Earnings

Earnings

-

Wells Fargo beat analysts’ expectations for third-quarter profit, another positive sign for Chief Executive Charlie Scharf’s turnaround efforts, but expenses were higher than anticipated and loans fell.

October 14 -

Bank of America beat analysts’ earnings estimates as fees climbed at the company’s dealmaking unit, boosted by a record-breaking period for mergers and acquisitions.

October 14 -

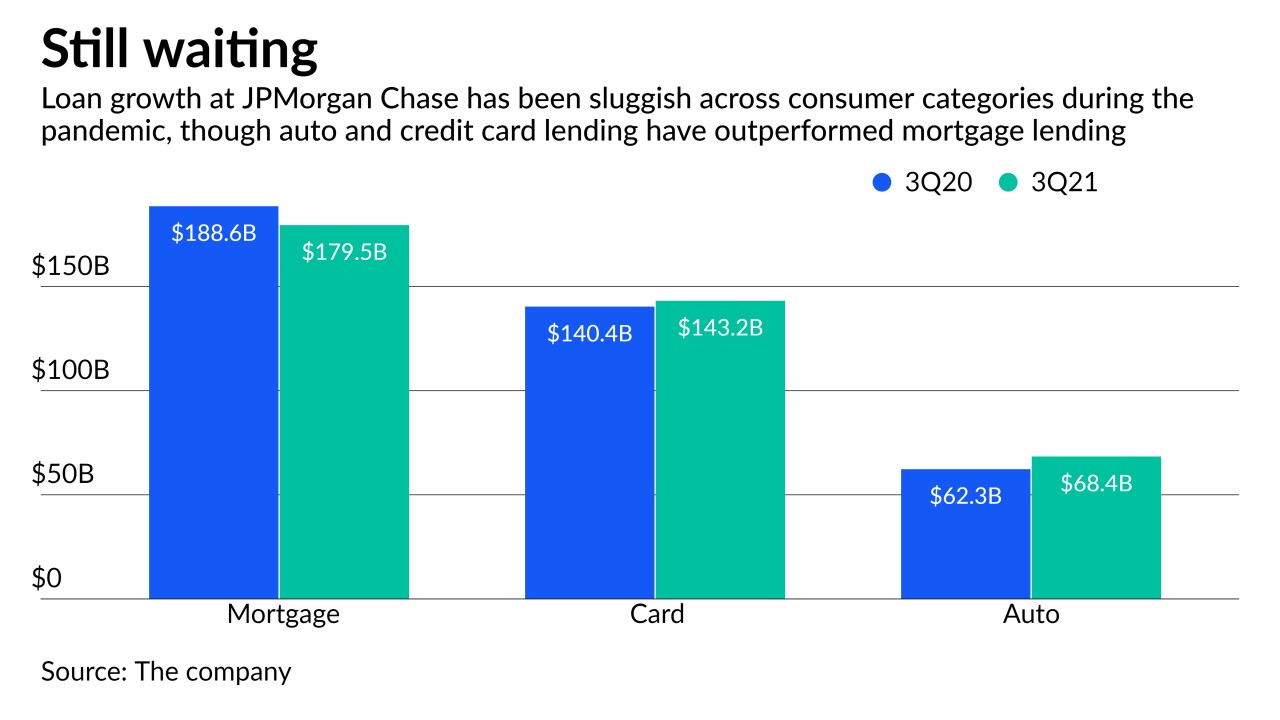

Spending on cards continued to increase during the third quarter, while loan balances rose slightly and payment rates began to return to more normal levels. A top company executive expressed confidence that loan growth will pick up but said, “It’s going to take time.”

October 13 -

The San Francisco bank reported a 26% increase in its third-quarter earnings, thanks to robust single-family, multifamily and commercial real estate loan activity in New York, Boston and its home city.

October 13 -

Total loans increased 6% from a year earlier, driven by gains in the company's asset- and wealth-management arm and corporate and investment bank, though consumer and commercial lending fell. Fees from advising on merger and acquisition deals almost tripled.

October 13 -

Net income significantly recovered compared with a year earlier, totaling $70.4 billion. But the average net interest margin fell to another record low as lending remained sluggish, the FDIC said in its quarterly update.

September 8 -

The Canadian economy’s comeback in recent months, even as COVID-19 lingers, fueled strong domestic lending results at the country’s banks during the third quarter.

August 26 -

The banks reported fiscal third-quarter results that topped analysts’ estimates on gains in domestic personal and business loans as well as continued strength in the Canadian housing market.

August 24 -

Many banks reported sharp declines in income from home loans during the second quarter. The large gains they enjoyed last year thanks to a surge in refinancing activity are unlikely to return, according to bankers and analysts.

August 4 -

First Hawaiian and Bank of Hawaii are warning that a global spike in coronavirus cases could stunt the state's momentum and threaten credit quality.

August 2 -

With virus cases in its home state hitting their highest level since February, the San Antonio company declined to release reserves — a route that many banks took to boost their second-quarter profits.

July 30 -

The card brand has been pitching itself as a testing ground for central bank digital currencies, a payment portal for stablecoins and — most recently — an accelerator for startups.

July 29 -

The digital lender, which bought Radius Bancorp in February, still expects to record a full-year loss partly because of merger-related costs. But its stock price soared Thursday after it reported second-quarter net income of $9.37 million.

July 29 -

The payments company has completed development of its all-in-one portal. It's an ambitious project, but the first few services — such as bill pay and savings — are relatively straightforward.

July 29 -

Flagstar’s main business is lending to nonbank mortgage lenders, and New York Community Bancorp CEO Thomas Cangemi has a plan for tapping those borrowers to drive loan and deposit growth.

July 28 -

Banco Santander SA said it’s on track to beat a key profitability metric for the year with earnings from the U.S. and U.K. fueling the Spanish lender’s resurgence after historic losses linked to the pandemic.

July 28 -

The card brand's recent deals to buy Tink and Currencycloud for a combined $3 billion are meant to give it a stronger presence in fast-growing fintech markets.

July 27 -

States in its footprint have some of the lowest vaccination rates in the country. Another round of shutdowns could further damage industries like hospitality that have already been hit hard by the pandemic, executives said.

July 23 -

CEO Stephen Squeri told analysts a fresh crop of rivals, possibly including Wells Fargo, will be quick to fill the void created by Citi's departure from the high-end market.

July 23 -

The Wisconsin company’s growth initiative, expected to be unveiled by mid-September, will fund both a bigger commitment to online banking products and a push to expand in new and existing markets.

July 23