-

New smartphones have subtle differences that require more complex security solutions, says Fingerprints' Ted Hansson.

January 21 Fingerprints

Fingerprints -

Truist emphasizes high-touch, high-tech focus with new logo; Wells Fargo loses another patent lawsuit to USAA; what the Visa-Plaid merger means for banks, fintechs; and more from this week's most-read stories.

January 17 -

Criminals will react to the EU legislation by changing their modus operandi, says Nets' Sune Gabelgard.

January 17 Nets

Nets -

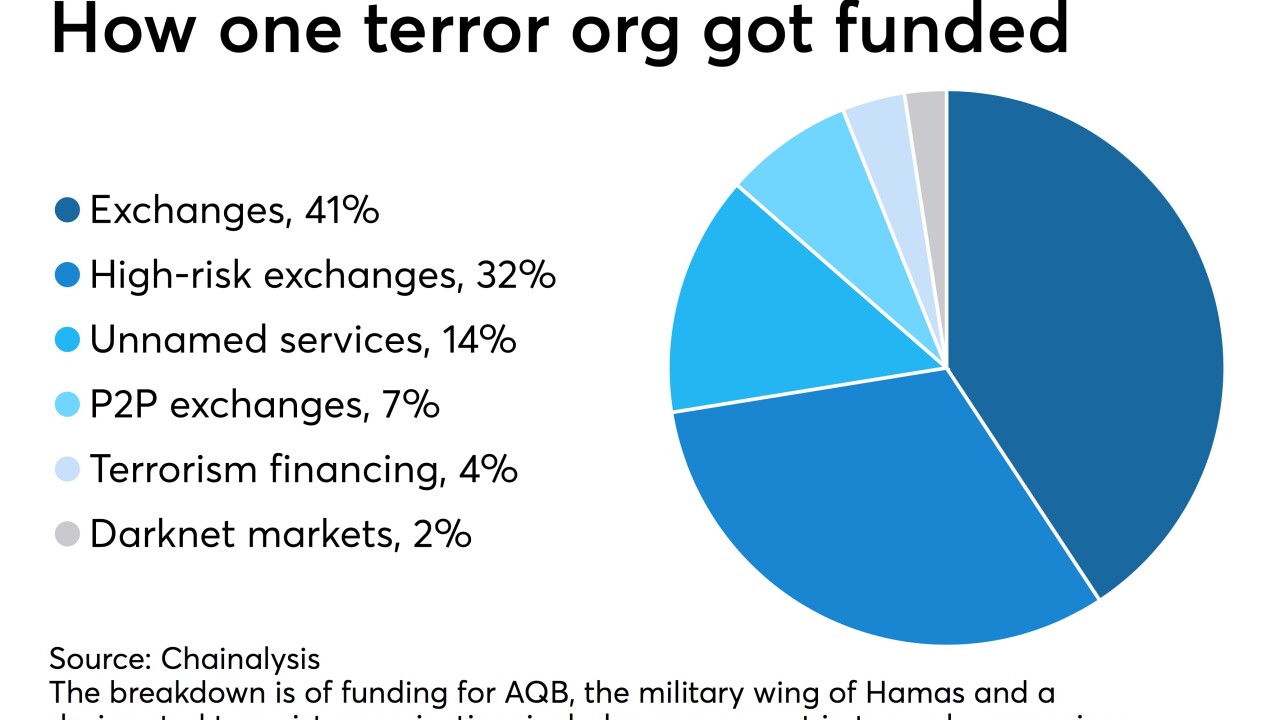

Terrorism financing schemes using cryptocurrencies are growing in sophistication, according to researcher Chainalysis, which helps law enforcement track digital-coin transactions.

January 17 -

Executives at Beach Community want to pursue more acquisitions in central Florida.

January 16 -

The ransomware attack chain uses a number of methods to infect an organization's systems, which can easily bypass an entire organizational security framework in seconds, according to Exabeam's Richard Cassidy

January 16 Exabeam

Exabeam -

The Supreme Court appointed Paul Clement to represent the agency after the bureau’s current director questioned its constitutionality.

January 15 -

Wells was ordered to pay USAA $102.8 million for infringing on its mobile deposit patents. It follows a separate lawsuit loss in November also related to patents.

January 15 -

Sophisticated attacks will show lower volume in many cases but attempt to emulate user behavior, says NuData Security’s Robert Capps.

January 15 NuData Security

NuData Security -

In a letter to the agency's inspector general, the 15 lawmakers pointed to specific cases where they said the bureau departed from legal standards in deciding not to require restitution.

January 14 -

Open banking and identity services are both still evolving to meet the needs of the new digital economy. These communities will need to connect at the hip to prevent fraud, avoid identity theft and to deter other financial crimes, like money laundering.

January 14 Regions Bank

Regions Bank -

Bank beats estimates as earning soar 21%; a cyberattack on the American banking system could create havoc on financial stability.

January 14 -

Data privacy regulations may be improving, and tech companies may now be forced to be more transparent about their practices, but the fact remains that vast quantities of personally identifying information are already out in the wild, says TRUSTID's Patrick Cox.

January 14 TRUSTID

TRUSTID -

Stephen Calk and the bank where he formerly served as CEO are both arguing that his bribery trial should be held in Illinois. Prosecutors oppose the move.

January 13 -

A North Carolina group is trying to take regulators' cue to work together. A successful effort could encourage others to follow its lead.

January 12 -

Potential sources of industry upheaval, and how to adapt; former Wells Fargo execs may face criminal charges in coming weeks; why banks have such high turnover of chief compliance officers; and more from this week's most-read stories.

January 10 -

Travelex unable to deliver cash to major banks following a New Year’s Eve cyberattack; Rep. Katie Porter says the bank is undermining purpose of its punishment.

January 10 -

Fraudsters can attack multiple individuals with the same scam, knowing that the details won’t be shared. Sharing the details of a scam takes that advantage away, says The ai Corporation's James Crawshaw.

January 10 The ai Corporation

The ai Corporation -

Cybersecurity, AML compliance and consumer protections top the credit union regulator's list.

January 8 -

Marcus and the Apple credit card accounted for 3% of the bank’s profit in the first three quarters of 2019, despite a multibillion-dollar investment in consumer operations; the senator’s plan would make it easier to expunge debt.

January 8