-

Democrats called on the social media company to halt its Libra project, while Republicans said Congress should keep the door open to innovation.

July 17 -

A new project backed by the government of Luxembourg could ultimately be influential in the U.S., where banks have been slow to develop a shared platform for digital identities.

July 16 -

David Marcus, who oversees Facebook’s digital wallet, plans to tell Congress that the company will roll out Libra only after it has "received appropriate approvals.”

July 15 -

Ousted CEO Alan Kaufman pleaded not guilty after being charged with accepting favors from a businessman in exchange for favorable treatment by the credit union.

July 12 -

A Spanish effort to prosecute a gang that used Bitcoin automated cash machines suspected of being a front for illegal-drug payments has exposed a hole in European anti-money-laundering controls, law enforcement authorities in the country said.

July 11 -

The Justice Department is investigating the bank for possible money laundering violations; the Fed chair says Facebook’s plan raises “serious concerns.”

July 11 -

Powell sees need to "keep firms on their toes" while Quarles wants easier tests; €52 million paid to leaving execs nears total paid to board.

July 10 -

Executive searches are hard enough, but a shortage of qualified candidates with strong resumes will make filling those jobs that much more challenging.

July 5 -

The ban, which came to light Monday, will remain in effect until either the final disposition of Stephen Calk’s court case or until it is terminated by Comptroller Joseph Otting.

July 1 -

Linda Landry, who at one time led Southeast Texas Employees FCU, has been barred from participating in the affairs of any federally insured financial institution.

June 28 -

Former Trump campaign chairman Paul Manafort pleaded not guilty in a New York mortgage fraud case — state charges that are beyond the reach of a presidential pardon.

June 27 -

Credit unions and the rest of the financial services sector, in the spirit of recent criminal justice reform, should be more open to hiring workers with low-level criminal convictions.

June 26

-

Some signed on because the deal didn't require using or promoting Libra; Chicago bank may get stuck with $190 million of losses from U.K. mutual fund.

June 26 -

Researchers found that stolen payment data has been used to finance terrorism, human trafficking and other organized crime. Their conclusion that card fraud needs to be taken more seriously by banks and card networks drew pushback from the financial industry.

June 25 -

Dallas Fed chief says lower interest rates may require stricter rules to ward off riskier lending; after financial crisis, debt backed by HELOCs disappeared.

June 25 -

Nearly half the nation's state regulators have agreed to a new multistate licensing business for money servicers, including fintechs.

June 24 -

Sterling Bancorp must enhance its BSA policies and hire an outside firm to review its account activity.

June 24 -

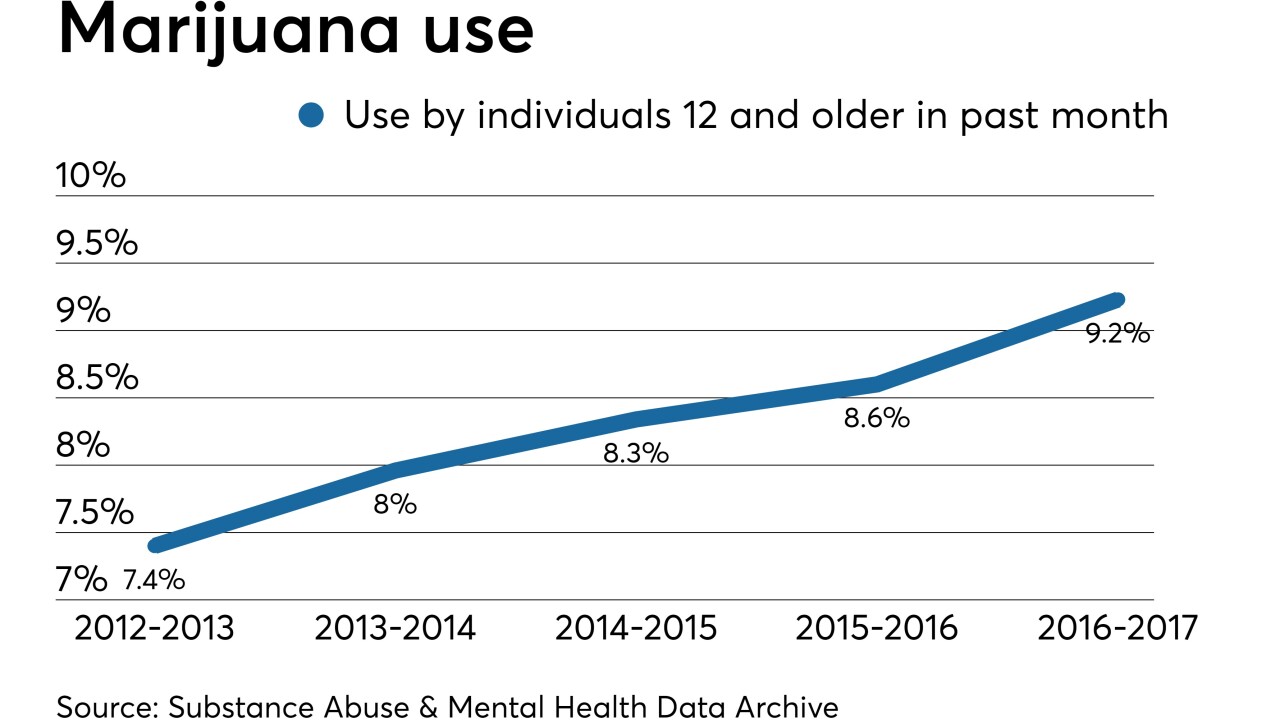

Credit union executives discussed serving the legal marijuana and hemp businesses during NAFCU's annual conference in New Orleans, including vastly different motivations for serving the industry.

June 20 -

While a bill to require firms to identify their owners has gained bipartisan support, some small companies argue it is burdensome and would subject them to harsh penalties.

June 20 -

Deutsche Bank is being investigated by U.S. federal authorities for potential lapses in money laundering compliance, The New York Times reported, citing unidentified people with knowledge of the inquiry.

June 20