-

Financial institutions providing funds via the Fed's same-day ACH transfers need to their systems protect their customers, are commercially reasonable and, most important, follow strictly the protocols the financial institution has agreed to with its customer, writes Alexander Buchanan, counsel at Waller Lansden Dortch & Davis LLP.

April 19 Waller Lansden Dortch & Davis LLP

Waller Lansden Dortch & Davis LLP -

Contractor invoices are sent up a long string of approvals and payment is sent back down that long string before they are ultimately paid, writes Will Mitchell, co-founder and CEO of Contract Simply.

April 16 Contract Simply

Contract Simply -

Financial institutions in the U.S. are not only under tremendous pressure to determine how they’ll become a part of the new Federal Reserve-driven faster payments ecosystem, but also what the shift to immediacy will mean to their current operating model, long-term strategy, and future relevance to consumers and corporates, writes Bruce Lowthers, COO at FIS.

April 16 FIS

FIS -

Driving an Uber car isn't like many other jobs, and drivers' payments and expenses are also very different. Much of those differences are built on Green Dot technology, and the bank is ready to see if its platform can work for more than just Uber.

April 13 -

Europe's banks stand to benefit a lot from the SEPA Instant Credit Transfer scheme — but "instant" is a high bar that many banks may not be able to reach.

April 4 -

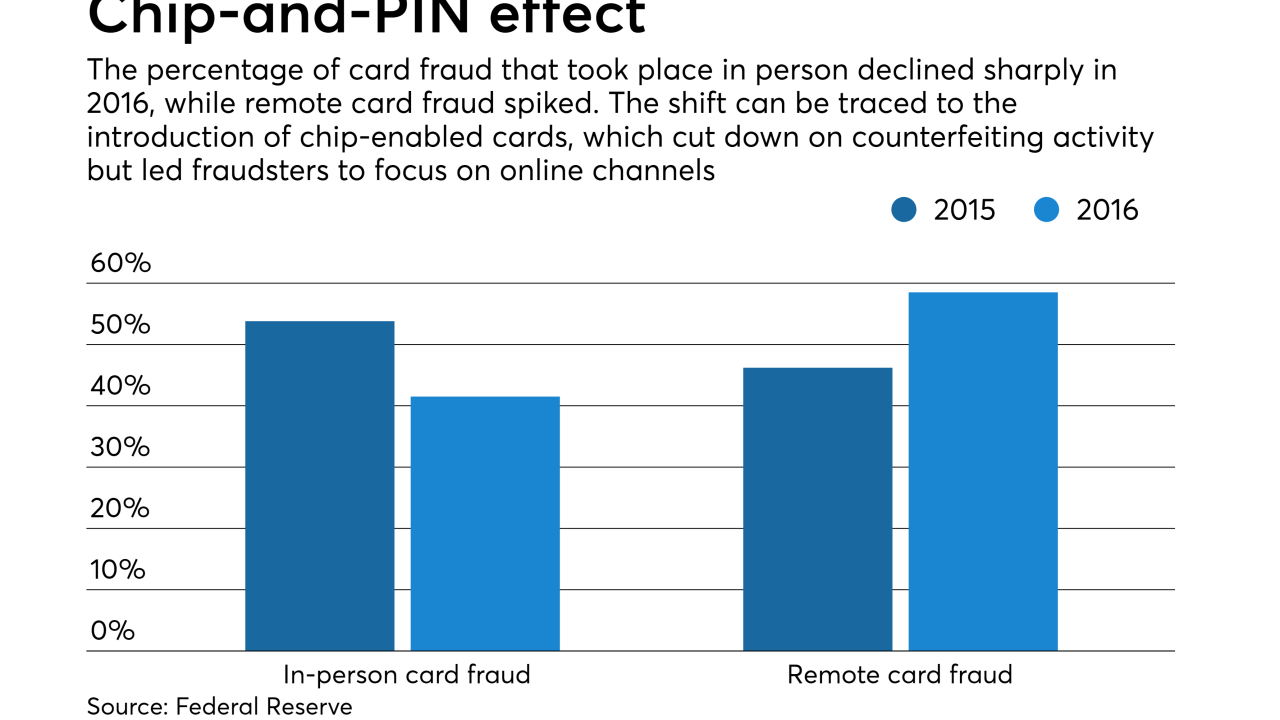

The central bank is taking a lead role in trying to combat the longstanding problem. A broad study by the Fed aims to measure the extent of payments fraud and to foster more collaboration in thwarting it.

April 3 -

The announcement comes after a Federal Reserve Board task force issued a report in September that said it would further examine options for modernizing the U.S. payments system.

March 29 -

These apps may not seem like much of a threat as long as they stay in their lane — but increasingly, ride-sharing companies are pushing the limits of how their apps can be used for payments.

March 29 -

Denizen is designed for expats and migrants to receive money and make payments without international transfer fees or currency exchanges.

March 26 -

The tracking engine automatically provides status updates to all GPI banks involved in any GPI payment chain and allows them to confirm when a payment has been completed.

March 23 -

The IATA said it's investigating how to apply faster payments to passengers, whether directly from the airline or indirectly via travel agents. Globally, airlines absorb more than $8 billion in costs for merchant fees and fraud.

March 22 -

Nacha has completed the third and final phase of the faster payments launch, requiring banks and credit unions to make Same-Day ACH funds available to depositors by 5 p.m. in local time.

March 16 -

Countries all over the world are embracing faster payment processing, and Di Challenor is one of the major forces behind the movement in Australia.

March 12 -

The network says more than $100 billion in Swift GPI payment messages are sent daily, enabling payments to be credited to the end beneficiaries within minutes — and some within seconds.

February 27 -

If they haven't already, card-issuing banks will soon receive a shock when the speed of PSD2's requirements becomes clear. Payments will have to happen faster, and the deadline to make that happen is fast approaching.

February 26 -

Global payment and fraud prevention provider Pelican is bringing its faster payments system to the North America market after working within the European SEPA Instant Payments scheme last year.

January 30 -

While Zelle is working hard to become the Venmo for grown-ups, it is also pushing into retail payments, particularly in opportunities for displacement of cash and check and where funds are needed in minutes rather than days or weeks.

January 29 -

PayPal has been working to expand Venmo's audience beyond millennials for more than a year, a strategy that it hopes to further with instant transfers.

January 26 -

The client groups aim to take an active role in shaping the future of payments.

January 23 -

The San Francisco startup behind the cryptocurrency XRP claims it can send money around the world faster, cheaper and with greater transparency.

January 11