-

Fintech still has a ways to go to change the financial world, but it already offers solutions to income insecurity that can be truly transformational right now.

May 17 Columbia University

Columbia University -

Gov. Mary Fallin, a Republican, sided with consumer advocates over payday lenders in a fight that is playing out in numerous states.

May 5 -

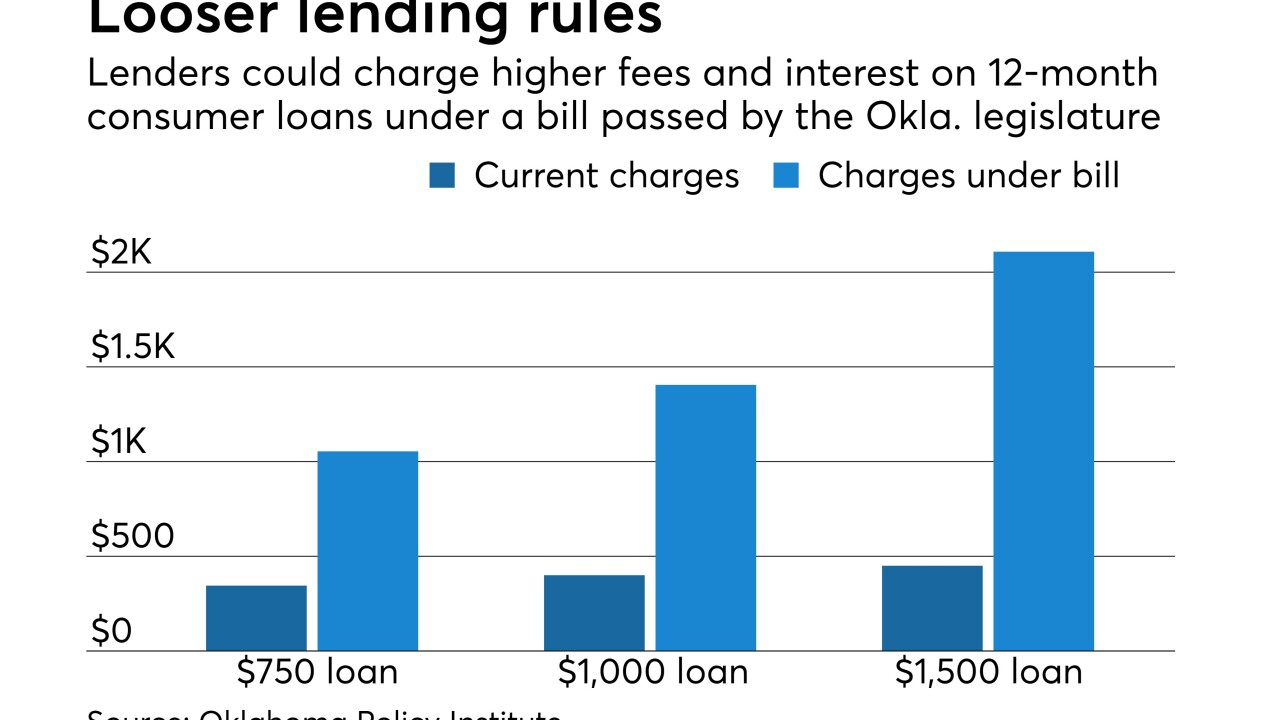

An industry-backed bill that is headed to the desk of Gov. Mary Fallin is seen by critics as an effort to minimize the impact of a potential CFPB crackdown.

April 28 -

The Consumer Financial Protection Bureau's prevailing mindset is apparently not affected by convincing evidence regarding options for borrowers looking for small-dollar credit.

April 17 Community Financial Services Association of America

Community Financial Services Association of America -

Elevate Credit in Fort Worth, Texas, debuted Thursday at half the price the company had been targeting. Investors may have been spooked by the possibility of rising losses.

April 6 -

Startups in the payday lending space say their use of artificial intelligence is allowing them to make better loans at lower rates with fewer defaults.

March 7 -

U.S. District Judge Gladys Kessler is set to rule next week on whether to halt the Justice Department's quest to force banks to cut ties to industries it considers to be at high risk for criminal activity.

February 16 -

Financial firms are going on offense in Washington, pressing a policy agenda that would have been unimaginable just a few months ago. Some proposals, like reforming the Consumer Financial Protection Bureau, have been floated before while others began to gain traction after Republicans swept the November elections. Here's a look at some of the industry's requests.

February 13 -

Jessica Rich, who joined the agency in 1991, is stepping down in mid-February, the FTC announced Tuesday.

February 7 -

The current single-director leadership structure of the Consumer Financial Protection Bureau is not a recipe for transparency and accountability. Creating a multimember commission to oversee the agency is the answer.

January 4