-

Featurespace wants to expand its fraud-fighting tool beyond its core audience of banks and payment processors to cover transactions across a broader industry spectrum including retail, gaming and insurance.

January 31 -

Banks use anti-money-laundering and fraud systems to try to catch scams that prey on senior citizens. A few, including Wells Fargo, are working on artificial intelligence that could spot them even earlier.

January 30 -

The senator wants Treasury to enhance fraud protection in the Direct Express prepaid program — now a partnership with Comerica Bank — when its contract is rebid in 2020.

January 10 -

The software, which was developed by Feedzai, will eventually block payments that appear to be fraudulent or mistaken.

December 21 -

Time and again, two former associates of President Trump deceived banks in connection with loan applications. Their wealth, proximity to power and willingness to tell big lies all appear to have helped them get away with brazen schemes.

December 12 -

While fraud is a year-round concern, credit unions need to be extra vigilant during the holiday season.

December 11 Advanced Fraud Solutions

Advanced Fraud Solutions -

As U.S. banks move toward faster payments, they should heed the lessons U.K. banks learned about criminals after launching their real-time transaction system, says Varo Money's fraud strategy leader.

November 27 -

With fraud rising alongside mobile deposit usage, credit union executives needed a way to solve the problem without making the process burdensome to employees and members.

November 13 -

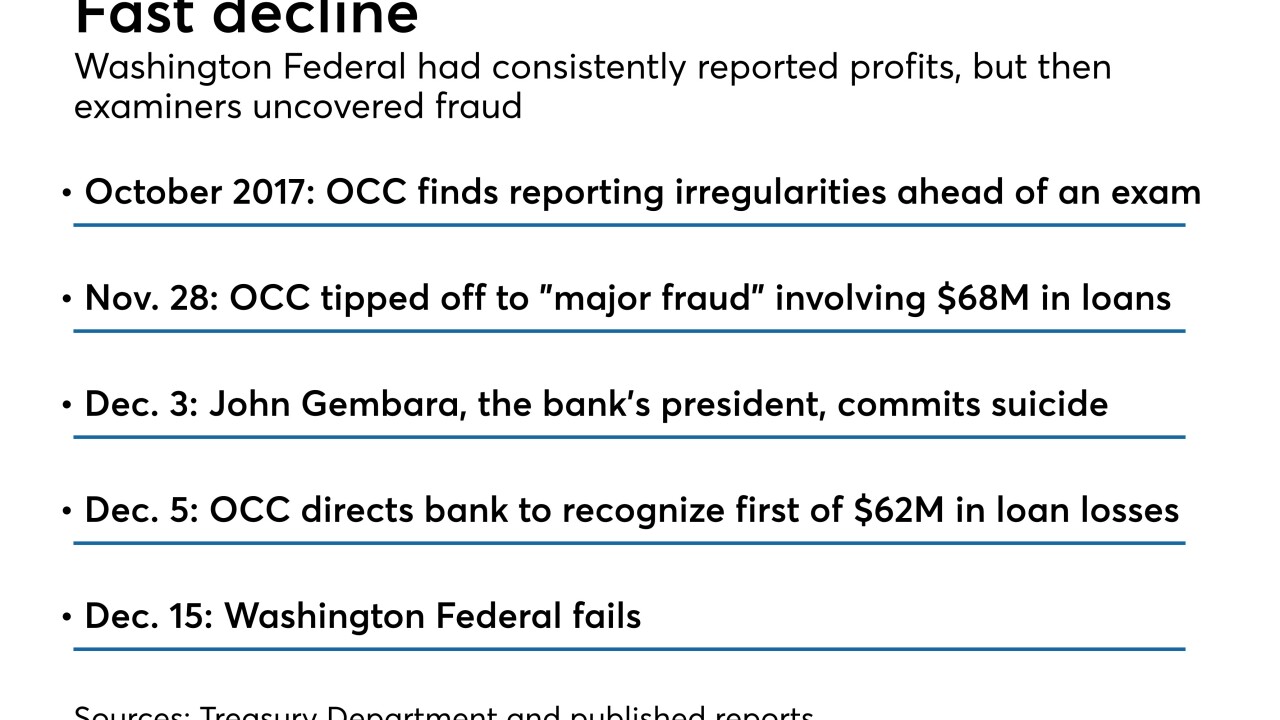

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -

-

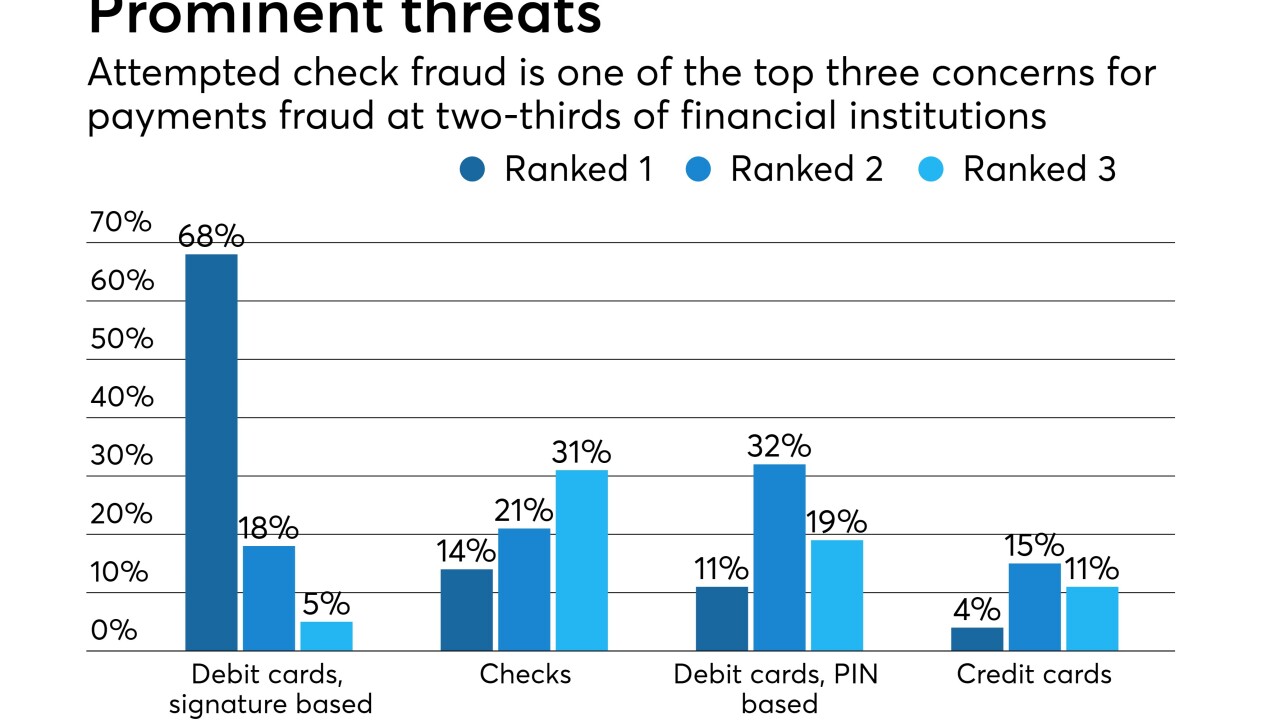

For bankers and network providers, it’s a given that moving to a real-time payment system like Zelle will lead to an increase in fraud attempts. Here's a look at the ways they're fighting back.

October 10 -

-

The company will record a quarterly charge after reporting potential fraud tied to commercial deposit accounts.

October 1 -

Happy State Bank and others use rewards, rather than punishments, to encourage employees to stay vigilant and catch fraud and cybersecurity issues.

September 11 -

Payments CUSO said it converted a ‘record number’ of credit, debit accounts in 4 months.

August 30 -

The Texas bank, which partners with the U.S. Treasury to dispense federal benefits via prepaid cards, is alleged to have dropped the ball as hundreds of cardholders say their money was forwarded to fraudsters posing as them.

August 26 -

State Treasurer John Chiang says that Wells Fargo is keeping patterns of abuse hidden from view by resolving customer disputes through private arbitration.

August 23 -

CO-OP Financial Services is currently pilot testing the new data-driven tool with credit unions in its shared branching network.

August 17 -

A mortgage fraud scheme involving fake employment records, initially thought to be contained to Southern California, is occurring statewide, Fannie Mae said in a new fraud alert.

August 9 -

Several firms are touting tools to help financial institutions bank legal marijuana-related businesses, an industry expected to yield $10 billion in retail sales this year.

July 24