Earnings

Earnings

-

CEO Max Levchin said the lender is testing technology that allows merchants to perform more advanced testing of promotional financing offers.

February 5 -

The mortgage technology unit at Intercontinental Exchange posted a profit for the third straight quarter, even as lower minimums among renewals capped growth.

February 5 -

HP CEO and current PayPal board chair Enrique Lores will take over March 1, following a deep slump in the payment company's key metric.

February 3 -

The Long Island-based bank returned to profitability during the fourth quarter of 2025. The results mark "a significant milestone" in the bank's turnaround plan, CEO Joseph Otting said.

January 30 -

The neobank was bullish on cryptocurrency and stablecoins, which could provide tailwinds as it looks to launch new products including crypto-based lending, institutional trading, and correspondent payments and settlements via stablecoins.

January 30 -

Like other payment executives, Steve Squeri expressed concern about affordability, but is not in favor of heavy restrictions.

January 30 -

CEO Ryan McInerney reiterated the company's long-held stance that the Credit Card Competition Act was "very harmful" and "just simply not needed."

January 29 -

The credit card issuer said it had little to add to widespread discussions regarding the Trump administration's proposed 10% cap on credit card interest rates.

January 29 -

The president has called for a 10% interest rate cap and endorsed the Credit Card Competition Act. Michael Miebach expressed strong opposition to the CCCA while expressing concern about a cap's potential impact on access to credit.

January 29 -

A one-time accounting change will boost the bank's ability to spend on marketing. Traders flinched at the change; analysts called it a buying opportunity.

January 29 -

The auto lender's earnings mostly surpassed expectations in the fourth quarter, but its financial outlook was dampened by its projection of a weaker labor market in 2026.

January 29 -

The Tulsa, Oklahoma-based bank expects the pace of loan growth to quicken this year, driven in part by its nine-month-old warehouse lending business.

January 27 -

Merchants have mostly been silent on President Trump's call for a cap on credit-card interest rates. But they'd take a "huge hit" under such a plan, Synchrony CEO Brian Doubles said Tuesday.

January 27 -

The Boston bank, which has been targeted by an activist investor over its M&A strategy, isn't pursuing deals, CEO Denis Sheahan said Friday. Instead, the company is focused on organic growth and share buybacks.

January 23 -

The Raleigh, North Carolina-based bank recently made its first payment on a $35 billion note held by the Federal Deposit Insurance Corp. The note was arranged as part of First Citizens' purchase of the failed Silicon Valley Bank.

January 23 -

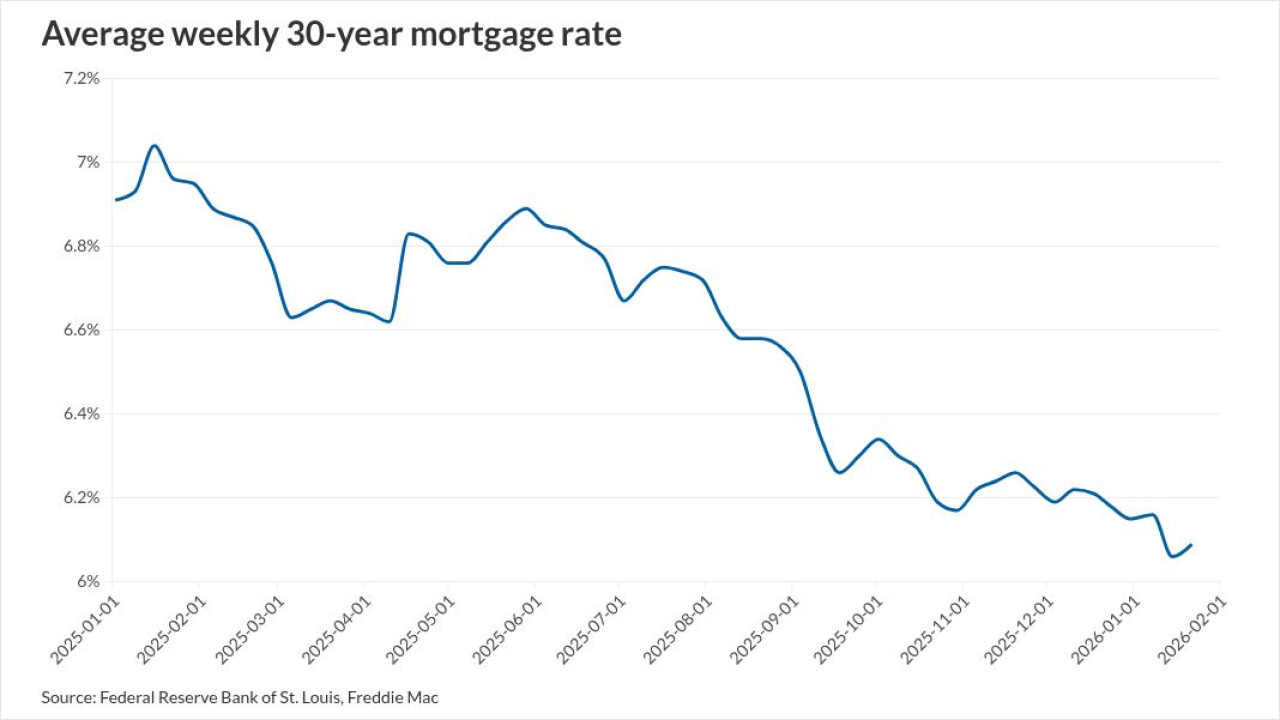

Many servicing metrics look weaker amid lower rates although valuations can vary depending on companies' models, operations and portfolio composition.

January 23 -

The McLean, Virginia-based bank plans to close the deal in mid-2026, about a year after it sealed its landmark purchase of Discover Financial Services.

January 22 -

With one Texas acquisition integrated and another deal set to close next month, Huntington Bancshares is projecting double-digit growth in loans and revenue this year.

January 22 -

Three weeks after completing its "merger of equals" with Synovus Financial, Pinnacle Financial Partners said it plans to hire 225 to 250 revenue-generating bankers in 2026 across its newly expanded Southeast footprint.

January 22 -

The regional bank recorded $130 million of legal charges during the fourth quarter in connection with the resolution of a legal battle involving overdraft fees. Its earnings also took a hit from $63 million in employee severance costs.

January 21