-

The Federal Reserve raised interest rates by a quarter-point at its Wednesday meeting and more increases are expected this year. Here's what credit unions need to know to be prepared.

March 21 -

Credit union examiners will be focused on cybersecurity, BSA compliance, fraud prevention and more.

December 27 -

Banks reported $6.4 billion in trading revenue in the third quarter, down 3.6% from the previous quarter, on falling interest rate and foreign exchange revenue, the Office of the Comptroller of the Currency said.

December 26 -

Banks are swapping out long-term holdings for short-term securities to manage interest rate risk. But in the process, they are sacrificing yield — and ammo they might need to pay more for deposits to retain customers.

October 24 -

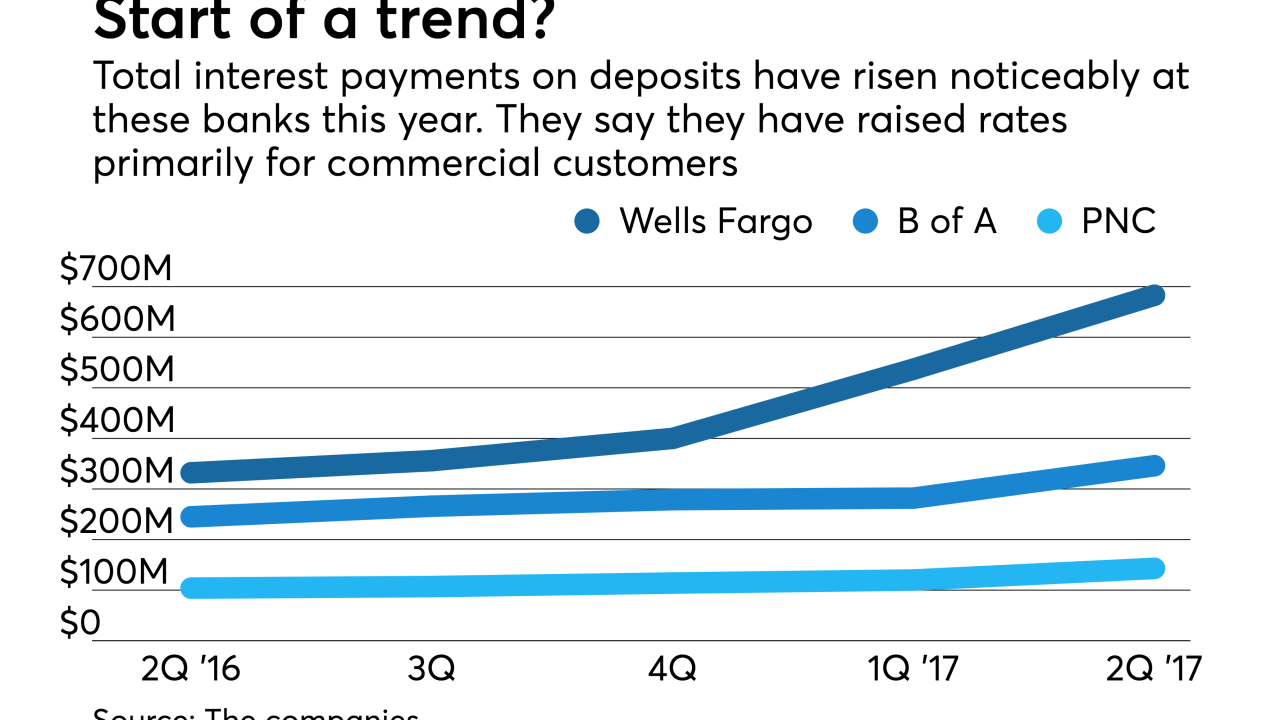

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

July 18 -

Some analysts suggest CUs cut fees in order to boost revenue, but CU’s haven’t wholeheartedly embraced that philosophy – at least not yet.

April 25 -

Simultaneous spikes in home prices and mortgage rates have put an unusual squeeze on borrowers' purchasing power and require lenders to be proactive about protecting their loan pipelines.

March 3