 19 -

Branch acquisitions, once a popular way to scale up in new markets, have started to go by the wayside in the digital age.

December 16 -

The fintech's new products may violate several banking and securities regulations and could mislead the public about the differences between coverage on banking and investment accounts, industry officials say.

December 14