-

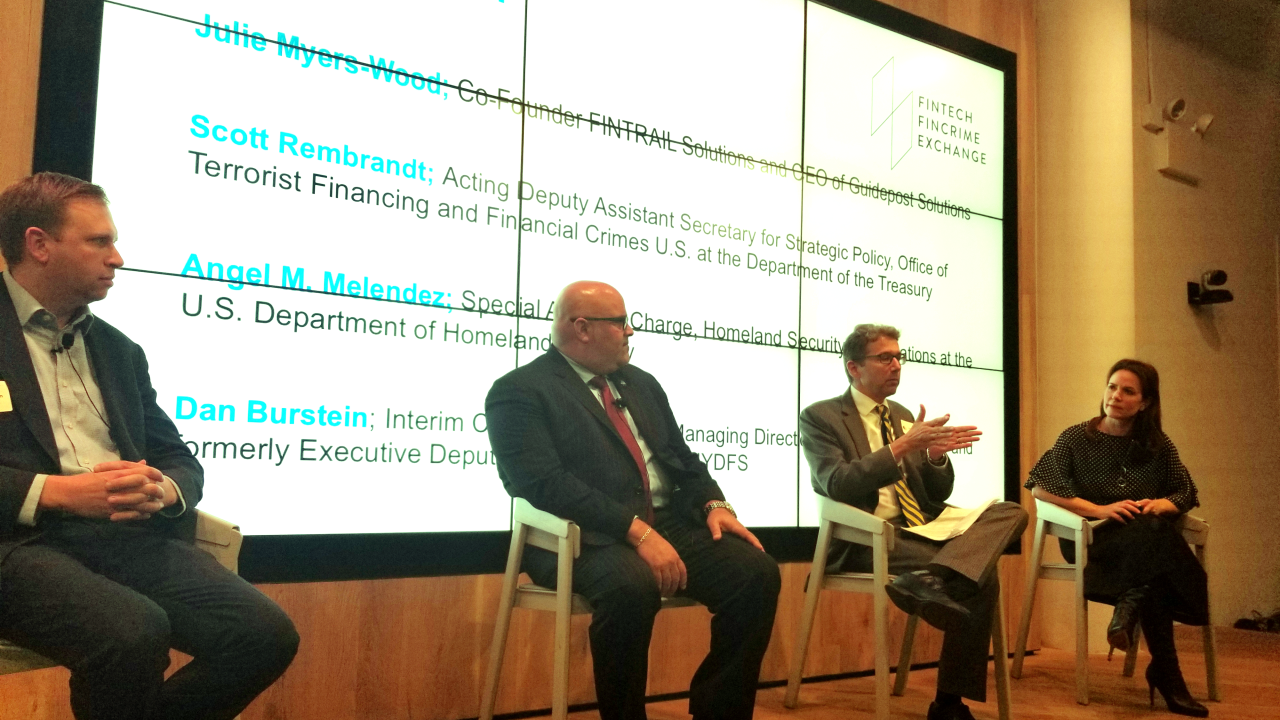

A new group aims to foster collaboration between fintechs and state and federal officials in the fight against crime — without hindering legitimate business innovation.

November 9 -

The hacks keep coming — most recently to Facebook and the federal government’s health insurance sites — and consumer trust in online security systems disintegrates along with them, according to a number of recent surveys.

October 24 -

-

Stripe’s expanding global profile has come with a growing security risk operation, which will now be overseen by former Google security expert Niels Provos.

October 17 -

-

It took about a day for Pennsylvania State Employees Credit Union to switch to the new system.

October 12 -

For bankers and network providers, it’s a given that moving to a real-time payment system like Zelle will lead to an increase in fraud attempts. Here's a look at the ways they're fighting back.

October 10 -

Members can play an integral role in helping credit unions fight fraud, but only if they have the right training.

October 9 Q2 Holdings

Q2 Holdings -

-

The cost of fighting fraud at financial institutions is up nearly 10 percent from last year. That means credit unions face significant challenges in being ready for the next threat.

October 2