Digital payments

Digital payments

-

PayU is expanding its umbrella of payment companies in developing markets in a $70 million deal to buy Wibmo, a Cupertino, Calif.-based digital payments company that integrates with banks in 20 countries for payment authentication and security.

April 12 -

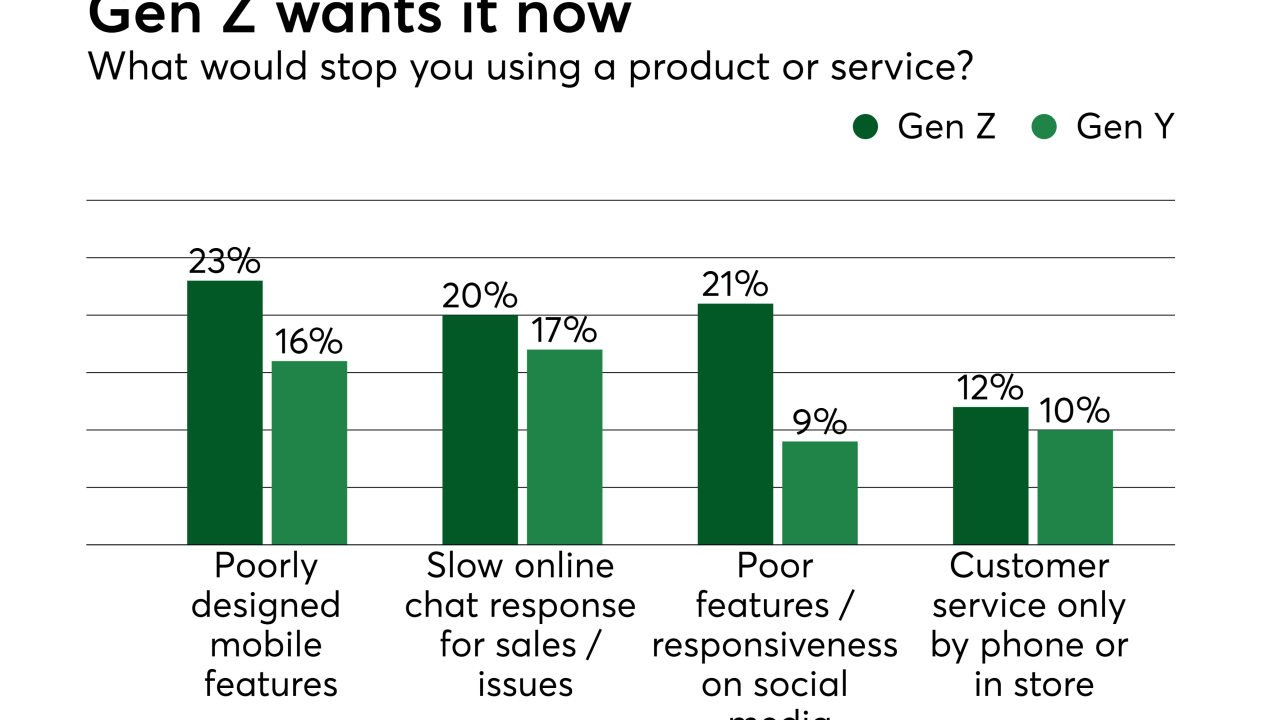

As Gen Z and the generations that succeed them begin to use financial services, digital capabilities become a must-have rather than a nice-to-have. By planning now, irrelevance in the near future can be avoided, writes John Mitchell, CEO of Episode Six.

April 12 -

Mastercard and MercadoPago, the payments arm of Latin American e-marketplace MercadoLibre, see opportunities for contactless prepaid cards among unbanked consumers even though local issuers have been slow to adopt the format.

April 12 -

Social media commerce platform provider Jumper.ai is helping Amazon merchants complete online transactions without the buyer being redirected to the Amazon online marketplace.

April 11 -

Alipay Financial Services’ Hong Kong unit is collaborating with McDonald’s, enabling consumers to order and pay for items at the fast-food chain within the AlipayHK wallet.

April 11 -

Over time, Pinterest has built a powerful e-commerce and payments engine underneath its social network site. This enables any Pinterest post to double as a portal for commerce — one that is especially powerful on mobile.

April 11 -

Amazon Go is caving to rising pressure from cities and states banning cashless stores and planning to introduce cash-acceptance to a model whose entire premise was about eliminating the friction of checkout with a seamless, card-based checkout.

April 10 -

Contactless transit fare systems are drawing lots of investment despite several false starts in the U.S. But new numbers out of London show there are clear and multiple benefits if the infrastructure can catch up.

April 10 -

Cash is expensive, overseas cards may be illegal and cryptocurrency is unreliable, argues David Ehrlich, COO and co-founder of Zodaka, who says e-wallets are an answer.

April 10 -

A Cleveland startup’s play in the crowded and noisy P2P market is to nudge the transaction as close to digital version of paper money as possible — without Venmo’s social tools or Zelle’s email model.

April 9