-

Trust in biometrics solves the major obstacle to even wider contactless adoption: contactless spending limits, says Fingerprints' Christian Frederickson.

July 17 Fingerprints

Fingerprints -

The coronavirus pandemic has led to a massive surge in Canadians using digital identity authentication platforms to get immediate access to government emergency aid.

July 9 -

The coronavirus pandemic has led to a massive surge in Canadians using digital identity authentication platforms to get immediate access to government emergency aid.

July 7 -

Getting rid of passwords is easier in concept than practice, with hundreds of initiatives designed to build something more digital, flexible and transportable. But none have taken hold, causing one developer to try an approach that rejects most of the prevailing methods.

May 19 -

The global efforts to contain the coronavirus outbreak are leading to drastic actions that test the limits of what consumers will accept when governments and other entities use their payment data.

March 4 -

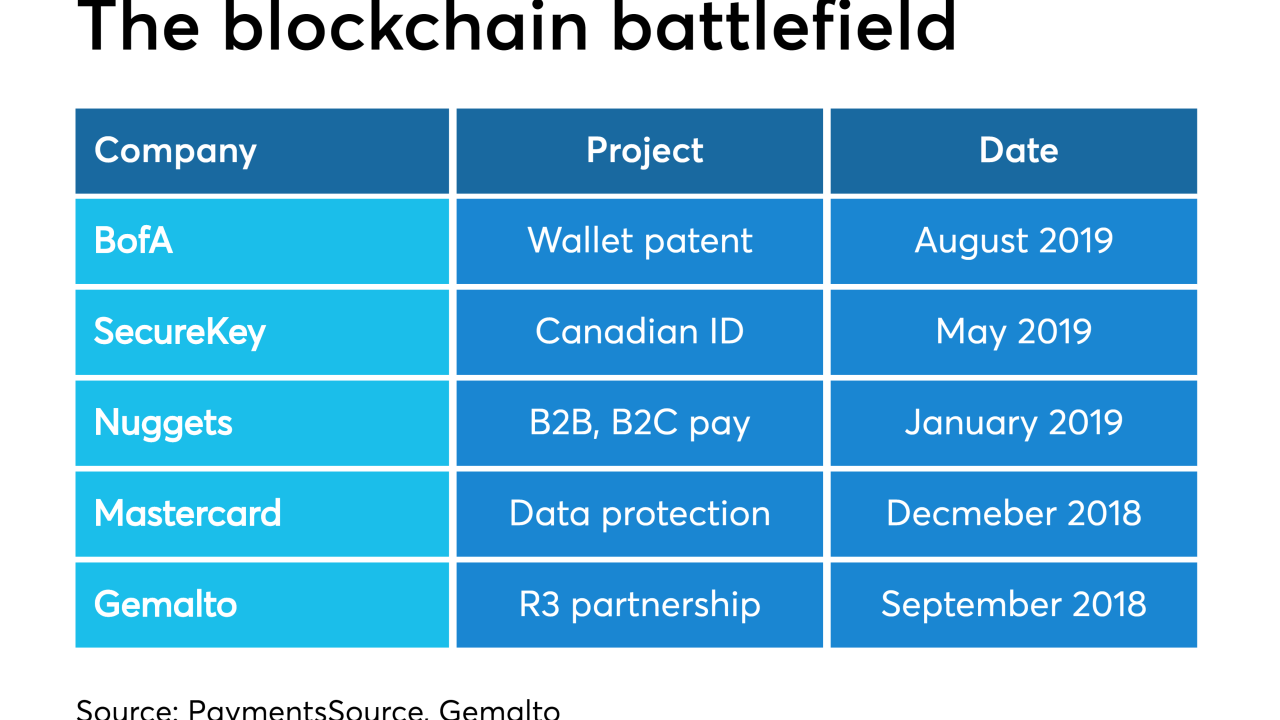

There's been a lot of interest in using blockchain, the distributed ledger technology developed for bitcoin, to modernize payments and banking systems. But as with any technology, blockchain is only secure if its users can be trusted.

February 24 -

Progress in the trade war is welcome news for Mastercard’s ambitions in China, though the coronavirus jeopardizes the rosy outlook.

January 29 -

The move to dump passwords in favor of more flexible authentication will likely happen in clusters, with schools providing many of the factors necessary.

January 17 -

The bank is investing in a new authentication platform because password-based security systems have too many weaknesses, says Juan Francisco Losa, BBVA’s global head of security architecture.

January 14 -

Innovation is showing little sign of slowing, creating both myriad benefits and risks moving ahead, says Visa's Paul Fabara.

December 26 Visa

Visa -

Consumer identities are becoming increasingly digital and more prone to privacy risks. Lawmakers cannot sit idle.

November 7 Orrick

Orrick -

Consumer identities are becoming increasingly digital and more prone to privacy risks. Lawmakers cannot sit idle.

October 30 Orrick

Orrick -

As requirements change, open standards can help governments feel confident that solutions are agnostic, flexible and safe from vendor lock-in, says the OSPT Alliance's Luiz Guimaraes.

October 24 OSPT Alliance

OSPT Alliance -

More states are adopting mobile driver’s licenses, sparking hope of creating a shareable consumer-driven digital ID to power e-commerce and data sharing among banks, fintechs and merchants.

October 1 -

Fincen and others say third parties are proving to be treasure chests for crooks who create synthetic identities, but aggregators argue they help detect risk banks can’t see.

September 30 -

The patent office is getting buried in applications for distributed ledger systems, a mountain of documents that chart a clear course toward making static identity and password protection irrelevant.

September 6 -

The idea of a common digital identity for consumers has become more compelling amid the digitalization of the world's economy. Many bank and credit union executives consider it a natural fit, one the industry should be prepared to lead on.

August 28 -

The idea of a common digital identity for consumers has become more compelling amid the digitalization of the world's economy. Many bank and credit union executives consider it a natural fit, one the industry should be prepared to lead on.

July 19 -

A new project backed by the government of Luxembourg could ultimately be influential in the U.S., where banks have been slow to develop a shared platform for digital identities.

July 16 -

The Los Angeles company has established a network that is designed to help verify the identities of consumer and small-business borrowers. It says 20 lenders are participating and that it is trying to recruit more.

June 12