-

Kenneth Montgomery, a top executive at the Federal Reserve Bank of Boston, will head the push to make faster payments available across the industry in the next four to five years.

August 15 -

Gregor Dobbie is taking on the role of CEO of Vocalink as the company looks to expand its B2B payments business in the U.K.

August 15 -

Were the Fed to develop its own payments platform, it would be expensive, duplicative, inefficient, and curtail development of real-time services, argues the National Taxpayers Union's Thomas Aiello.

August 15

-

Expense management provider Bento for Business has launched its Bento Pay B2B payment app with partner Dwolla, which has specialized in B2B payments the past few years after initially operating mobile wallet and financial institution faster payment services.

August 13 -

The San Francisco-based fintech is using JPMorgan Chase’s real-time payments service to power the new overdraft prevention tool.

August 13 -

From housing finance to Facebook’s crypto plans, moderators questioning the presidential candidates in Texas next month would have no shortage of financial policy topics from which to pick.

August 11 -

Readers react to the Fed's lengthy plan for a real-time payments system and Fifth Third's minimum wage increase, jab at Sen. Warren's absence on the Senate Banking Committee and more.

August 8 -

Vice Chairman Randal Quarles’ public dissent raises questions about how the board will proceed on other policy debates.

August 7 -

Three years ago, payments technology provider Dwolla submitted a 164-page proposal to the Federal Reserve's Faster Payments Task Force. This week, the Fed unveiled a plan for its own faster payments system, but Dwolla had already moved on to other projects.

August 7 -

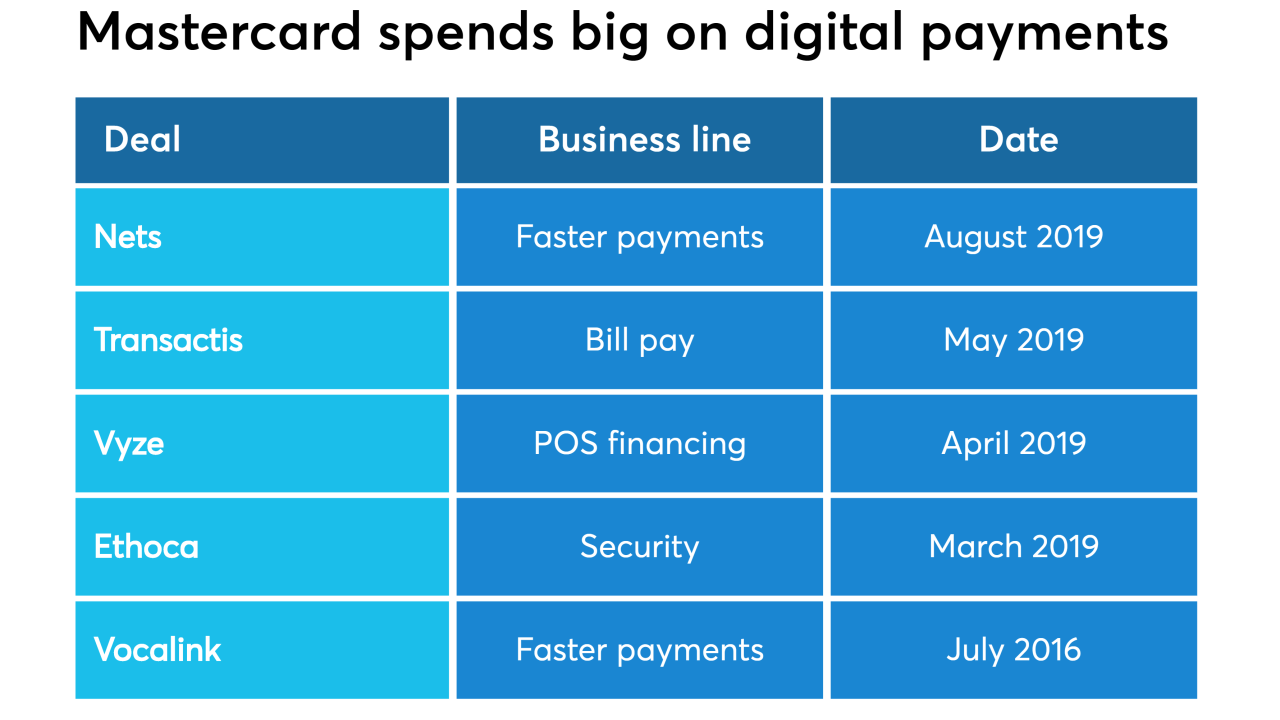

Mastercard has spent more than $4 billion on investments so far in 2019 to thread a needle between several must-haves in the digital payments market.

August 6 -

Mastercard Inc. agreed to buy a payments platform owned by Denmark-based Nets for 2.85 billion euros ($3.19 billion), using its biggest-ever acquisition to help extend a push into faster payments.

August 6 -

The payments system, called FedNow, would go head-to-head against one built by big banks; the senator from Oregon wants Amazon to address vulnerabilities in its cloud data storage.

August 6 -

Addressing payment security and achieving interoperability with a rival, private-sector network are just some of the challenges the central bank faces in building a government-backed real-time payment system.

August 5 -

As part of its justification for developing its own government-backed system, the central bank said that leaving only a single fast network run by big banks constitutes a potential risk to the economy.

August 5 -

Community banks shouldn’t wait for the Fed to create a new real-time payments rail when consumers are already flocking to other options.

August 5Cape Cod Five Cents Savings Bank -

The CEO's tenure lasted just 18 months; the former FDIC chair says having Congress more involved in setting accounting standards "could well backfire on the banks."

August 5 -

Standardizing charge backs would make management easier, and merchants would only have to understand one set of protocols, which could also standardize responses, says Monica Eaton-Cardone, COO of Chargebacks 911 and CIO of its parent company Global Risk Technologies.

August 1 Chargebacks911

Chargebacks911 -

“It wouldn't be unusual” for the Federal Reserve to work alongside private-sector operators in the creation of a U.S. real-time payments system, its chairman said.

July 31 -

Community banks shouldn’t wait for the Fed to create a new real-time payments rail when consumers are already flocking to other options.

July 31Cape Cod Five Cents Savings Bank -

Two weeks after lawmakers grilled a Facebook exec over its crypto plans, they acknowledged there are benefits from digital currency technology and urged U.S. companies to take the lead.

July 30