-

COVID-19 has pushed an increasingly popular, non-traditional POS lending product into the mainstream.

March 3 -

The London bank is trying out new models that help it assess the creditworthiness of recent college graduates, and layering on software that analyzes the fairness of its credit decisions.

February 25 -

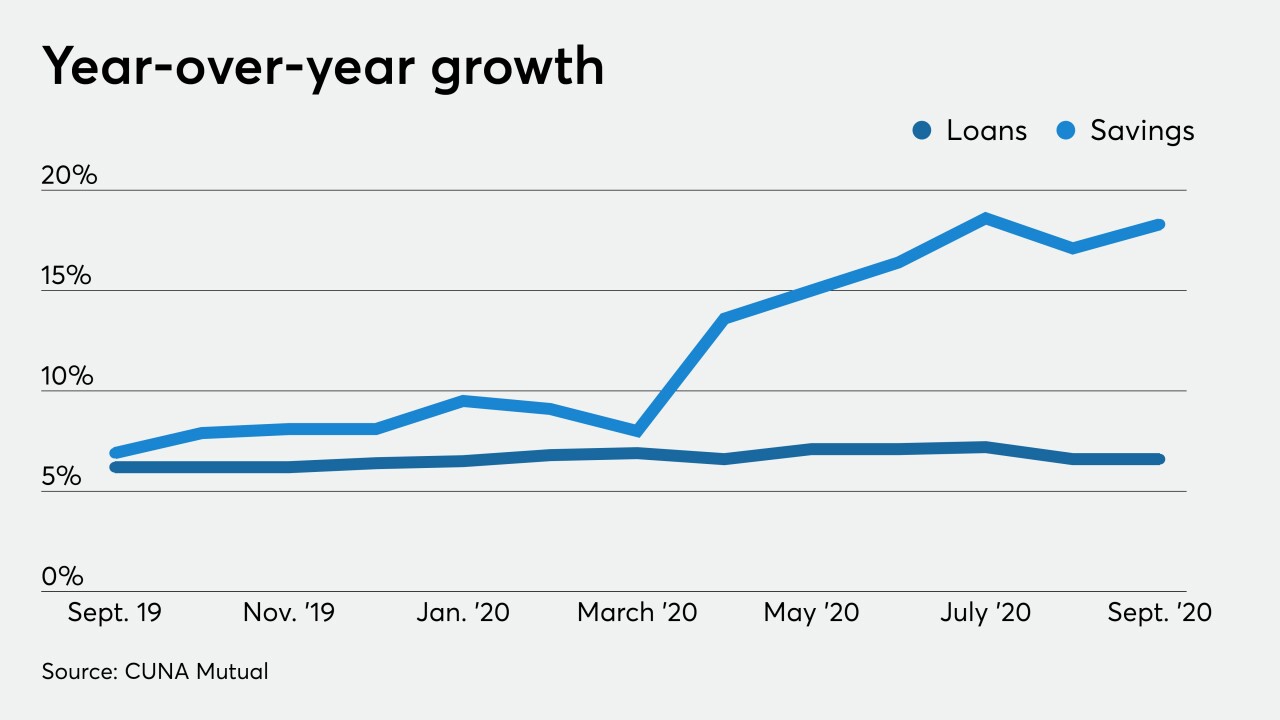

A new report from CUNA Mutual Group shows just how much COVID-19 and the economic slowdown impacted the credit union industry in 2020.

February 25 -

Year to date Sep. 30, 2020. Dollars in thousands.

February 16 -

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9 -

On Sep. 30, 2020. Dollars in thousands.

January 25 -

Some categories of businesses, such as restaurants, have different needs the program doesn't adequately address, says LendingFront's Jorge Sun.

January 12 LendingFront

LendingFront -

If you are underbanked you probably have limited access to mainstream financial services normally offered by retail banks. Many fintech startups offer alternative ways to measure credit risk, and assert that their products can help extend financial services to consumers who have not been well-served by traditional banks.

-

Affirm Holdings Inc., which provides installment loans to online shoppers, increased the price range for its initial public offering, seeking to raise as much as $1.1 billion when it goes public this week.

January 11 -

A new report from the National Credit Union Administration showed institutions in many states are struggling with a deluge of deposits while their lending opportunities are drying up.

December 20 -

Amazon-owned PayFort has changed its name to Amazon Payment Services and will offer installment payments to the markets it serves in the Middle East and North Africa.

December 15 -

“If you get your credit decisions right and you manage fraud well, you can run a very efficient bank. That’s an area where AI is very applicable,” Toronto-Dominion Bank's chief AI officer says.

December 10 -

Travel has declined dramatically during the past year, but buy now, pay later firm Uplift contends there's a vigorous recovery on the horizon, adding Air Canada to its client roster.

December 10 -

Capital One contends point of sale credit transactions are too risky to support, but competitors believe it's credit card debt that's falling out of favor with consumers.

December 8 -

Credit quality has remained strong at credit unions, but there are hints that some of them — especially the smallest ones — could report lackluster earnings well into next year, according to the National Credit Union Administration's latest intel on industrywide finances.

December 8 -

Lenders should be prepared to act quickly and decisively, leveraging the power of technology, innovative lending approaches, low interest rates and renewed commitment to small business funding, says LendingFront's Jorge Sun.

December 2 LendingFront

LendingFront -

Year to date Jun. 30, 2020. Dollars in thousands.

November 23 -

While digital pay innovation was once seen as a “nice-to-have” benefit, it's quickly becoming integral to business survival, says LendingFront's Jorge Sun.

November 23 LendingFront

LendingFront -

The company's latest report predicted there could be sustained economic pressures well into next year tied to rising coronavirus cases.

November 20 -

The uncertainty from the pandemic has made costs unpredictable, says Ally Lending's Hans Zandhuis.

November 5 Ally Lending

Ally Lending