-

With multiple business sectors reeling from the pandemic, banks are facing tighter net interest margins, provisioning more for losses and seeing their balance sheets expand, the agency said in a report.

June 29 -

Consumers are parking their funds at financial institutions as lending slows and interest rates remain near zero, making it difficult for credit unions to deploy these deposits.

June 22 -

With rates so low — after steep emergency Federal Reserve cuts in response to the pandemic’s fallout — banks will struggle to generate bread-and-butter interest income and asset-sensitive lenders will face substantial net interest margin contraction this year and next, analysts say.

May 18 -

The group that worked with the Fed to devise an alternative rate to Libor rejects criticism that the index favors megabanks.

May 11 Alternative Reference Rates Committee

Alternative Reference Rates Committee -

Some megabanks are pushing New York lawmakers to add a legal safe harbor if lenders use the new Secured Overnight Financing Rate. Smaller banks would have little choice but to take that option.

May 4 Signature Bank of New York

Signature Bank of New York -

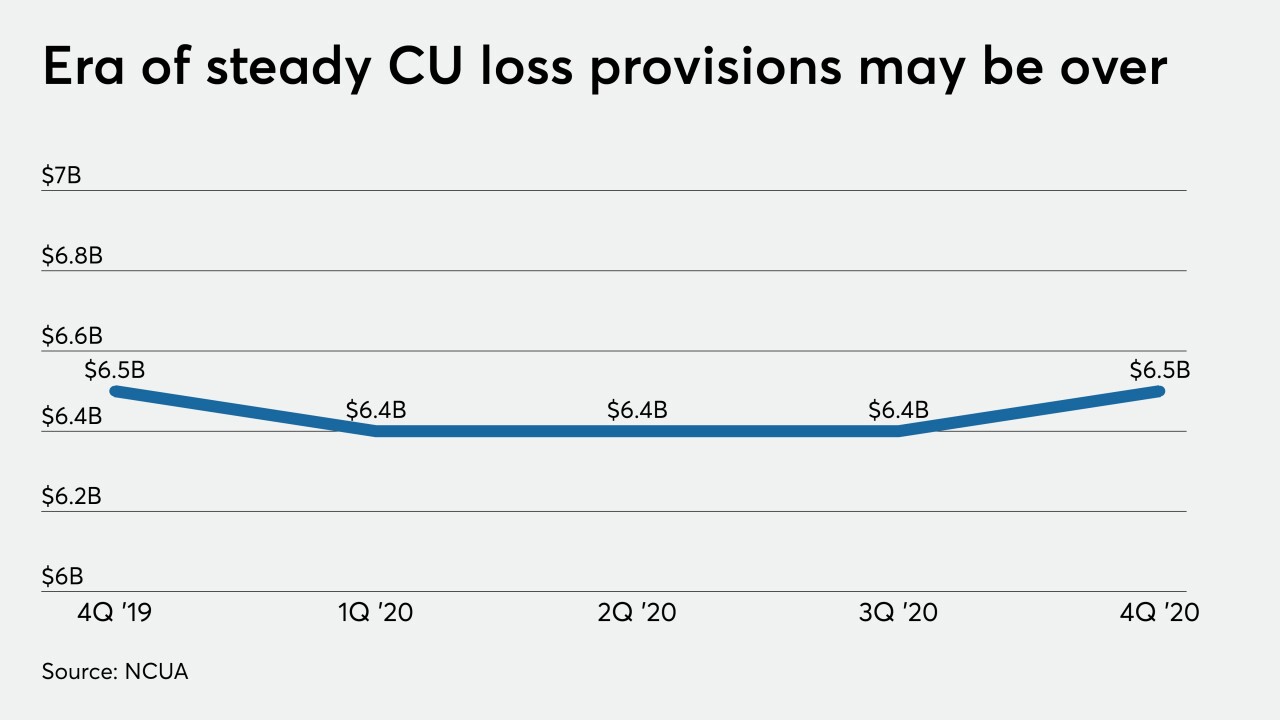

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20 -

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

March 3 -

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 7 Nations Lending Corp.

Nations Lending Corp. -

While his focus is on organic growth in Texas and California, Curt Farmer says he would consider a deal in those states if the right one comes along.

January 2 -

Negative benchmark interest rates are becoming commonplace in Europe and Japan. Here’s what US credit unions need to know in case that happens here.

December 3 Bonneville Power Administration

Bonneville Power Administration