-

While some key indicators dropped in the year ending Dec. 31, 2017, credit unions in many states continue to thrive, with several new states jumping to the head of the pack for various growth measurements.

March 22 -

The Federal Reserve raised interest rates by a quarter-point at its Wednesday meeting and more increases are expected this year. Here's what credit unions need to know to be prepared.

March 21 -

The Jacksonville-based credit union released its 2017 annual report, highlighting record loan originations, strong member growth, community engagement and more.

March 16 -

Small-business payments are an inefficient mess of unpaid invoices and paper processes that are causing substantial funds to languish and companies to stagnate. One possible solution is to address the cash flow, not the payment mechanism itself.

March 14 -

Credit unions saw strong gains in membership, loans and more in 2017, though the industry continued to shrink, with 200 fewer credit unions in operation than at the end of 2016.

March 8 -

The Eureka, Calif.-based credit union saw assets rise by 8 percent last year, while lending was up more than 10 percent.

February 27 -

The Arizona-based online auto dealer has partnerships with 35 credit unions – and is looking to expand.

February 22 -

Provider of lending, marketing automation technology predicts more growth in 2018.

February 22 -

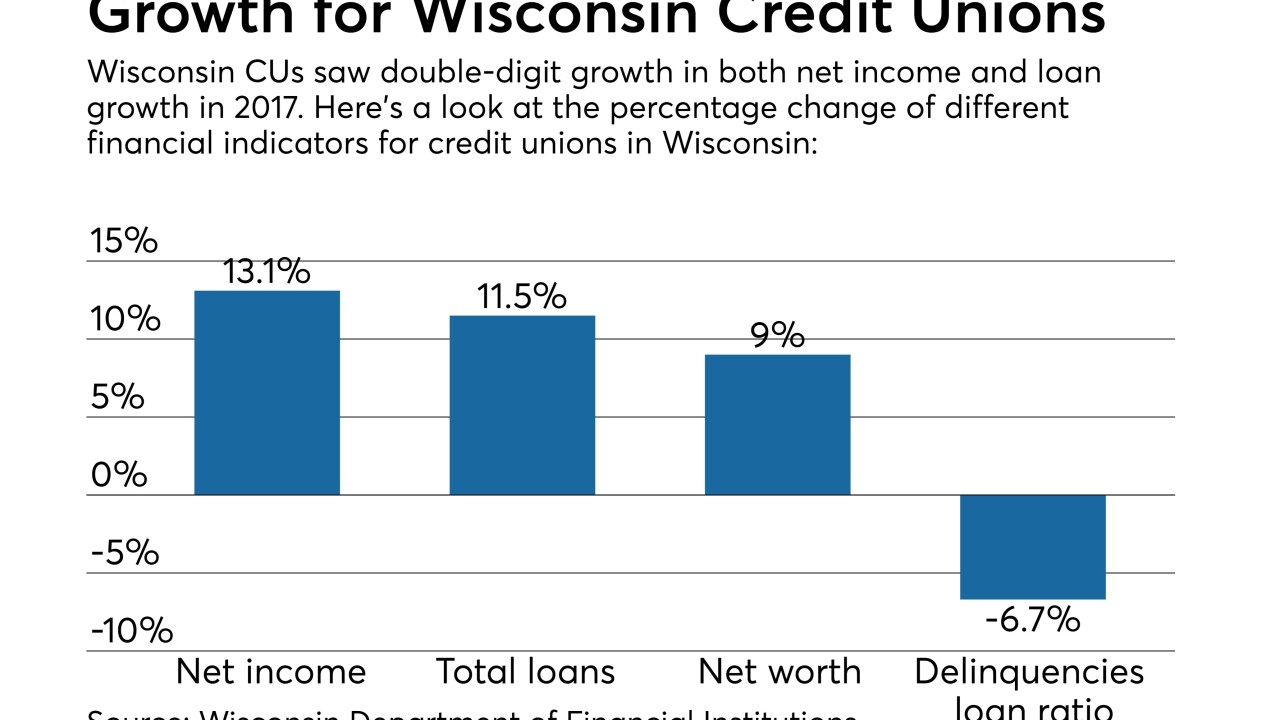

On top of a banner year for lending, delinquency rates in the state are at historic lows.

February 14 -

The Silicon Valley-based CU is funding development of an apartment building.

February 14 -

The California-based CU says its 2018 emphasis will be on member retention and expansion.

February 13 -

Year to date Sep. 30, 2017. Dollars in thousands.

February 12 -

After launching a video-banking platform in 2016, Vibrant Credit Union has now rolled the program out across its entire branch network, citing high member satisfaction rates, a boost in lending and decreased wait times.

February 9 -

The Massachusetts bank — and former credit union — bought Cumberland County Mortgage in Maine.

January 31 -

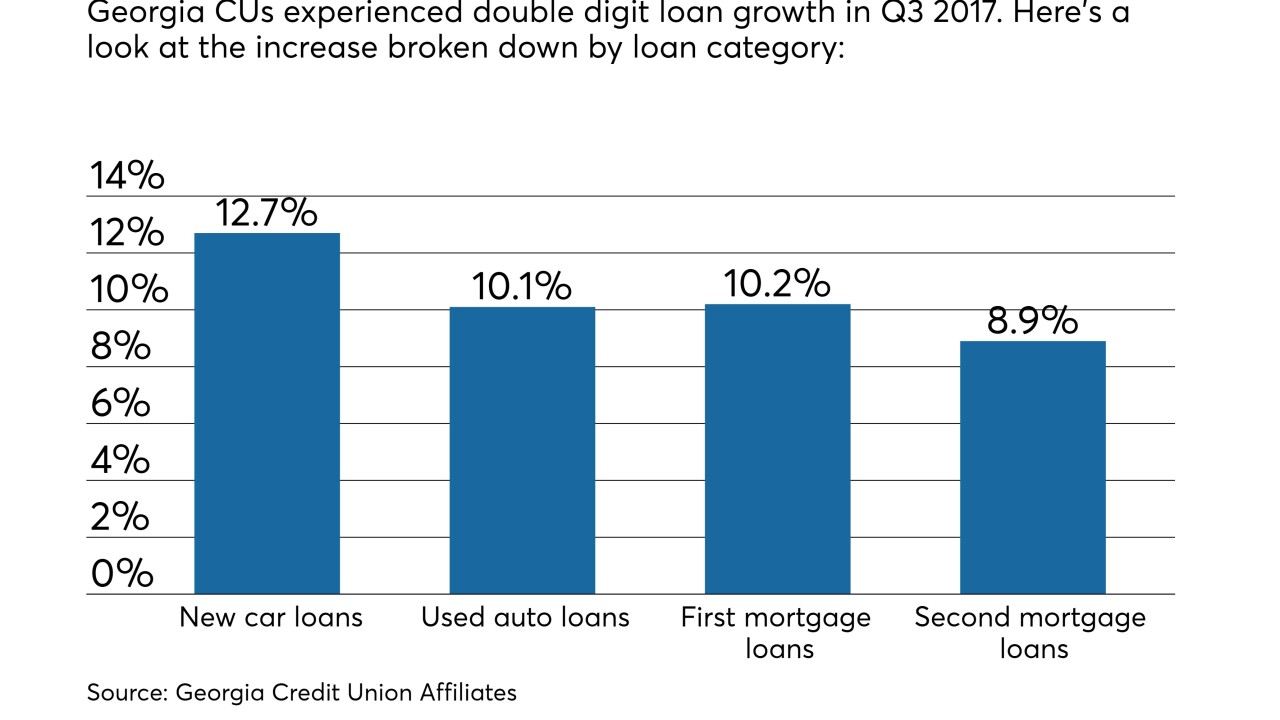

The increase was led by new car loans, which rose by 12.7 percent. Approximately 20 percent of the state's population are now credit union members.

January 31 -

Meta Financial expects to originate $500 million to $1 billion in personal loans as part of a three-year partnership with Liberty Lending in New York.

January 26 -

In a move rare for the industry, the bank bought a team of data scientists to bolster its artificial intelligence efforts in areas including product recommendations and fraud prevention.

January 16 -

Weak loan growth, a $3.25 billion litigation accrual and other costs tied to the phony-accounts saga all added up to a messy fourth quarter for the San Francisco bank.

January 12 -

Credit unions in the Gem State had a $638 million economic impact, according to a newly released study.

January 10 -

The Carson City-based credit union now has three wholly owned subsidiaries.

January 9