Digital payments

Digital payments

-

Electronic payments are spiking during the coronavirus, but access to different automated versions is needed, says Qualpay's Penny Townsend.

June 12 -

The push for a public option to digitize government payments has gotten stronger, and the discussion has moved on from whether it should happen to how it should happen.

June 11 -

Europe’s Just Eat Takeaway.com NV agreed to acquire U.S.-based Grubhub Inc. for $7.3 billion, in a deal that creates one of the world’s largest meal-delivery companies as the coronavirus pandemic drives a surge in orders.

June 11 -

AI is not merely a play to cut costs or replace human capital, says Silent Eight's Jim Logan.

June 11 -

The immediate lockdown of the nation’s economy in response to attempts to flatten the coronavirus infection curve has had a widespread impact on the revenues of all businesses, particularly small ones that are more susceptible to economic disruptions.

June 11 -

The coronavirus dealt a double blow to procurement, cutting off both goods and money. Banks and e-commerce firms are relying on partnerships to tweak payment tools to rescue the market.

June 11 -

In a sign of the rapid shift to digital transactions, MoneyGram reported that its digital transactions grew by 100% in May, compared to the same time last year.

June 10 -

Manual work is time-intensive and resource-draining, especially when it involves high volumes of data across disparate systems. When it comes to payments, this can get really complicated with all the moving pieces, says Global Payments Integrated's Ashley Jones.

June 10 -

Mondial Bony has partnered with Credorax to launch the MondialPOS merchant acquiring solution in Italy to address the country’s shift to e-commerce amid coronavirus.

June 10 -

Meeting customers where and how they want to pay is critical for completing transactions, and while retailers want to offer as healthy and safe of a solution as possible, but that can be expensive and complex, says Merchant Advisory Group's John Drechny.

June 10 -

As treasury departments modernize, new ways to serve consumers also arise, says Icon Solutions Lauren Jones.

June 9 -

B2B space will have a permanent shift towards digitization, a desire for contactless experiences, and a greater need for efficient and reliable cash flow, according to Billtrust's Nick Babinsky.

June 9 -

Alfie’s Beer Bus found a niche as an offbeat character at events in the U.K. — like an ice cream truck, only with alcohol. Then the coronavirus came.

June 9 -

SolarisBank and Visa have provided the technology to enable Vivid Money to launch its mobile banking app in Germany with virtual cards and cash-back rewards.

June 8 -

Apple Inc. is planning a service that will allow customers to buy products including iPads, Macs and AirPods and split up the cost over several months with interest-free payments.

June 8 -

Paysafe is expanding the reach of its Skrill digital wallet to U.S. consumers who will be able to use it to send funds to 18 countries.

June 8 -

As merchants are challenged to adapt their business just to survive, and consumers push for greater control over where and how they spend, the payments industry is in a position to align the various needs, says Splitit's Brad Paterson.

June 5 -

Grab Holdings Inc., Southeast Asia’s ride-hailing giant, is expanding delivery services from convenience stores and supermarkets across 50 cities in the region.

June 4 -

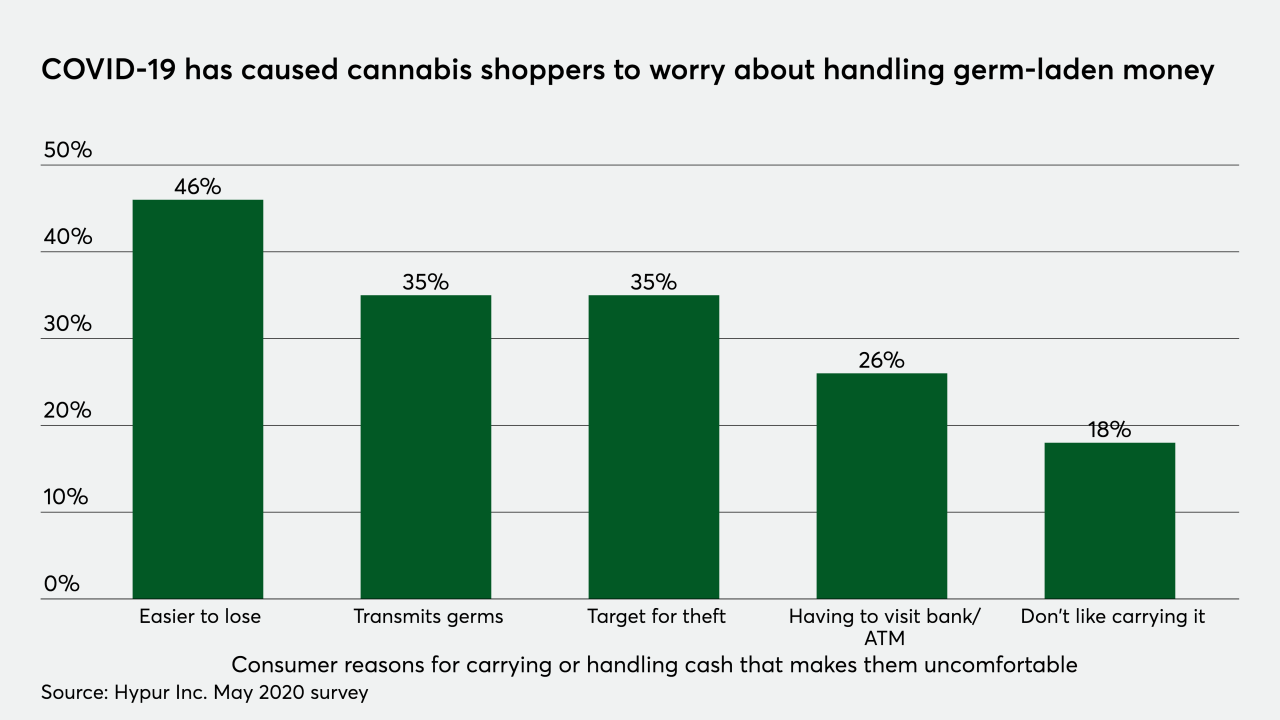

The coronavirus pandemic has changed the way many industries conduct business — and that's especially true of the legal cannabis industry, which was already struggling in the U.S. to find the best way to handle noncash payments.

June 4 -

Walt Disney Co. has at least temporarily cut several reservation and incentive features tied to its closed loop payment system, revealing the complexities of mixing health guidance with tourism.

June 4