-

New York’s banking regulator ordered Habib Bank Ltd. to pay $225 million and surrender its license to operate in the state, effectively removing Pakistan’s largest lender from the U.S. financial system.

September 7 -

The Consumer Financial Protection Bureau has fined a California-based lead aggregator and its owner hundreds of thousands of dollars for allegedly directing consumers toward illegal loans that would be void in their states.

September 6 -

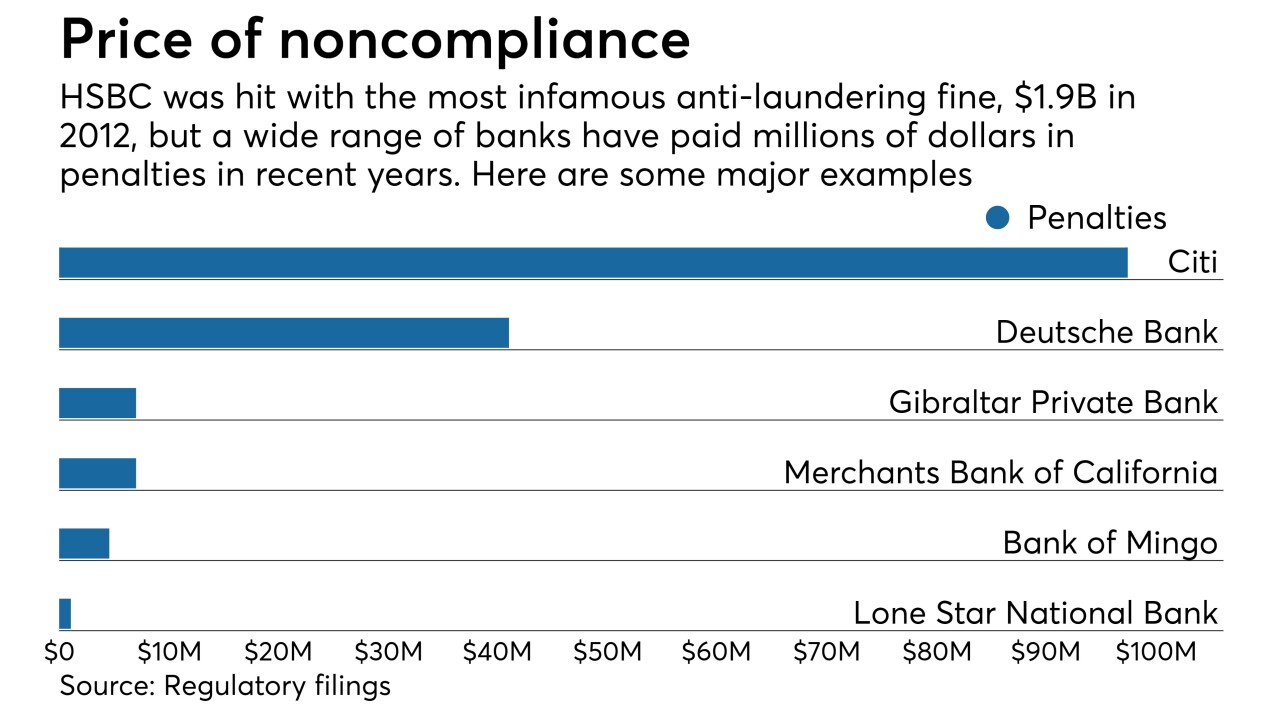

Nothing like revelations of a client’s Ponzi scheme that lead to your bank paying $4 million in anti-money-laundering fines. That’s what happened at Gibraltar Private Bank & Trust, but its CEO argues its compliance overhaul has given the bank a competitive advantage in cosmopolitan New York and South Florida.

September 5 -

Bank undercounted fake accounts and says it also opened more than 500,000 bill-pay accounts; CFPB director provides “no further insights” on his future.

September 1 -

Wells Fargo said Thursday that employees opened 3.5 million potentially unauthorized consumer accounts over a nearly eight-year period, a 67% increase from its earlier estimate.

August 31 -

Wells Fargo said Thursday that employees opened 3.5 million potentially unauthorized consumer accounts over a nearly eight-year period, a 67% increase from its earlier estimate.

August 31 -

A credit service provider agreed to exit the industry on Wednesday after a yearlong lawsuit with the Consumer Financial Protection Bureau.

August 31 -

Powell downplayed fears about subprime auto lending, saying he aims to improve Santander Consumer's compliance culture, beef up customer services and expand its relationship with Chrysler Capital.

August 28 -

The Boston company — a division of the Spanish banking giant Banco Santander — announced that the Federal Reserve has terminated a 2014 written agreement barring it from declaring dividends without central bank approval.

August 25 -

American Express charged higher interest rates and annual fees to cardholders in Puerto Rico, the U.S. Virgin Islands and other U.S. territories than in the U.S., the CFPB said Wednesday.

August 23 -

Regulators reached a $183.5 million deal Thursday to get debt relief to 41,000 students of the bankrupt Corinthian Colleges.

August 17 -

There are outstanding questions about whether Elizabeth Duke, who has been on Wells Fargo's board since January 2015, is the right person to lead a culture change at a large bank mired in scandals and investigations.

August 16 -

PHH Corp. will pay the Justice Department $75 million to settle a False Claims Act investigation of its underwriting practices on government-insured mortgages and loans sold to Fannie Mae and Freddie Mac.

August 8 -

The Consumer Financial Protection Bureau ordered JPMorgan Chase to pay a $4.6 million fine for failing to provide accurate information when denying checking account applicants.

August 2 -

With a heavy focus on the granular details of compliance, bankers and regulators might miss the big picture — not unlike New York City’s approach to fighting crime in the 1990s.

July 17 IBM Global Business Services

IBM Global Business Services -

The promise of fintech is that it might offer underbanked consumers access to financial products. But some are worried that relying on algorithms to make credit decisions could open up problems of its own.

June 30 -

Readers weigh in on chatbots, Amazon’s physical footprint expansion plans, alternative credit data and more.

June 23 -

The message to banks is loud and clear: A vendor’s mistake is your mistake. You can outsource a function, but not the responsibility for mishaps.

June 21 Treliant LLC

Treliant LLC -

Sen. Elizabeth Warren, D-Mass., asked Federal Reserve Chair Janet Yellen on Monday to remove 12 Wells Fargo board members because of the fake-accounts scandal.

June 19 -

Litigation is soaking up a significant share of resources at the Consumer Financial Protection Bureau, which faces at least a dozen cases challenging its constitutionality and a surging number of legal disputes to its enforcement actions.

June 7