-

SumUp, a U.K.-based mobile point of sale company, needed a way to differentiate itself from larger rivals such as PayPal, Square and iZettle. Its solution is to offer faster settlement, in partnership with Starling Bank.

September 11 -

Stripe and JPMorgan Chase are firing rapid shots in their battle to win businesses, with faster payments as the centerpiece of their offerings.

September 10 -

The massive scale of the e-commerce market is burdening community banks with its volume of payments. But there may be strength in numbers.

September 10 -

FedNow will provide another option for real-time payments but executives will have to decide if this option is right for their institution.

September 9

-

Although those fintech companies whose primary service is the provision of faster payments may face a future threat for the proposed FedNow Service, fintech companies may also benefit from the availability of a Fed-led real-time payments network, Jeffrey Alberts and Dustin Nofziger of Pryor Cashman write.

September 6 Pryor Cashman

Pryor Cashman -

The Fed's development of a real-time payments systems has sparked a pointless debate about paper checks.

September 4 Nacha

Nacha -

Community banks and tech companies that are happy the central bank is building a next-generation system are not as pleased with its four- to five-year timeline. But big banks see the slow rollout as an opportunity to expand their own instant payment network.

August 29 -

The Fed's development of a real-time payments systems has sparked a pointless debate about paper checks.

August 29 Nacha

Nacha -

The Clearing House has been quite clear that it did not think the Federal Reserve's FedNow real-time settlement service would be necessary. But some of its executives are rethinking that stance.

August 28 -

A new study released by the prepaid issuer MetaBank finds that most consumers want businesses to use faster payment methods when sending them money for refunds, rebates and claim payments.

August 27 -

Kenneth Montgomery, a top executive at the Federal Reserve Bank of Boston, will head the push to make faster payments available across the industry in the next four to five years.

August 15 -

Gregor Dobbie is taking on the role of CEO of Vocalink as the company looks to expand its B2B payments business in the U.K.

August 15 -

Were the Fed to develop its own payments platform, it would be expensive, duplicative, inefficient, and curtail development of real-time services, argues the National Taxpayers Union's Thomas Aiello.

August 15

-

Expense management provider Bento for Business has launched its Bento Pay B2B payment app with partner Dwolla, which has specialized in B2B payments the past few years after initially operating mobile wallet and financial institution faster payment services.

August 13 -

The San Francisco-based fintech is using JPMorgan Chase’s real-time payments service to power the new overdraft prevention tool.

August 13 -

From housing finance to Facebook’s crypto plans, moderators questioning the presidential candidates in Texas next month would have no shortage of financial policy topics from which to pick.

August 11 -

Readers react to the Fed's lengthy plan for a real-time payments system and Fifth Third's minimum wage increase, jab at Sen. Warren's absence on the Senate Banking Committee and more.

August 8 -

Vice Chairman Randal Quarles’ public dissent raises questions about how the board will proceed on other policy debates.

August 7 -

Three years ago, payments technology provider Dwolla submitted a 164-page proposal to the Federal Reserve's Faster Payments Task Force. This week, the Fed unveiled a plan for its own faster payments system, but Dwolla had already moved on to other projects.

August 7 -

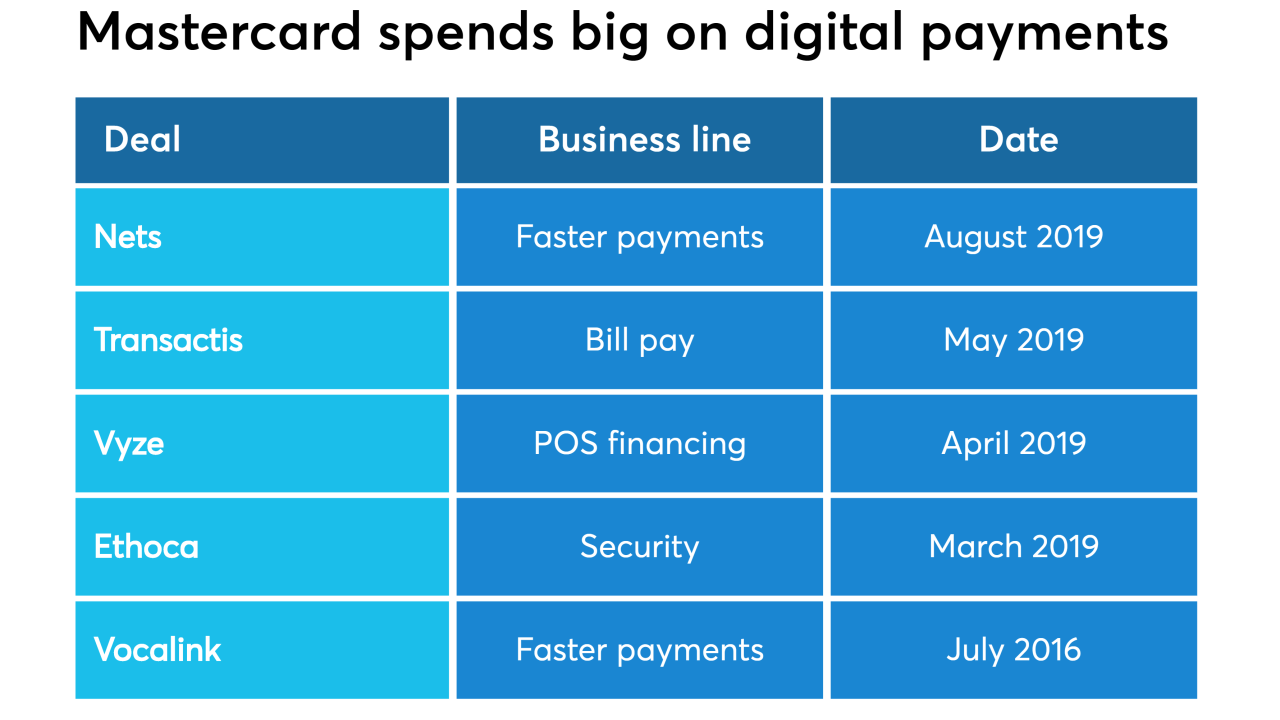

Mastercard has spent more than $4 billion on investments so far in 2019 to thread a needle between several must-haves in the digital payments market.

August 6