-

Restaurants have a broad menu of tech services to choose from. The challenge now is to make these products work together.

May 5 -

The "as a service" model cuts costs and streamlines deployment of new card programs and technology, says Zeta's Bhavin Turakhia.

May 5 Zeta

Zeta -

The $925 million deal would bring Zego's real estate management and payments software to Global Payments, which views real estate as a $6.5 billion market.

May 4 -

Payment facilitators give the power back to field service companies and allow them to run their business their own way, says WorkWave's Rick Agajanian.

May 4 WorkWave

WorkWave -

This Apple/Epic battle is likely to encourage more companies to play the field, find the right payments solution for them, and avoid higher costs, says Credorax's Igal Rotem.

May 4 Credorax

Credorax -

As businesses accept automation, more innovation is flowing into the market, says Billtrust's Flint Lane.

May 3 Billtrust

Billtrust -

European regulators say App Store fees distort competition, a claim similar to Epic Games' contention in legal action in the U.S. over gaming download charges and transaction routing.

April 30 -

Widespread card acceptance was key to keeping small businesses afloat during the pandemic and will be crucial to helping consumers and businesses get the economy booming again, says the National Taxpayers Union's Thomas Aiello.

April 30

-

Contactless ticketing innovation has long driven parallel adoption nearby retail. New work habits may change that dynamic.

April 30 -

Apple Inc. was handed a European Union antitrust complaint over its app payment rules, drawing one of the world’s toughest competition enforcers into a global battle over fees for downloads on smartphones and tablets.

April 30 -

Citizens Bank and Barclays US are among the lenders expanding in this market — with or without fintechs on board.

April 30 -

Citizens Bank and Barclays US are among the lenders expanding in this market — with or without fintechs on board.

April 30 -

Incumbents have access to tons of information on consumers, but developing the means to analyze and act on it requires a strategic change, says Icon Solutions' Simon Wilson.

April 30 Icon Solutions

Icon Solutions -

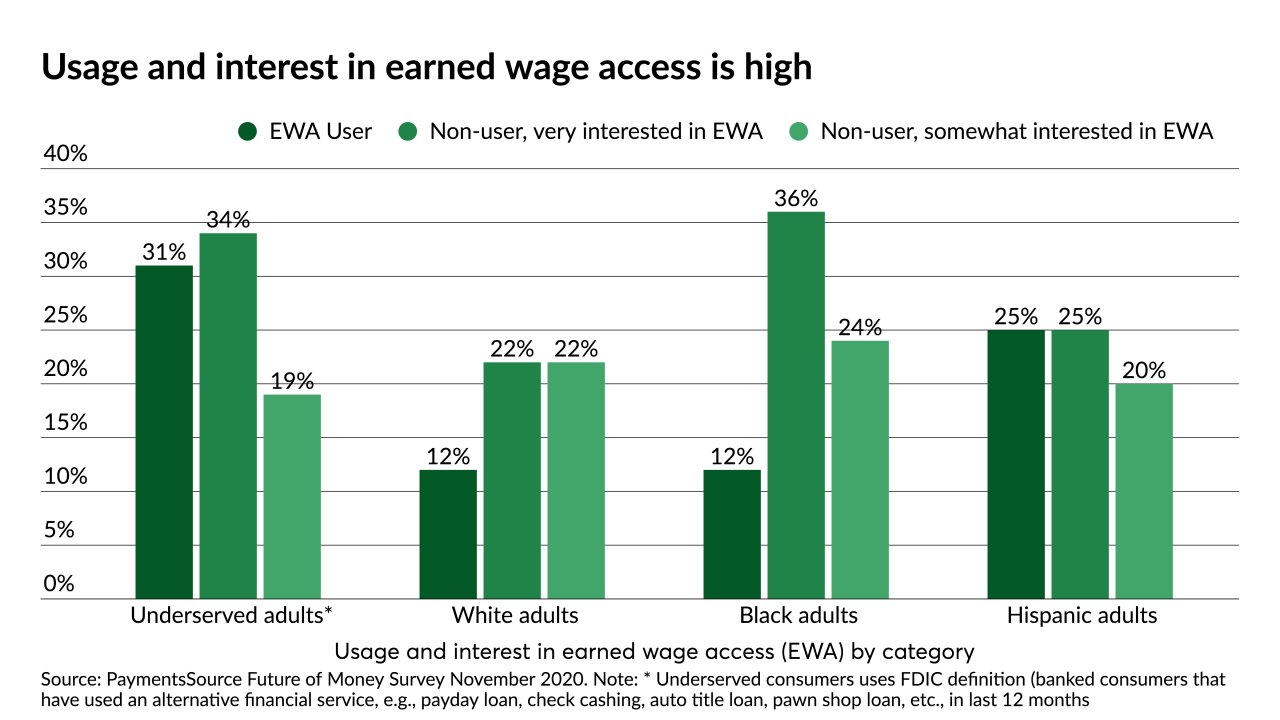

Fiserv is joining the increasingly crowded market for earned wage access in partnership with Instant Financial.

April 29 -

It’s time organizations use the same type of data security approach to meet Nacha compliance as they do to secure PANs in accordance with PCI DSS, says comforte AG's Trevor Morgan.

April 29 comforte AG

comforte AG -

With greater connectivity and more information being shared about customers and transactions, there will be more potential to generate valuable business intelligence, says Citizens' Matt Richardson.

April 28 Citizens

Citizens -

While a merchant may choose to run a program incorrectly, it is our responsibility as professionals to fully understand what the rules are and communicate the impact if they are not followed, says Clearent's Phil Ricci.

April 28 Clearant

Clearant -

The tech vendor allows merchants using the Clover point-of-sale platform to accept PayPal and Venmo payments, a move that serves the company's continuing focus on full omnichannel experiences for its merchants.

April 27 -

Barclays US, which offers a range of cobranded credit cards targeting middle-income consumers, is adding a buy now/pay later option for its merchant partners.

April 27 -

Kate Fitzgerald, senior editor at PaymentsSource, talks to Eric Schuppenhauer, Head of Consumer Lending and National Banking at Citizens Bank, about lending at the point of sale.

April 27