-

As PayPal seeks to turn Venmo into a profit engine, the service has also taken steps to collect consumer debts, moves that are sure to spark controversy as some of the targeted users claim they have been fraud victims.

March 25 -

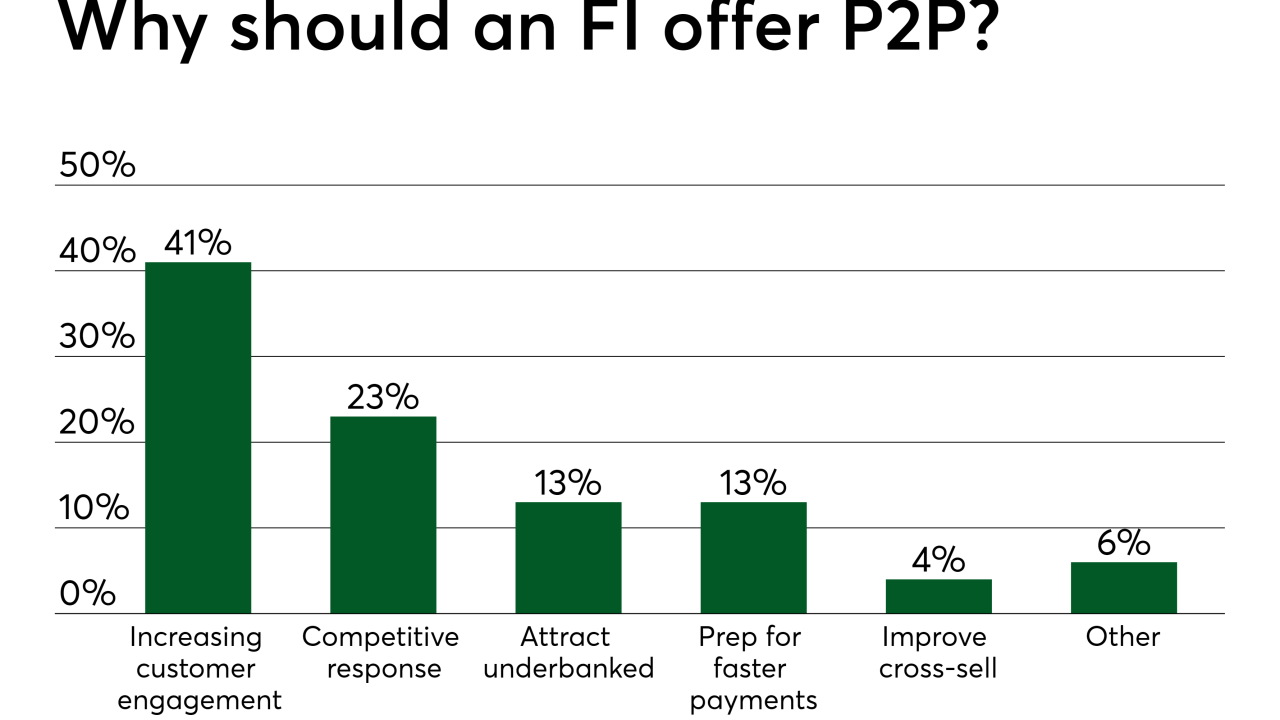

The market for P2P payments is finally taking off after years of false starts, but there are still many unanswered questions. The biggest one: How do banks get value out of offering this service free of charge?

March 22 -

Person-to-person payments have become table stakes for institutions looking to attract and retain younger customers. The service may also be one of the keys to keeping big-tech insurgents like Amazon at bay.

March 22 -

The market for P2P payments is finally taking off after years of false starts, but there are still many unanswered questions. The biggest one: How do banks get value out of offering this service free of charge?

March 22 -

Person-to-person payments have become table stakes for institutions looking to attract and retain younger customers. The service may also be one of the keys to keeping big-tech insurgents like Amazon at bay.

March 21 -

There is a growing proliferation of social P2P technologies within the U.K. banking sector, but the market for such payments is vastly different from that in the U.S., where social payment apps have found a welcoming audience.

March 21 -

The new U.S. Faster Payments Council states a clear mission — to promote faster payments in the U.S. But this new entity could butt heads with the Federal Reserve if it thinks the Fed isn't moving fast enough.

March 14 -

Jack Henry & Associates has overcome an obstacle that delayed banks and credit union integration with Zelle, with a hub to streamline the onboarding process. But the new system’s first bank doesn’t go live until May, and the hub won’t hit full stride until next year.

March 14 -

Vipps, which launched in Norway in 2015 as a P2P app accessible to all local bank customers, is integrating invoice and bill-payment capabilities through a collaboration with Nets Group, a Nordic payment service provider.

March 12 -

Driving rapid consumer adoption of faster payments and the bank-run person-to-person payment network, Zelle, has been a core role for Early Warning’s Lou Anne Alexander over the past decade.

March 12 -

Jenifer Swallow has been here before, feeling the excitement of being in in an industry that was about to change commerce forever.

March 12 -

Mastercard has dropped out of a recent bidding war with Visa to acquire Earthport, announcing it will instead buy Transfast, a different cross-border payments firm.

March 8 -

Barclays plc has spent years experimenting with creative ways to promote mobile payments, and it's not showing signs of stopping.

March 8 -

The mobile revolution is turning Western Union into a very different company, one that must adjust to new ways to pay while pouring substantial resources into fending off the threat of e-commerce.

March 8 -

Pan-European payments and transaction services provider equensWorldline has launched its domestic interoperable P2P mobile payment scheme across the continent.

March 5 -

Barclays is preparing to merge its wearable mobile payments product BPay with its more popular Pingit app, after it struggled to attract users.

March 5 -

The bank-run Zelle P2P network was designed without the social media-esque touches that made Venmo a hit among millennials. And as one might expect, half of all new P2P users are 45 and older.

March 4 -

P2P transfer apps aren't just for splitting the rent — they can also be portals to a wider array of financial services, as Canada’s national Interac debit network plans to prove.

February 28 -

Consumers are expressing an ever-increasing interest in making digital Person-to-Person payments to friends, families and even businesses for bills, shared expenses or temporary loans. Digital P2P payments are quickly beginning to displace other payment forms such as cash and checks due to their convenience and growing ubiquity.

February 20 -

Singapore’s banks have gained a six-month extension to comply with regulations aimed to protect consumers and businesses using P2P and other electronic funds-transfers within the country.

February 4