-

In recent years, the in-aisle payments and checkout-free stores have become increasingly common across the U.K. retail market, especially in the supermarket and grocery sector. Now High Street fashion outlets are coming under pressure to introduce faster and more convenient payment options to keep up with consumer demands.

August 12 -

From housing finance to Facebook’s crypto plans, moderators questioning the presidential candidates in Texas next month would have no shortage of financial policy topics from which to pick.

August 11 -

-

Anticipating recession, banks start scrubbing loan books; how Trump's political appointees thwarted tougher settlements with two big banks; the Fed's plans on its real-time payment service; and more from this week's most-read stories.

August 9 -

The U.K.’s Equals Group’s FairFX currency unit has purchased Hermex FX, another U.K. firm serving corporate customers with currency exchange and payment services.

August 9 -

Square has launched Square Terminal in Canada in an effort to lure merchants that use myriad iPads, tablets and smartphones to receive payments in stores and remotely.

August 9 -

Lightico is focusing on how users engage with institutions on a mobile device, something the company believes is a shortcoming among card issuers.

August 9 -

Marqeta was in on the API digital payments game early, but rivals from Stripe to Wirecard are aggressively expanding digital payment solutions for diverse consumer and B2B use cases.

August 9 -

Most ATM update projects fail for a variety of reasons, such as the amount of time and effort required was simply underestimated, competing priorities get in the way, a lack of resources, a reliance on manual testing processes and procedures, according to Paragon Application Systems' Steve Gilde.

August 9 Paragon

Paragon -

Issuers like Chase and Citi that added installment features to compete with digital lenders will need to think beyond traditional card options.

August 9 FICO

FICO -

Know Your Customer and open banking create tough barriers for 'near real-time' account opening, says Entersekt's Jennifer Singh.

August 9 Entersekt

Entersekt -

Readers react to the Fed's lengthy plan for a real-time payments system and Fifth Third's minimum wage increase, jab at Sen. Warren's absence on the Senate Banking Committee and more.

August 8 -

The maturation of e-commerce has ushered in an era of personalization at scale and growing customer demand for convenient, flexible shopping experiences, writes Will Walker, enterprise manager at Roadie.

August 8 Roadie

Roadie -

Despite being compliant, market-specific deployments leave retailers facing a new set of compliance challenges when moving into new geographies, argues Arnaud Crouzet, VP of security and consulting at FIME.

August 8 FIME

FIME -

Vice Chairman Randal Quarles’ public dissent raises questions about how the board will proceed on other policy debates.

August 7 -

Under the Illicit Cash Act, anti-money-laundering rules would be clearer — so banks would have no excuses for noncompliance.

August 7 Kroll

Kroll -

Three years ago, payments technology provider Dwolla submitted a 164-page proposal to the Federal Reserve's Faster Payments Task Force. This week, the Fed unveiled a plan for its own faster payments system, but Dwolla had already moved on to other projects.

August 7 -

As technology advances, new terms are existing with older vocabulary, causing potential confusion that challenges user experience, says NvoicePay's Alyssa Callahan.

August 7 Nvoicepay

Nvoicepay -

Klarna raised another $460 million in fresh equity funding, pushing the Swedish company’s valuation to about $5.5 billion.

August 6 -

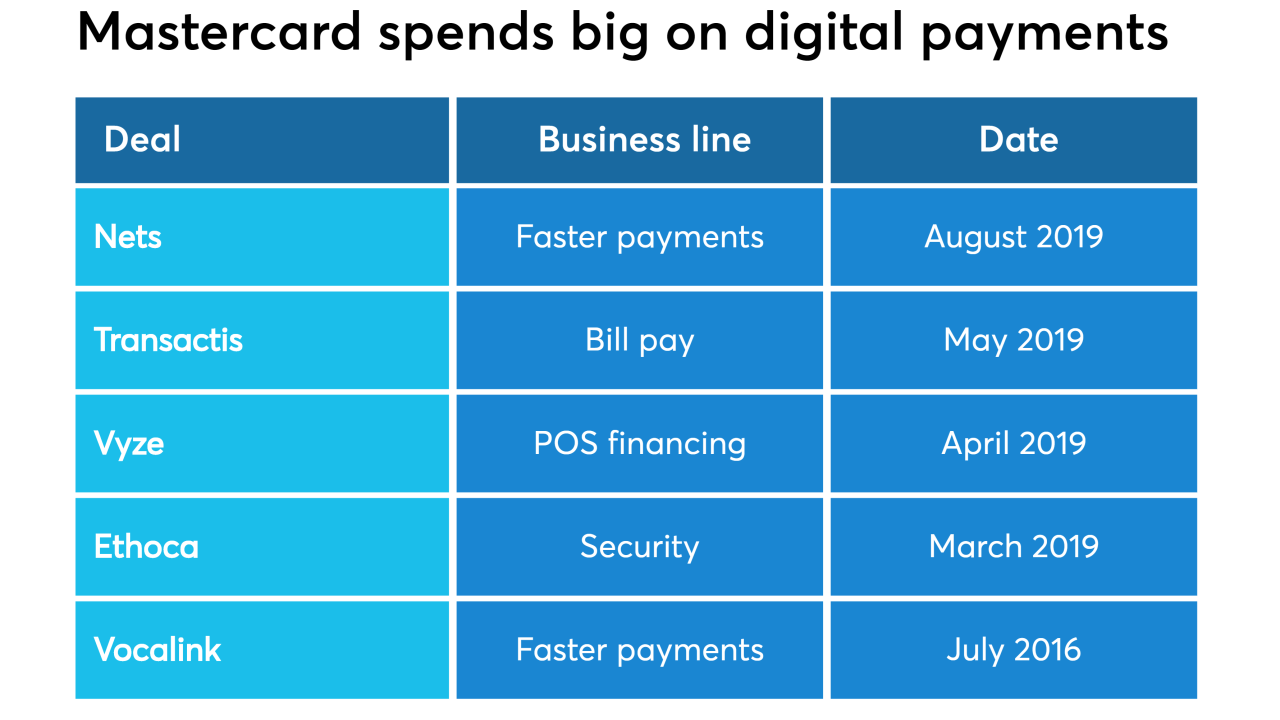

Mastercard has spent more than $4 billion on investments so far in 2019 to thread a needle between several must-haves in the digital payments market.

August 6