-

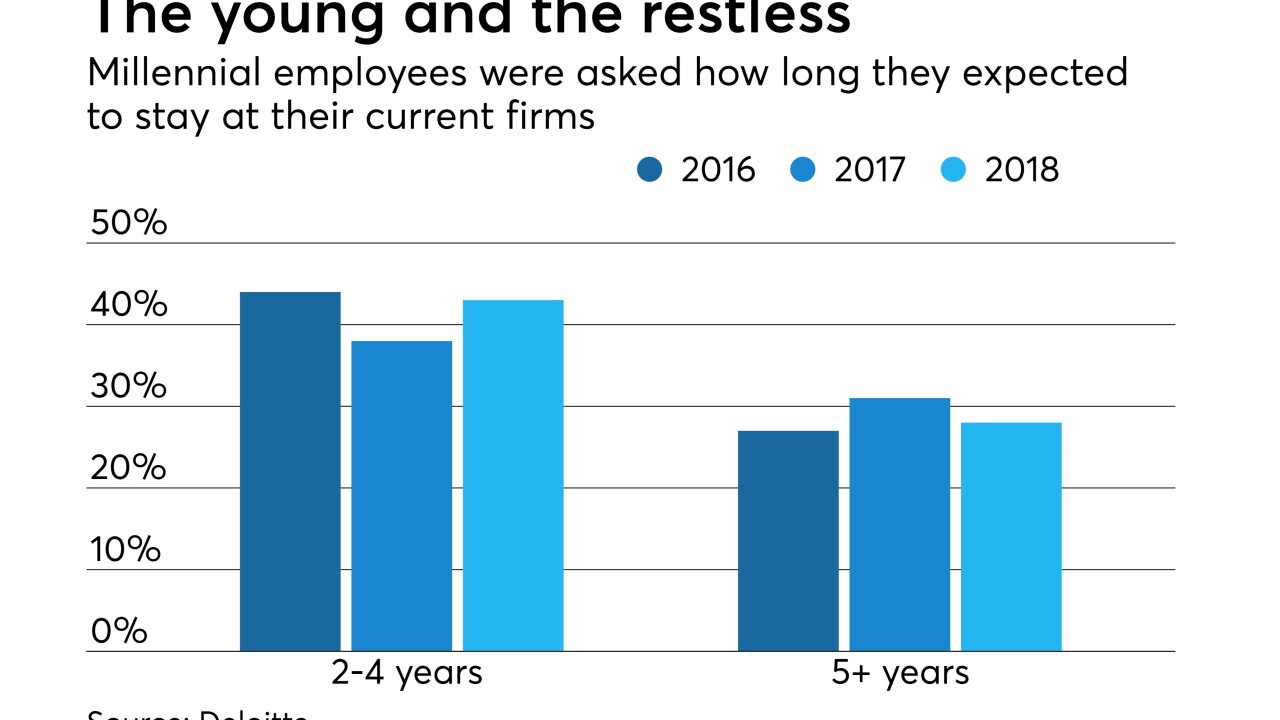

Businesses need to shift focus away from millennials and toward the next age group, which is expected to be so demanding that business processes will have to be overhauled, says Julia Carreon, the bank's managing director of digital and fiduciary operations.

December 9 -

Many community banks are launching digital banks, more aggressively courting younger customers and abandoning the idea that only primary banking relationships are worthwhile.

October 4 -

Surety's first online bank, booyah, is aimed at college students and young grads.

October 1 -

Millennials hate bureaucracy but big banks aren't agile enough to meet the demand for fast service. That gives credit unions a big opening.

September 30 Polyient Labs

Polyient Labs -

The app, which started with mobile gaming, will now integrate itself with some of the most popular video games on the market such as Fortnite.

September 24 -

Readers react to plans by Democratic presidential candidates to reform college tuition, credit unions buying more banks, whether the next president could fire the CFPB head and more.

September 19 -

With 20- and 30-somethings just beginning to build financial wealth, banks must orient their business to meet the needs of these consumers.

September 19 Financial Health Network

Financial Health Network -

Changes in consumer behavior patterns will force banks to reassess the information they use to attract customers.

September 11 CCG Catalyst

CCG Catalyst -

Young people prefer transfer apps, but privacy and authentication will need to be improved, says Sonarax's Benny Saban.

September 4 Sonarax

Sonarax -

Even relatively wealthy Americans are so worried about their finances that it's affecting their mental and physical health. That's one of the findings in a Bank of America survey of more than 1,000 people in the U.S. who have enough investable money to qualify as "mass affluent."

June 14 -

When it comes to digital-native shoppers, it’s more than just understanding how their expectations have changed. These expectations are tied to emotional factors that influence buyer behavior, says Michael Rouse, chief commercial officer at Klarna.

June 4 Klarna

Klarna -

When a tweet drew backlash from customers and politicians on Monday, it brought into question how banks should couch their messages on social media.

May 2 -

A rapidly changing workforce and the proliferation of public and shareholder activists have fundamentally reshaped the job of running a bank.

-

Generation Z is scarred by the financial crisis, but has an awareness of technology that gives payment and financial companies a point of entry, according to Mickey Goldwasser, vice president of marketing at Payrailz.

April 26 Payrailz

Payrailz -

As Gen Z and the generations that succeed them begin to use financial services, digital capabilities become a must-have rather than a nice-to-have. By planning now, irrelevance in the near future can be avoided, writes John Mitchell, CEO of Episode Six.

April 12 Episode Six

Episode Six -

Fifty-nine percent of Americans between the ages of 18 and 23 want to buy a house in the next five years, and more than half have already started saving for one, according to a survey by Bank of America.

April 11 -

A focused approach on product standards and social responsibility can help build healthy relationships with Gen Z shoppers, who will, in turn, promote products to their family, friends and followers, writes Steve Davidson, vice president of warranty products at Fortegra.

March 13 Fortegra

Fortegra -

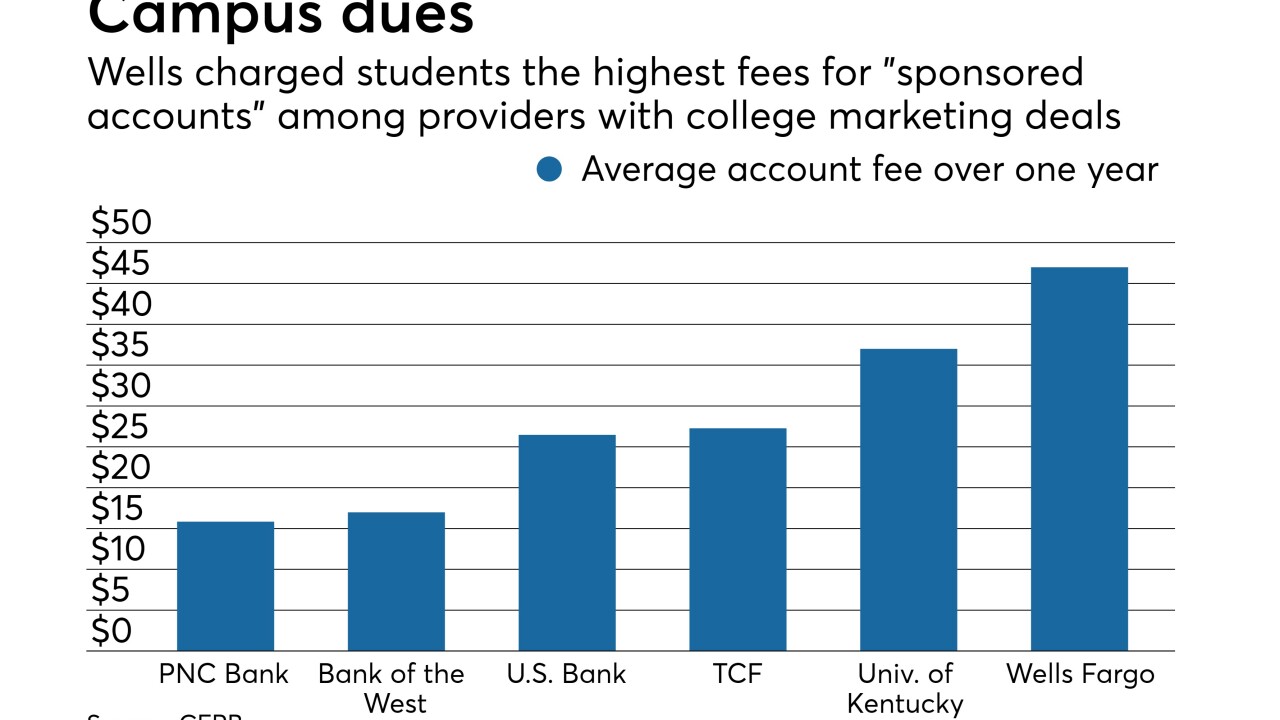

Wells Fargo charges students nearly four times as much in fees as banks without college marketing agreements, according to an internal report by the Consumer Financial Protection Bureau.

December 10 -

The online lender has acquired NextGenVest, which uses AI and text messaging to advise high school and college students about getting loans. CommonBond’s goal is to better understand the distinctly different demographic group rising behind millennials.

December 4 -

The bank has long had a program in place to train new employees, but now it’s testing a pilot to help retrain existing staff for different careers at the institution.

November 15