-

The number of religiously affiliated credit unions continues to dwindle and many have changed their name as part of a push to diversify their fields of membership.

October 5 -

The expansion will give the $416 million-asset institution a deeper reach into southern parts of the state.

October 2 -

A new initiative from the Minnesota Credit Union Network to help deepen share of wallet is believed to be the first of its kind and could be a model for credit union leagues in other states.

October 1 -

Regulators have approved the Colorado institution's bid to serve consumers across three different counties.

September 30 -

Having already changed charters for a statewide field of membership, the Jackson, Mich.-based institution will now merge with Washtenaw Federal Credit Union.

September 25 -

It's unlikely that lawmakers will pass new coronavirus-related legislation before Congress leaves for its October recess.

September 14 -

Federal credit unions still account for more than 60% of active institutions, but their share of total assets continues to shrink.

September 14 -

The Vermont-based credit union received the OK from federal regulators to add 650,000 potential members to its FOM, an increase of 15%.

September 3 -

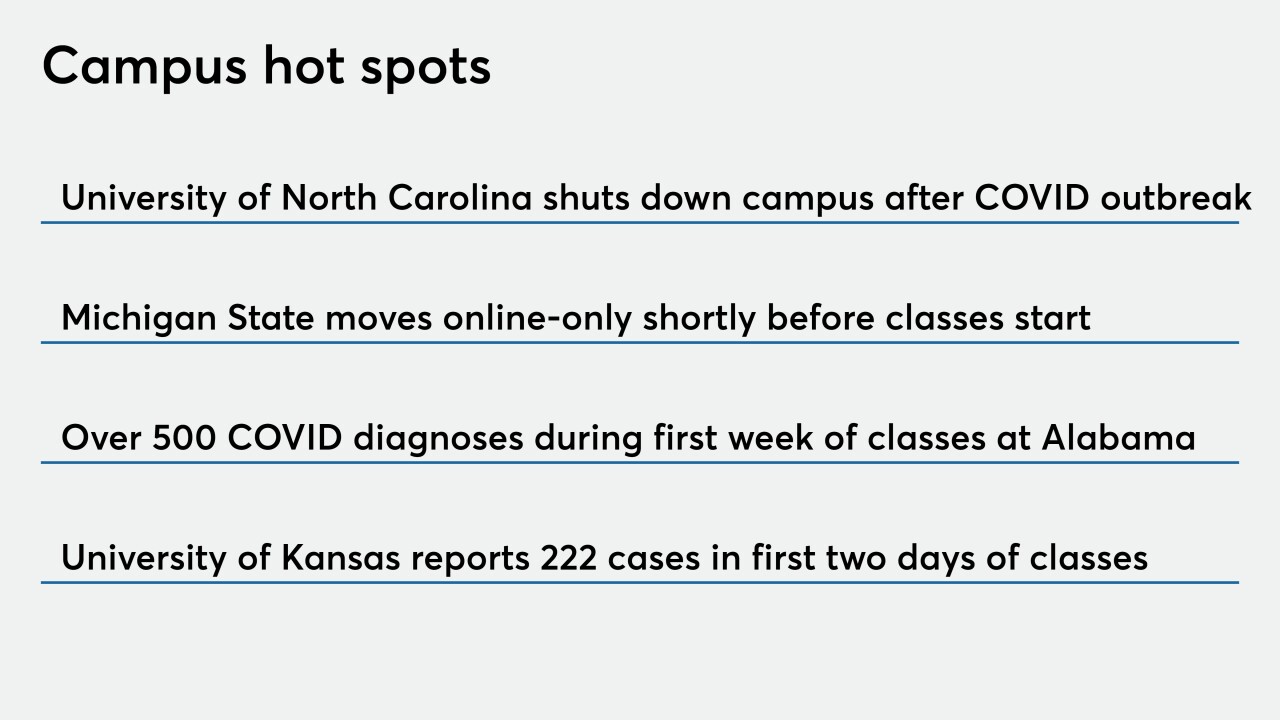

Institutions serving colleges and universities traditionally see membership surge in the fall, but are now planning for a decline as classes move online.

August 27 -

Keith Leggett, a former economist at the American Bankers Association, has overseen Credit Union Watch since 2009.

August 3 -

A site run by Keith Leggett, a former American Bankers Association senior economist, was frequently critical of credit unions and called for parity among federal regulators.

August 3 -

The regulator approved a proposal that mirrors a rule banking regulators implemented in February 2019 to cushion the Current Expected Credit Losses standard's impact on capital levels.

July 30 -

The National Credit Union Administration will also discuss the current expected credit losses standard, which trade groups have argued that the industry should be exempt from.

July 27 -

Cadmus Credit Union agreed to merge into Chartway Federal Credit Union after one of its select employer groups said it would shutter the facility where its only branch was located due to business issues that arose from the coronavirus.

July 23 -

A letter from the National Taxpayers Union requested changes, such as requiring federal credit unions to fill out a certain IRS form for non-profits, before lawmakers considered easing member business lending limits.

July 22 -

United Methodist Federal Credit Union is set to become Interfaith Credit Union. It is also planning to absorb a small South Dakota-based institution with a similar field of membership.

July 20 -

The streak of strong gains for new members was flagging by the end of 2019 and has only worsened since then.

July 20 -

The two institutions are part of the continuing trend of federally chartered credit unions converting to state charters in a push for greater flexibility and membership growth.

July 15 -

The Boulder-based institution can now serve consumers across 16 different counties, or more than 88% of the state's population.

July 14 -

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 9 Sound Financial

Sound Financial