-

A coordinated effort would make it possible to develop the widely applicable standardized processes we need by collecting perspectives from every dimension of the payments process, writes Monica Eaton-Cardone, COO of Chargebacks 911 and CIO of its parent company Global Risk Technologies.

April 23 Chargebacks911

Chargebacks911 -

The EMVCo standards organization has accredited FIME's transaction security testing labs for the upgraded EMV contactless interface software.

April 1 -

The next step for trucking industry payment providers is tapping the full benefit of available data streams as they upgrade from decades-old paper-based payment systems to cloud-driven mobile apps.

March 29 -

Merchant terminals—the longtime bedrock technology of the payments industry—are rapidly evolving, and few people have a better view than Jennifer Miles, executive vice president of North America for France-based payment terminal maker Ingenico.

March 12 -

Fuel payment options in the trucking industry have long relied on private-label cards from giants like Comdata and WEX, but a new challenger called Gas Pos is hoping to break in by capitalizing on new payments technology and the looming gas-station EMV migration.

February 22 -

Fraudsters have evolved their strategies to focus on other flavors of fraud, and its actually encouraging to see retailers are still treating payment fraud as a top-of-mind concern as that evolution happens, according to Håkan Nordfjell, senior vice president of digital banking at Gemalto.

January 30 Gemalto

Gemalto -

Dynamics has launched an interactive credit card with India's IndusInd Bank that allows consumers to choose between three different funding sources when making purchases: credit, points and installment payments.

January 9 -

5 ways a richer data set and advanced analytics give merchants more control—and a competitive edge

January 7 -

The data generated by EMV 3DS can be a competitive advantage if you have the right partner

January 7 -

The rise of contactless cards could eclipse mobile payments adoption, experts predicted, while evolving fraud threats may give rise to increased account controls for consumers.

December 31 -

Gas Pos, which markets a solution for petroleum operators to convert to EMV payment technology at the pump, has raised $1 million in funding from a Silicon Valley venture capital firm.

November 14 -

JPMorgan Chase & Co. has committed to roll out contactless chip cards for all new and replacement payment cards, which will likely spark a mass movement, if the experience of other global markets is any guide.

November 14 -

In the U.S., most banks and retailers seemed to have given up on contactless cards with the 2011 demise of the much-publicized Chase Blink brand. But the payment format is making a strong comeback in 2018.

October 25 -

Even consumers are fed up with passwords, which seem to do little to deter hackers, but Visa says there's still some life left in the dated authentication method.

October 23 -

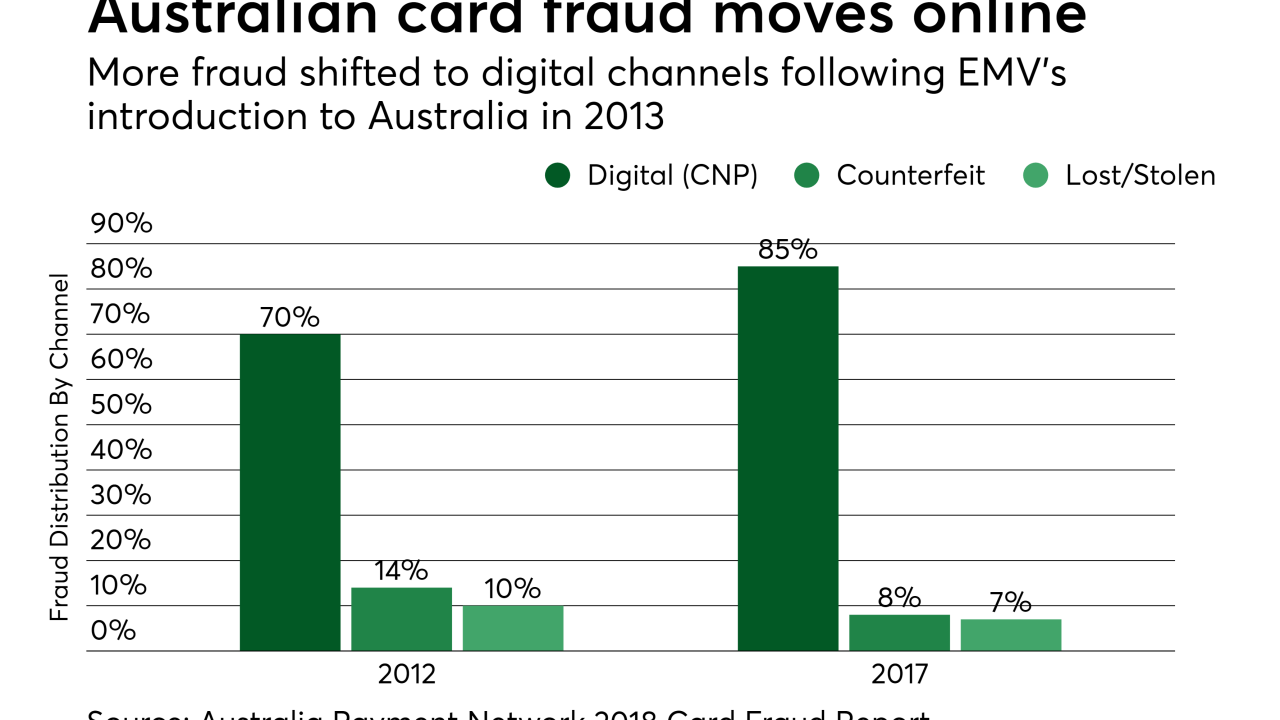

The vast majority of card fraud in post-EMV Australia affects digital payments, a trend that has prompted government action, expedited security projects, and financial pressure on banks from retailers.

October 18 -

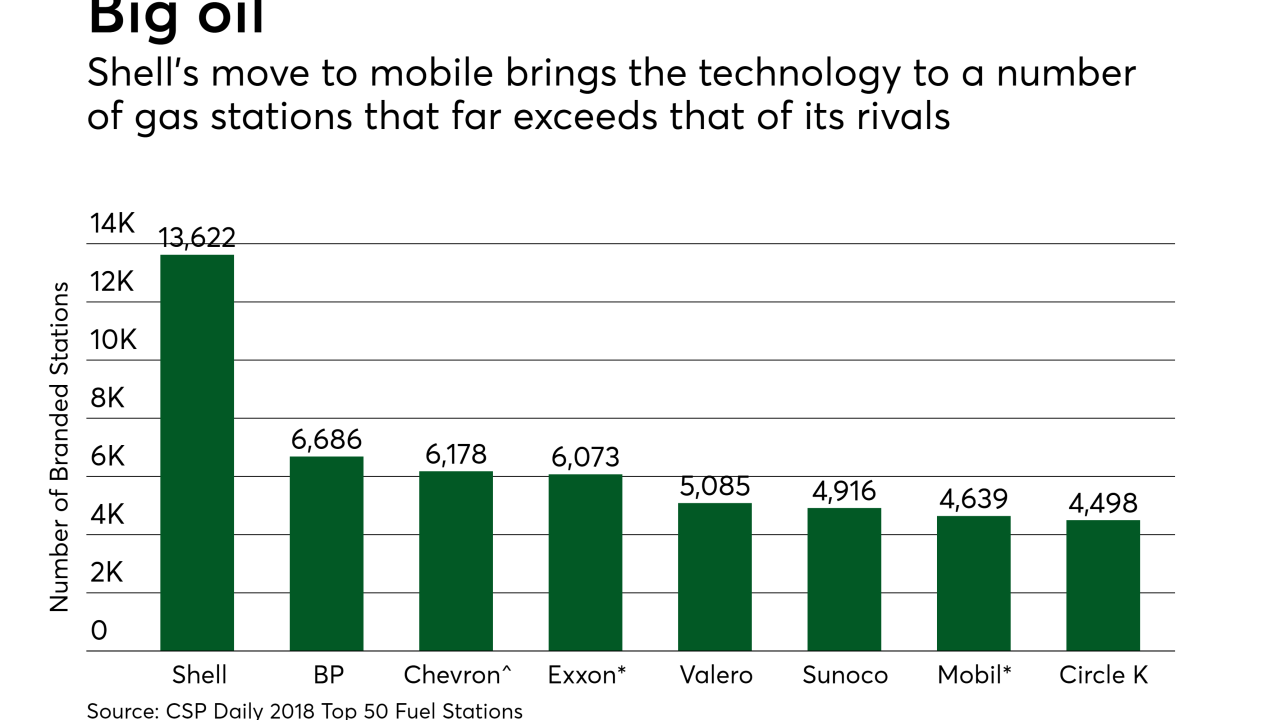

Shell has launched a new mobile app called Pay & Save, designed as a frictionless complement to the EMV-chip cards it must accept at its pumps by late 2020.

October 16 -

Companies using First Data's payments network through unattended kiosks and other settings can now accept EMV payments through the ID Tech hardware and Worldnet software.

September 24 -

Participation by all members of the global payments ecosystem is encouraged through EMVCo's work to secure card-present transactions and incorporate broader applications.

September 19 -

Executives from four companies—Worldnet co-founder John Clarke, Payrailz CEO Fran Duggan, CardFree CEO Jon Squire, and Sionic Mobile CEO Ron Herman— view Uber and Amazon as drivers of the shift to an "unattended" retail experience that removes human interaction from the process of making a payment.

September 17 -

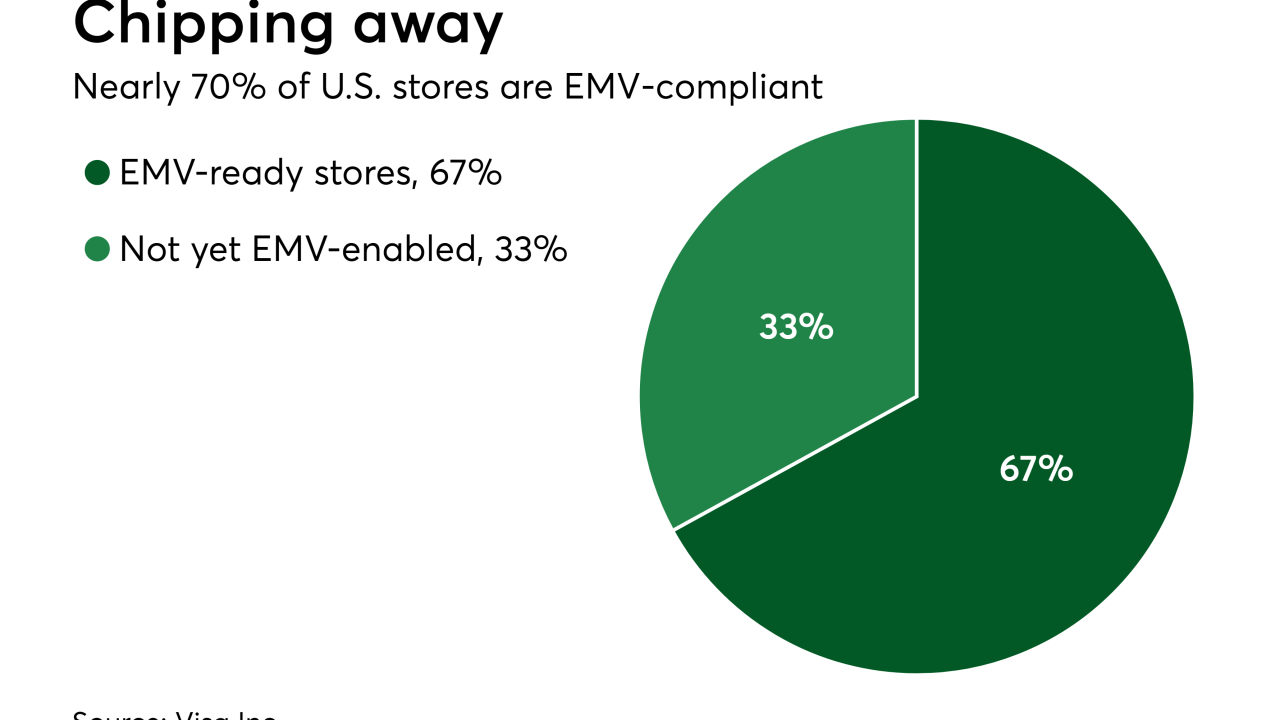

U.S. EMV coverage has gaping holes—including smaller financial institutions that haven’t fully converted to EMV and millions of merchant locations still not accepting chip cards.

September 12