-

Median annual membership growth stood at just 2% at the end of the first quarter, though delinquencies dropped and ROA got a boost.

June 14 -

The McLean, Va.-based institution said that its capital hit a record $2.5 billion last year.

May 23 -

The credit unions, all of them small institutions, will pay a total of $4,069 in penalties for tardy submission of Q3 2018 all reports.

May 7 -

The Bedford, Ind.-based credit union distributed a $2.7 million dividend to members in recognition of a year that saw loan growth exceed 9%.

April 5 -

The Houston-based institution said investments in financial technology have led to operational efficiencies that enabled it to return more than $263,000 to members.

April 4 -

Growth in the KeyStone State was close to or surpassed national averages across a number of fields.

April 2 -

The latest Credit Union Trends Report from CUNA Mutual shows CUs serving more consumers even as the industry continues to contract.

March 20 -

Recent data from the National Credit Union Administration breaks down which states surged and which states struggled in 2018.

March 18 -

Software startups say bringing borrowers, builders and lenders onto one digital platform can remove some of the risks lenders faced during the crisis.

March 14 -

The San Diego-based credit union’s membership grew at double the national average.

March 11 -

The Michigan-based institution also awarded $315,000 in bonus reward points to members who use the CU's credit card.

February 20 -

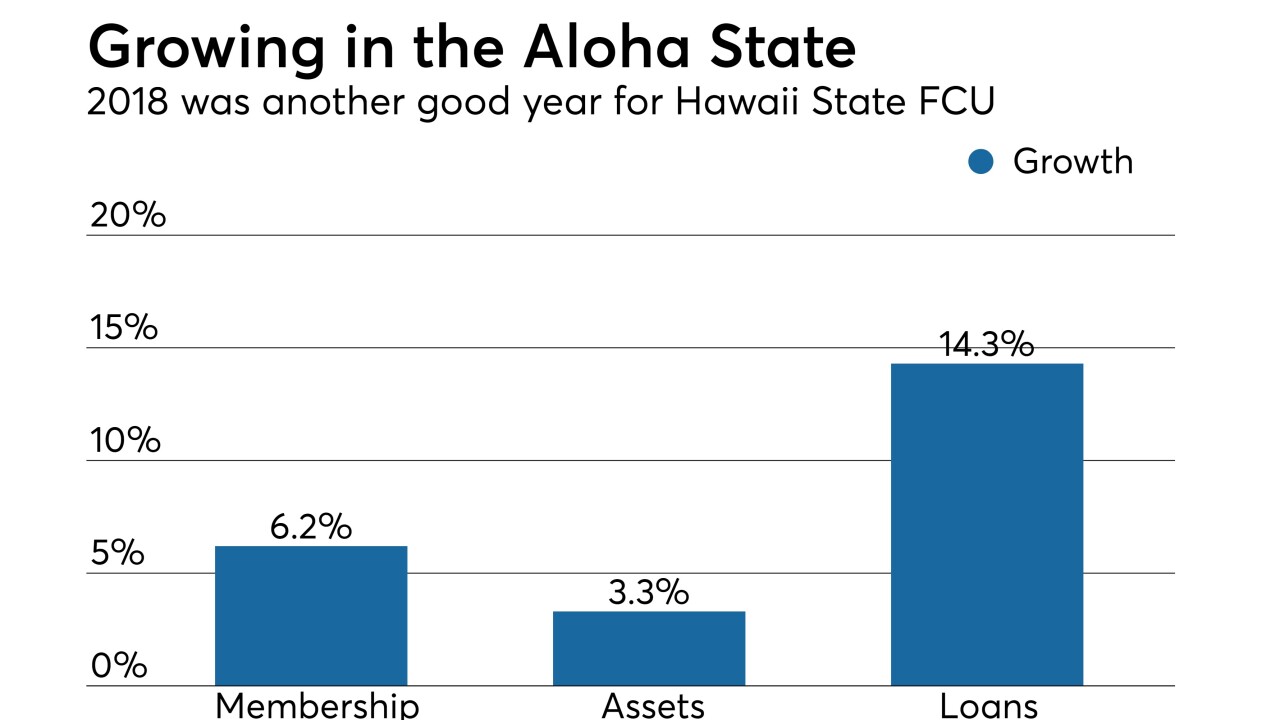

Among the 2018 highlights for the Honolulu-based credit union were a 108% rise in net income.

February 11 -

New data from the League of Southeastern Credit Unions sees CUs in the two states exceeding national averages in a number of growth metrics.

January 30 -

After struggling during the Great Recession, the Las Vegas-based credit union has now posted 27 consecutive quarters of positive results.

January 29 -

Last year Corporate Central returned more than $725,000 to its member credit unions, bringing the three-year total to $1.8 million.

January 10 -

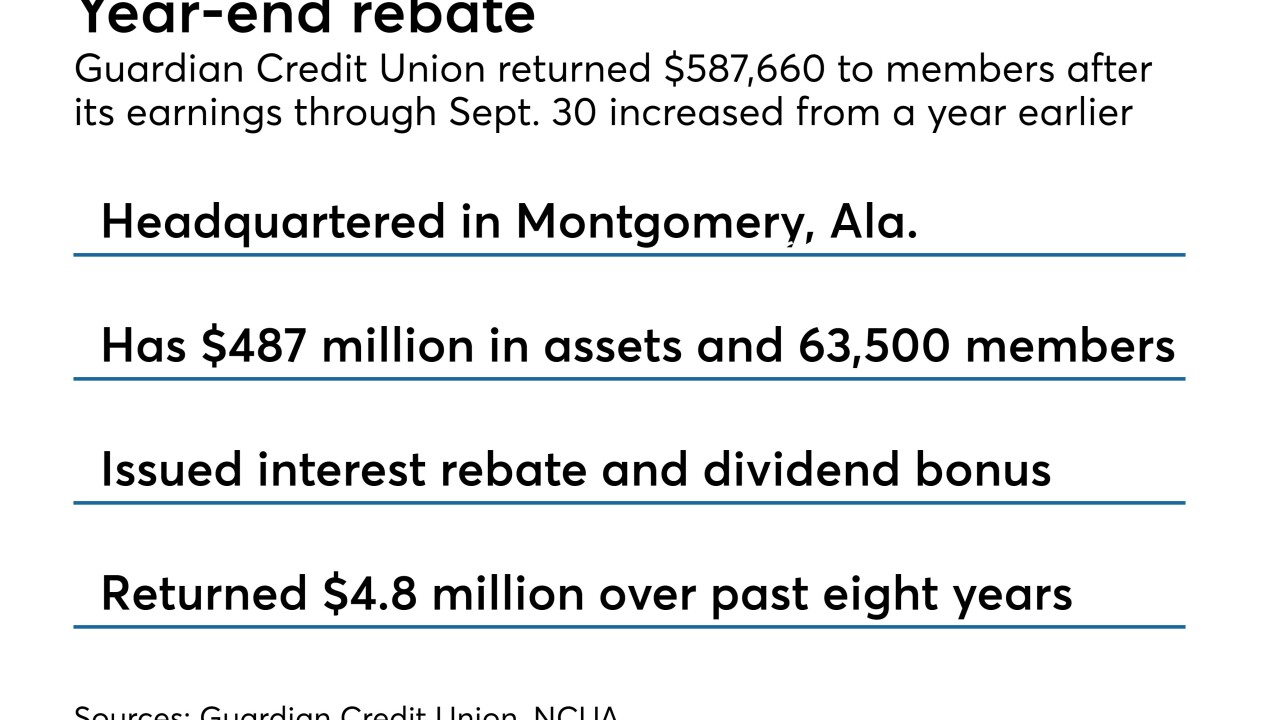

The Montgomery, Ala.-based institution has paid out more than $4.8 million to members over the last eight years.

January 4 -

The credit union rewarded members based on the CU's performance last year and the depth of their relationship with the institution.

January 3 -

These CEOs don't just run their credit unions, they're also the chief executive for their community -- and despite a desire to serve, they face some unique challenges.

January 2 -

Recent data from NCUA showed a lot of positives for the industry, but it also revealed some potentially worrisome trends.

December 18 -

The North Carolina-based institution distributed more than $624,000 with some members receiving as much as $500.

December 14