-

Amazon-owned PayFort has changed its name to Amazon Payment Services and will offer installment payments to the markets it serves in the Middle East and North Africa.

December 15 -

“If you get your credit decisions right and you manage fraud well, you can run a very efficient bank. That’s an area where AI is very applicable,” Toronto-Dominion Bank's chief AI officer says.

December 10 -

Travel has declined dramatically during the past year, but buy now, pay later firm Uplift contends there's a vigorous recovery on the horizon, adding Air Canada to its client roster.

December 10 -

Capital One contends point of sale credit transactions are too risky to support, but competitors believe it's credit card debt that's falling out of favor with consumers.

December 8 -

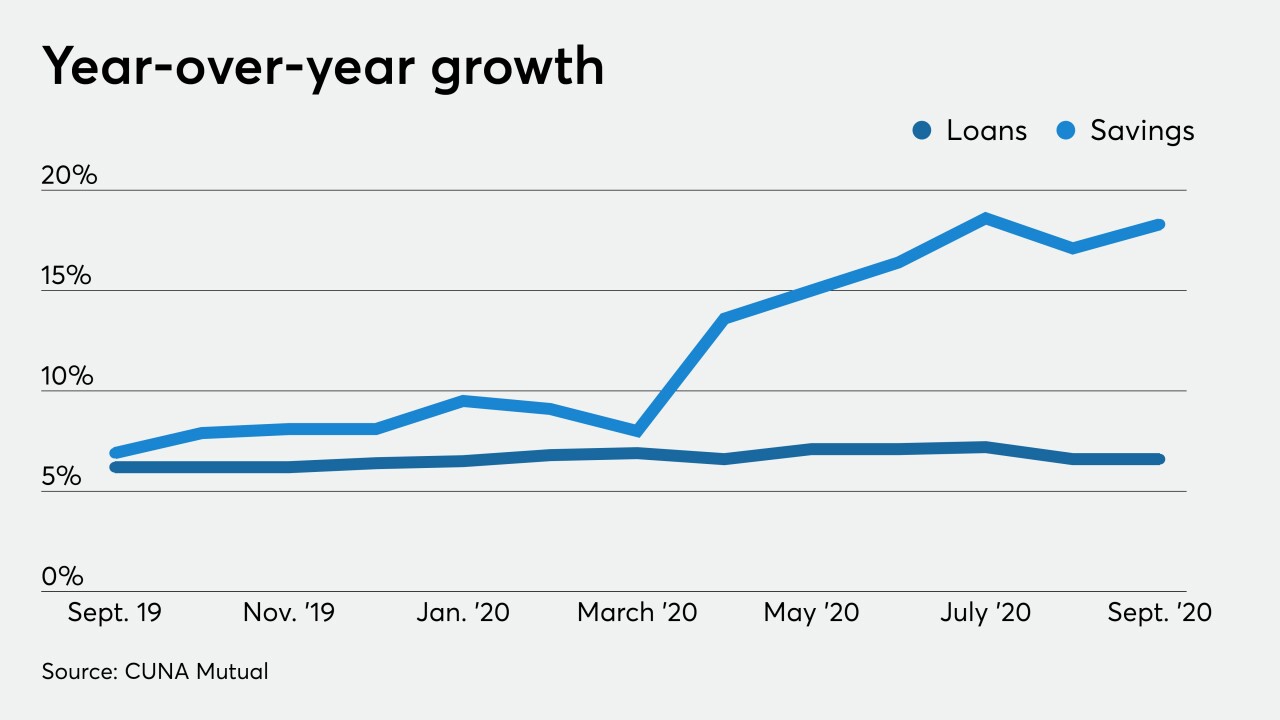

Credit quality has remained strong at credit unions, but there are hints that some of them — especially the smallest ones — could report lackluster earnings well into next year, according to the National Credit Union Administration's latest intel on industrywide finances.

December 8 -

Lenders should be prepared to act quickly and decisively, leveraging the power of technology, innovative lending approaches, low interest rates and renewed commitment to small business funding, says LendingFront's Jorge Sun.

December 2 LendingFront

LendingFront -

Year to date Jun. 30, 2020. Dollars in thousands.

November 23 -

While digital pay innovation was once seen as a “nice-to-have” benefit, it's quickly becoming integral to business survival, says LendingFront's Jorge Sun.

November 23 LendingFront

LendingFront -

The company's latest report predicted there could be sustained economic pressures well into next year tied to rising coronavirus cases.

November 20 -

The uncertainty from the pandemic has made costs unpredictable, says Ally Lending's Hans Zandhuis.

November 5 Ally Lending

Ally Lending -

Underwhelming participation in the middle-market loan program has forced the central bank to reduce the minimum borrowing amount for the third time, to $100,000.

October 30 -

With the COVID-19 pandemic creating unprecedented challenges for small businesses, American Express has increasingly targeted its investments in that niche.

October 23 -

When both origination and forbearance demand spiked in the early weeks of COVID-19, quick thinking lenders were able to leverage their expertise and tech stacks to respond quickly.

October 22 -

The coronavirus pandemic has turned every industry on its head. For lending, it exposed the need for modernized, fully digital platforms.

October 22 -

Banks, lenders, and fintechs have been on a path toward digitizing the mortgage process from end-to-end — long before the term coronavirus entered our daily lexicon. How has the pandemic affected progress?

October 22 -

Crane Credit Union has taken an Instagram Stories-like approach, while Certified Federal Credit Union is crafting personalized email messages.

October 9 -

The $3.1 billion-asset institution's product will not carry any fees and offers a variable APR.

October 8 -

The industry says the 2017 cut in the corporate rate helped position lenders to support the economy when the pandemic hit. But a plan proposed by Democratic nominee Joe Biden could strain banks' capital investment and hiring, observers say.

October 6 -

Credit union groups continue to make ad buys for industry-supported candidates in advance of Nov. 3, but recent positive economic news could be short-lived.

October 5 -

The former chairman of the National Credit Union Administration will work with the fintech to broaden its reach in the credit union space.

October 1