-

The California-based CU gave Credit Union Journal a behind-the-scenes view of what can be a painful process, while another expert offered best practices for CUs considering similar moves.

April 30 -

The most satisfied customers are those who frequently use online or mobile banking, but still visit branches two or three times a month, J.D. Power said in its annual Retail Banking Satisfaction Study.

April 26 -

Nymbus is offering its bank clients a service to create a digital brand under their existing charter in as little as 90 days.

April 25 -

Online banks have good reason for wanting regulators to update the 41-year-old Community Reinvestment Act.

April 18 -

WebAuthn could eventually mean passwords are replaced with fingerprints and facial recognition. But how hard will it be to implement?

April 18 -

Community banks are increasingly turning to account onboarding technology to help them solve a growing problem — how to win new customers without opening physical branches.

April 17 -

Customers are sprinkling symbols into their texts, and it's a challenge for banks to fine-tune systems to support the use of the cartoon code in communications.

March 29 -

The field is crowded, but that’s not stopping well-established banks from trying to reach new markets by creating separately branded digital units.

March 27 -

Denizen is designed for expats and migrants to receive money and make payments without international transfer fees or currency exchanges.

March 26 -

Citigroup plans to launch an online bank that will be marketed nationally. It is one of several large companies with an online bank or niche platform in operation or on the drawing board.

March 6 -

The estimated costs of recent digital glitches at BB&T, TD and Wells Fargo are in the hundreds of millions of dollars, but contractual and economic realities make it hard for banks to sue vendors for the money or fall back on insurance policies.

March 2 -

One problem is that banks are shifting to online and mobile channels for delivering advice, which is inferior to in-person communications, according to a recent survey conducted by J.D. Power.

February 26 -

The digital-only Ally Bank has taken several steps to deepen customer relationships through electronic channels, including use of personalized emails and websites that have yielded strong click-through and loyalty rates.

February 26 -

The North Carolina bank is the latest regional to experience a widespread outage.

February 23 -

The bank will allow its customers to apply for car financing online and receive a decision within minutes.

February 22 -

Scores of customers have been unable to use digital channels to access accounts for more than a week, and many have taken to social media to voice their displeasure with TD’s response to the outage. The lesson for other banks: Test new platforms, and test them again, before making them live.

February 20 -

As regulators look to update the Community Reinvestment Act, they should better integrate online and mobile banking activity as part of exam performance.

February 15 Consumer Bankers Association

Consumer Bankers Association -

Webster Bank’s partnership with the national broker-dealer LPL is a reversal of its initial opposition to robo-advisers. It is the latest regional bank to enter a market first claimed by the biggest banks.

February 13 -

The bank joins a small group of companies that believe short-term forecasts will ultimately help customers build healthier financial lives.

February 13 -

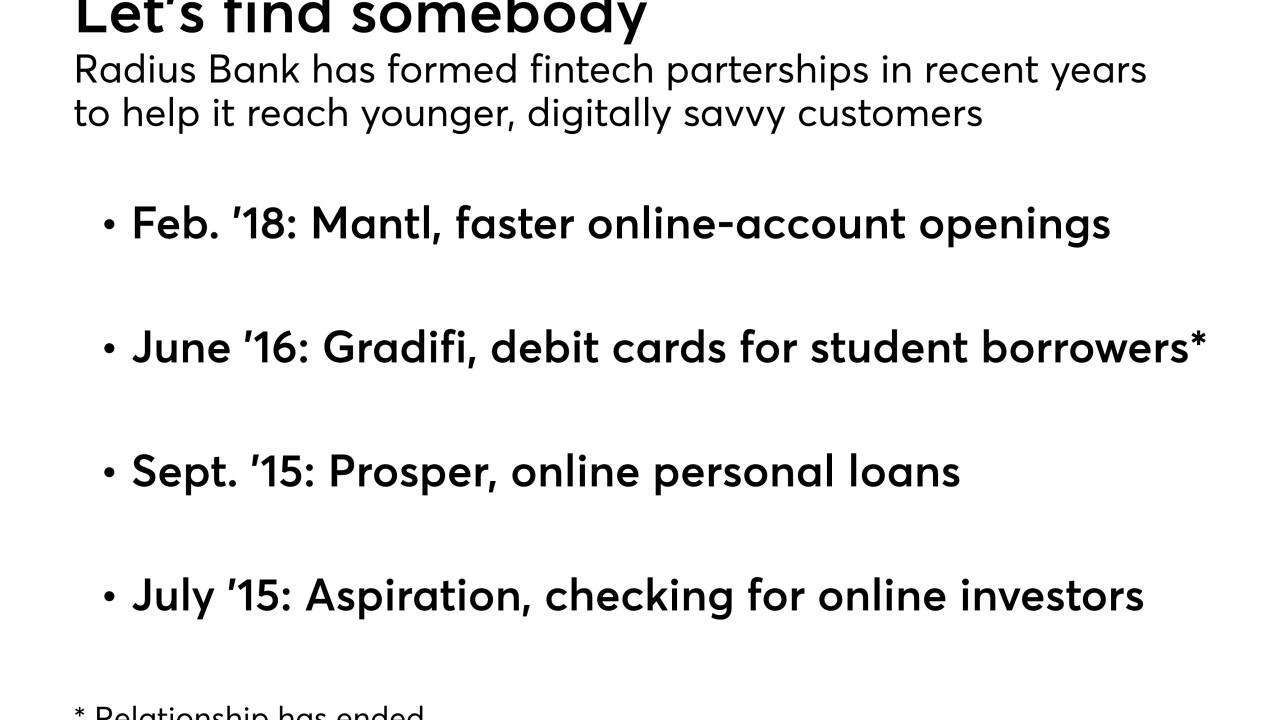

Its latest partner, Mantl, has built software that lets consumers open accounts in four minutes. In such alliances Radius seeks expertise it lacks, gets heavily involved in product development, and tries to balance the spirit of innovation with the demands of compliance.

February 7