-

Republicans still receive more money overall from bankers, but the gap is narrowing ahead of the November elections. Experts say that the trend corresponds with signs of a “blue wave” and that many in the industry prefer Democrats on nonregulatory issues.

July 15 -

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 9 Sound Financial

Sound Financial -

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 8 Sound Financial

Sound Financial -

Despite success lobbying for PPP inclusion and the elimination of Regulation D, the industry must continue to push for additional reforms.

June 25

-

Lobbying lawmakers via videoconferencing has some advantages, but it's unclear if that format will continue to be used once social distancing requirements are eased.

May 15 -

Brian Smith, who spent the past decade with Regions Financial, will head the bank's government relations and public policy team.

April 17 -

Readers react to a regulator's promise to reduce regulation that hinders innovation, Sen. Elizabeth Warren's plan to impose heavier taxes on lobbying groups, Freddie Mac's exploration into AI and more.

October 3 -

Large financial institutions and trade groups are among the organizations targeted in the Democrat’s latest proposal to rein in corporate influence in Washington.

October 2 -

A new employee each year will be selected to represent the Eau Claire, Wis.-based credit union at industry events.

August 13 -

The government-sponsored enterprises have continued to expand over the past decade, despite being in conservatorship. New leadership at the FHFA should reverse this trend.

March 26 American Enterprise Institute

American Enterprise Institute -

Vice President Mike Pence congratulated credit unions on their work with consumers but he also urged attendees at CUNA's Governmental Affairs Conference to promote the controversial wall.

March 12 -

Michael Bright is resigning as acting president of Ginnie Mae to run the Structured Finance Industry Group, a trade association that's been without a CEO since Richard Johns resigned in July amid a reported split with the group's board.

January 10 -

The Massachusetts senator said a private event where Mick Mulvaney briefed donors about the party’s midterm prospects may violate the Hatch Act.

September 19 -

With strategic changes at key trade groups and attention shifting away from regulatory relief for community banks, the interests of large institutions have taken on more prominence.

August 22 American Banker

American Banker -

The senator's proposed legislation includes a ban on individual stock ownership and restrictions on government employees joining the lobbying ranks.

August 21 -

The banking industry has been raising alarms about the growth of a few credit unions, but the critiques ignore the vast size differences between the two sectors and the tremendous growth banks have seen since the crisis.

August 20 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

The banking industry has been raising alarms about the growth of a few credit unions, but the critiques ignore the vast size differences between the two sectors and the tremendous growth banks have seen since the crisis.

August 20 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

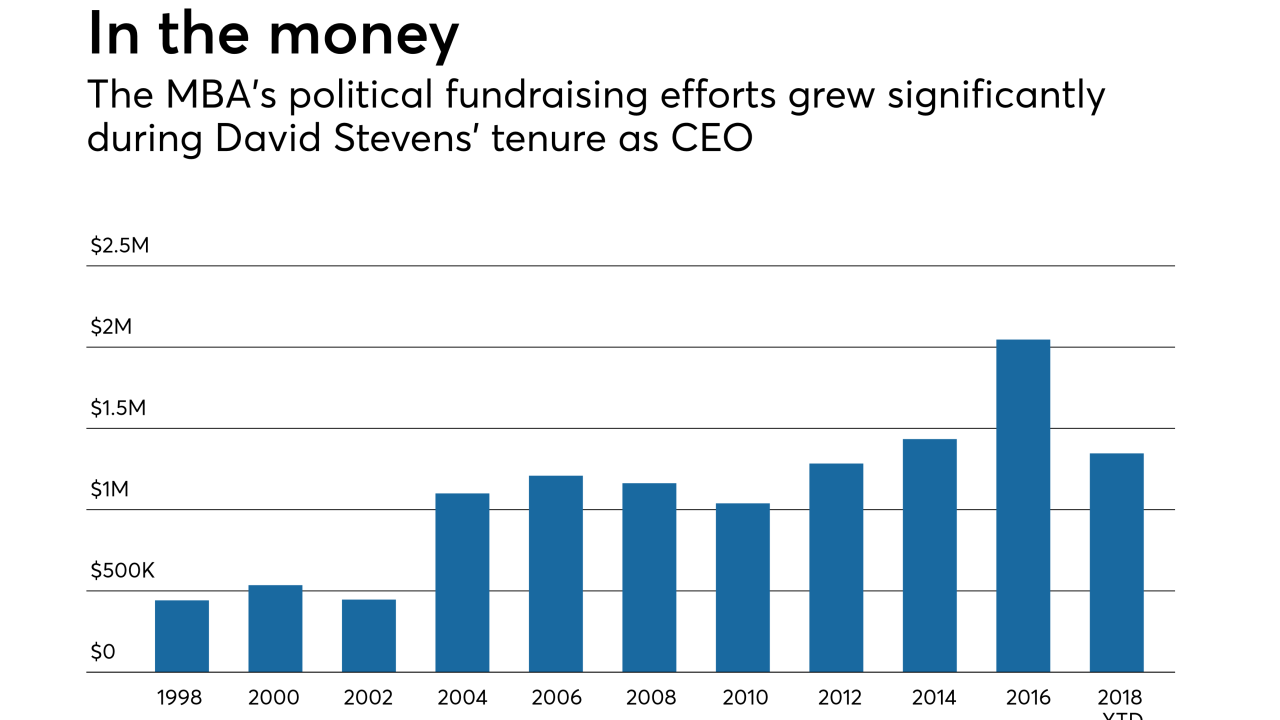

Robert Broeksmit has a tough act to follow succeeding David Stevens, the CEO revered for navigating the Mortgage Bankers Association through one of its most tumultuous eras on record. But in doing so, Broeksmit has a distinct advantage over many of his predecessors: inheriting an organization on the upswing.

June 8 -

The firms were initially slated to be included in a newly merged trade association, but they were blocked after some executives objected to adding more Wall Street banks.

June 8 -

With comment periods quickly closing, responding to the agency’s abundant requests for information is proving a logistical hassle for the industry and consumer advocates.

June 6