Digital banking

Digital banking

-

JAM FINTOP Banktech will fund startups that offer services designed for the banking industry. All 66 limited partners are banks.

April 7 -

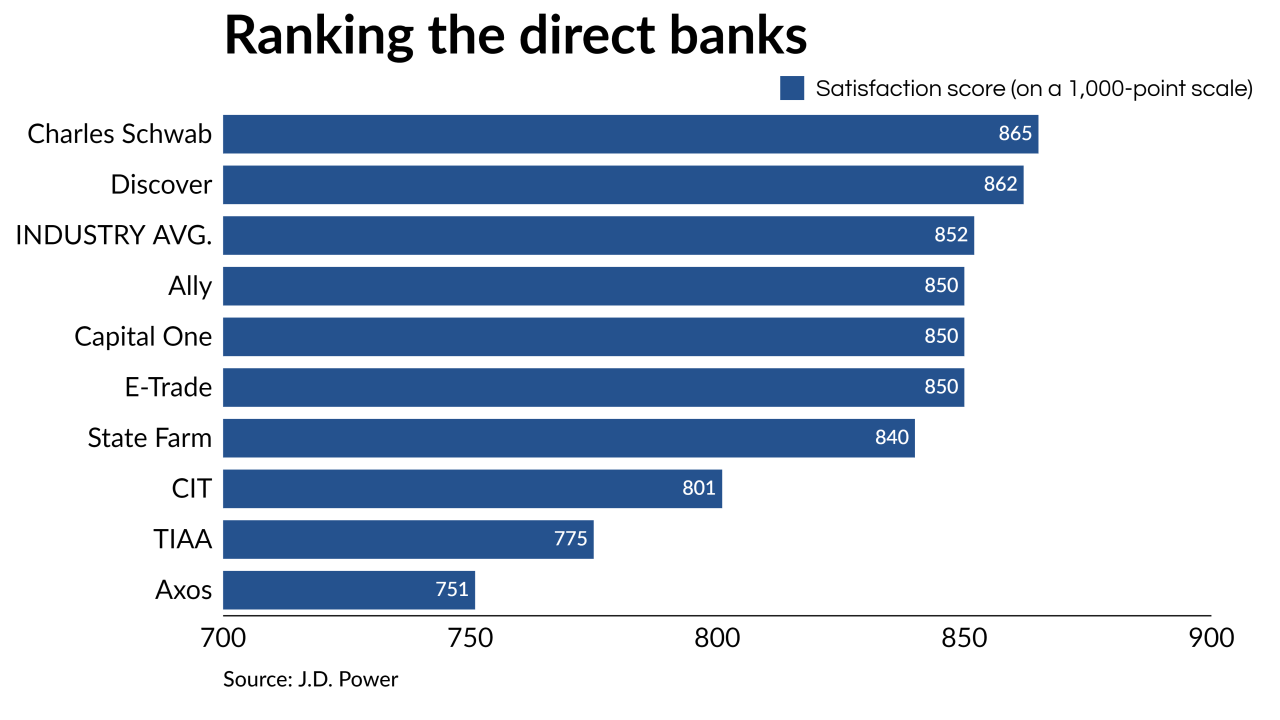

While branchless banks are taking market share from brick-and-mortar rivals, they aren’t necessarily wowing consumers with service, according to a recent J.D. Power survey. The findings suggest that direct banks can do a better job communicating with their customers, particularly in times of crisis.

April 6 -

A comprehensive strategy around when and how consumers pay bills online can better help credit unions understand members' behavior patterns and deepen those relationships.

April 5 -

Thousands of customers have called OceanFirst Bank with a new set of technical questions: How do you download an app? Make a mobile deposit? Load a debit card into Apple Pay? CEO Chris Maher explains how the New Jersey company is handling the shift to digital banking.

March 30 -

Bradley Riss is chief commercial officer at Checkout.com, a firm that acts as a payment gateway, acquirer and processor through a single channel, covering cards, passthrough wallets, stored value wallets and alternative payment options such as point of sale credit. It charges a fee based on processing and card payment costs rather than the percentage+ model that most payment API companies charge. The model is designed to make the service customized to different merchants and serve as a base to offer other merchant products.

March 26 -

Six years after unloading its bank unit, the tax preparation chain wants to diversify by launching a digital account targeting low- and moderate-income households. How will it differentiate itself from upstarts like Chime, Varo and Green Dot?

March 26 -

Truist Financial's venture capital division led the Series A funding round for Greenwood, a platform aimed at Black and Latino customers. Other investors include Bank of America, Citigroup, Mastercard and Visa.

March 25 -

The Minneapolis company teamed with the fintech Personetics to develop an automated-savings feature on its app that goes beyond most rival offerings by monitoring cash flow and spending to determine safe amounts to set aside.

March 24 -

Decentralized finance, in tandem with financial institutions, could create a more efficient, convenient, wider-reaching and more secure experience than traditional finance alone, says FISPAN's Clayton Weir.

March 23 -

Front-line employees yearn to be told they still have a critical role to play, as more customers are seeking in-person help amid the pandemic.

March 19 -

The American Fintech Council and the Financial Technology Association say they’ll promote responsible innovation, fair access to financial services and more. Their dozens of members include some of the biggest names in fintech.

March 17 -

Showcasing contactless ATM access and enabling easier use of stimulus funds are among the ways the megabank and digital upstart are tailoring services to customers acquired during the pandemic.

March 17 -

Showcasing contactless ATM access and enabling easier use of stimulus funds are among the ways the megabank and digital upstart are tailoring services to customers acquired during the pandemic.

March 17 -

M&F Bancorp in North Carolina plans to use some of the $18 million it received from big banks to make overdue improvements to its commercial lending platform.

March 16 -

Harmening, set to take the helm of Associated Banc-Corp next month, is being asked to replicate the digital transformation he led at Huntington Bancshares. His career path is a signal to the industry’s rising stars that the road to the corner office includes hands-on technology work.

March 12 -

The company is anticipating at least $175 million in losses in 2021, but its recent acquisition of Radius Bancorp will reduce funding costs and allow it to develop a full gamut of banking products that its CEO says will eventually yield big profits.

March 11 -

The Delaware company would remove a rival, gain scale in affluent Philadelphia suburbs and accelerate its transformation from a branch-heavy lender to a digital-first bank with the $976 million acquisition.

March 10 -

Square, LendingClub and SoFi are among the upstarts that once positioned themselves as outsiders but now seek to challenge banks more directly. Here's how they're doing it.

March 10 -

Andrew Harmening, who oversaw Huntington's digital strategy, will succeed the retiring Philip Flynn as president and CEO of the Wisconsin regional bank in April.

March 10 -

The acquisition of Golden Pacific Bank will accelerate the online lender’s effort to become a full-service bank.

March 9