-

Even relatively wealthy Americans are so worried about their finances that it's affecting their mental and physical health. That's one of the findings in a Bank of America survey of more than 1,000 people in the U.S. who have enough investable money to qualify as "mass affluent."

June 14 -

Credit unions are helping out in a number of ways, including one institution that provided scholarships to student who excelled at a game about personal finance.

May 20 -

The total includes donations to community groups helping low-income people, support for the development of financial coaching programs and investment in the creation and testing of fintech tools that can help underserved people.

May 15 -

-

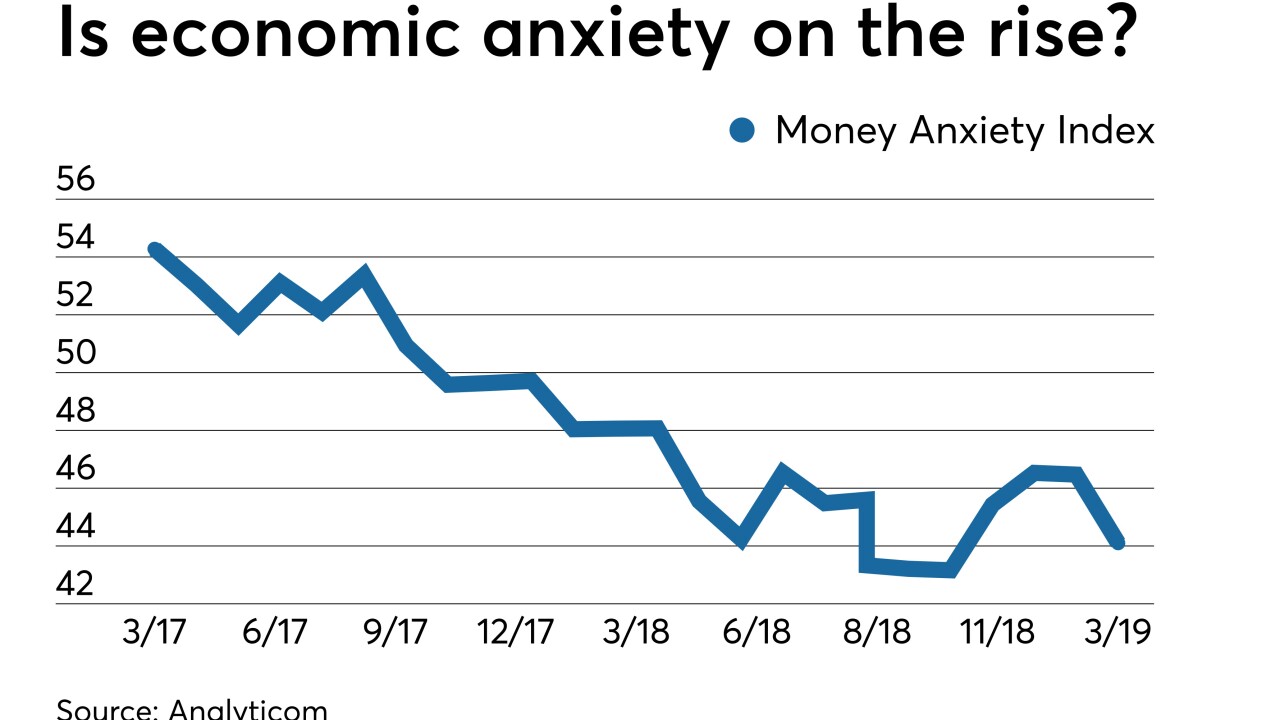

The Money Anxiety Index, a measure of consumer saving and spending habits, has started rising off a 50-year low. The economist who created it says that means another slump is nearing, and that banks should use the intel in pricing deposits and making other decisions.

May 2 -

Making donations for a variety of causes and teaching Boy Scouts about coins are just some of the ways credit unions are helping out in their communities.

May 1 -

Congress has returned from its two-week vacation with plans to debate a number of issues important to the credit union industry.

April 29 -

"If you gathered the U.S.-based senior counsels of the major Chinese banks operating in the United States," said Joseph Loffredo, assistant general manager and chief financial officer at the New York branch of China Merchants Bank, "you'd find one outlier, a lady about half the age of most of the others."

April 28 -

The U.S. subsidiary of the British banking giant has partnered with Everfi to offer an online self-guided financial education program, and with GreenPath Financial Wellness to deliver in-person seminars in numerous cities.

March 28 -

These programs are becoming a more common employee benefit but many lack some of the tools users need to be successful.

March 26 FinFit

FinFit -

A handful of institutions are dipping a toe into a niche lending market that saw sales level off precipitously in the wake of the Great Recession.

March 19 -

Flourish, a fund backed by Pierre and Pam Omidyar, invests in startups that address social and financial inequities yet (key caveat) are still promising moneymakers, a top official of the fund explains.

March 13 -

A number of credit unions made donations to help charitable causes, including one institution where employees wore jeans to help a dozen nonprofits.

March 1 -

California-based CuVantis aims to change the model for how credit unions offer financial planning by offering non-commissioned services to members.

February 20 -

Credit unions tout their readiness to assist with a variety of life stages, but a loan product for one of the most difficult potential life experiences is virtually nowhere to be found.

February 15 -

The combination of their convenient branch networks and strong digital offerings makes large, national banks tough to beat in dispensing financial guidance, consumers say.

January 31 -

Billionaire CEO Jamie Dimon is OK with tax hikes on the rich, as long as the revenue goes where he thinks it'll do the most good.

January 30 -

The data aggregator has purchased Abe AI and plans to use the artificial intelligence firm's technology in a host of applications.

January 25 -

The director of the Consumer Financial Protection Bureau has asked Congress to clarify its ability to conduct exams that ensure compliance with the Military Lending Act.

January 17 -

The Financial Solutions Lab, a joint initiative, has announced the winners of its annual competition to identify solutions to consumer financial challenges, this year focusing on startups dedicated to improving financial health in the workplace.

January 15