-

Enforcement actions are on the rise despite recent rollbacks of regulations. Fair lending, money laundering compliance and CRA remain focal points for examiners.

August 22 -

The bank said the candidate planned to accept money from the medical marijuana industry; the crash in digital currency prices’ long-term consequences.

August 21 -

Bank of America and several other large U.S. financial services companies, as part an effort organized by the Thomson Reuters Foundation and Western Union, have published resources to help smaller banks spot signs of forced labor and kidnapping.

August 20 -

After 20 years of working with a clunky, time-consuming 3-D Secure authorization method for online purchases, the wheels are finally in motion to get the upgraded 2.0 version in place for merchants and banks, granting access to more data for spotting fraud.

August 20 -

The money trail is a prominent part of investigations dominating headlines in the Trump era, casting attention on banks that have facilitated transactions for various people in the president's orbit.

August 19 -

One community bank decided it can build closer relationships with business clients by hosting events to help them learn how to fortify their cyberdefenses.

August 17 -

No outrage over more Wells disclosures; Steve Calk accused of conspiring with Manafort against his own bank; FBI warns banks about threat to ATMs; and more from this week's most-read stories.

August 17 -

As the state phases in tougher requirements from its 2017 regulation, federal agencies continue to show an interest in updating their cyber policies.

August 17 -

CO-OP Financial Services is currently pilot testing the new data-driven tool with credit unions in its shared branching network.

August 17 -

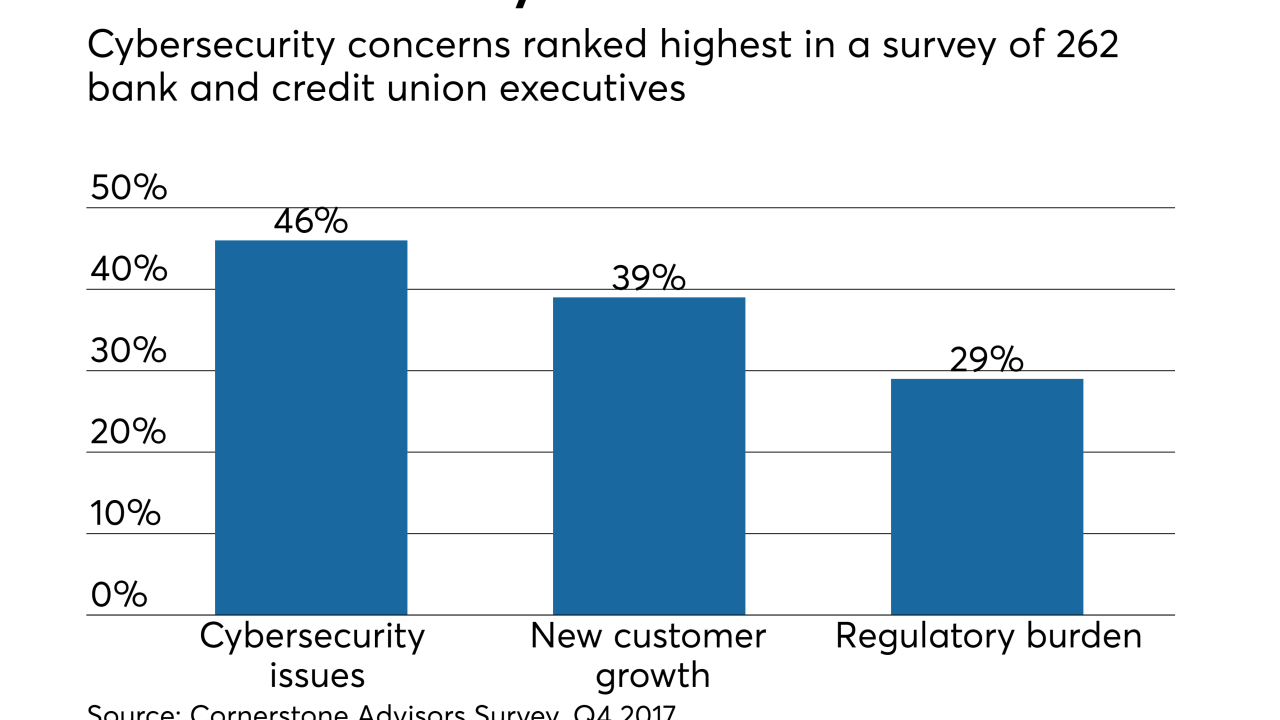

Cybersecurity remains a chief concern for small credit unions as a panel of experts warns small CUs may not just be a target, they could be one step in a larger attack.

August 16 -

More than 100 staffers at the Allentown, Pa.-based credit union took to the picket lines in a dispute with management over compensation and benefits, forcing the credit union to temporarily close at least two branches.

August 16 -

Rep. Emanuel Cleaver, D-Mo., says he is concerned that banks are freezing accounts of customers if they aren't providing citizenship information.

August 16 -

IBM claims that by monitoring customer behavior first and foremost, banks can make suspicious activity reporting far more accurate.

August 16 -

The Securities and Exchange Commission sanctioned Citigroup because of unauthorized proprietary trading as well as for the failure to detect suspect loans issued by its Banamex unit.

August 16 -

The board chair for CoastHills Credit Union says a wrongful termination suit by ousted CEO Jeff York is full of "false allegations," and that the credit union acted in the "best interests" of members.

August 16 -

The investors initially won the right to sue as a group in 2015 before an appeals court reversed the ruling; the $13 billion lawsuit can now proceed as a class action.

August 15 - Finance and investment-related court cases

Paul Manafort turned to Jared Kushner for help in an attempt to secure a Trump administration job for a Chicago banker at the center of Manafort’s fraud trial.

August 14 -

After being fired earlier this year, former CEO Jeff York says in legal action he was let go without cause, prior to end of contract term.

August 14 -

Concern over Exobot is spreading beyond banking and across other sectors where customers regularly transact online, from e-commerce and retail to health care, writes Don Duncan, security engineer for NuData Security.

August 14 NuData

NuData -

The bank continues to battle a series of negative headlines such as erroneous foreclosures, but public and investor reaction has been muted.

August 13 American Banker

American Banker