-

Each company has introduced its own program to give dealerships access to real-time digital transactions.

April 10 -

The banks that own the peer-to-peer payment network are reportedly considering a retail launch that could fend off rival payment methods — or simply cannibalize the sizable revenue issuers get from credit and debit cards.

April 7 -

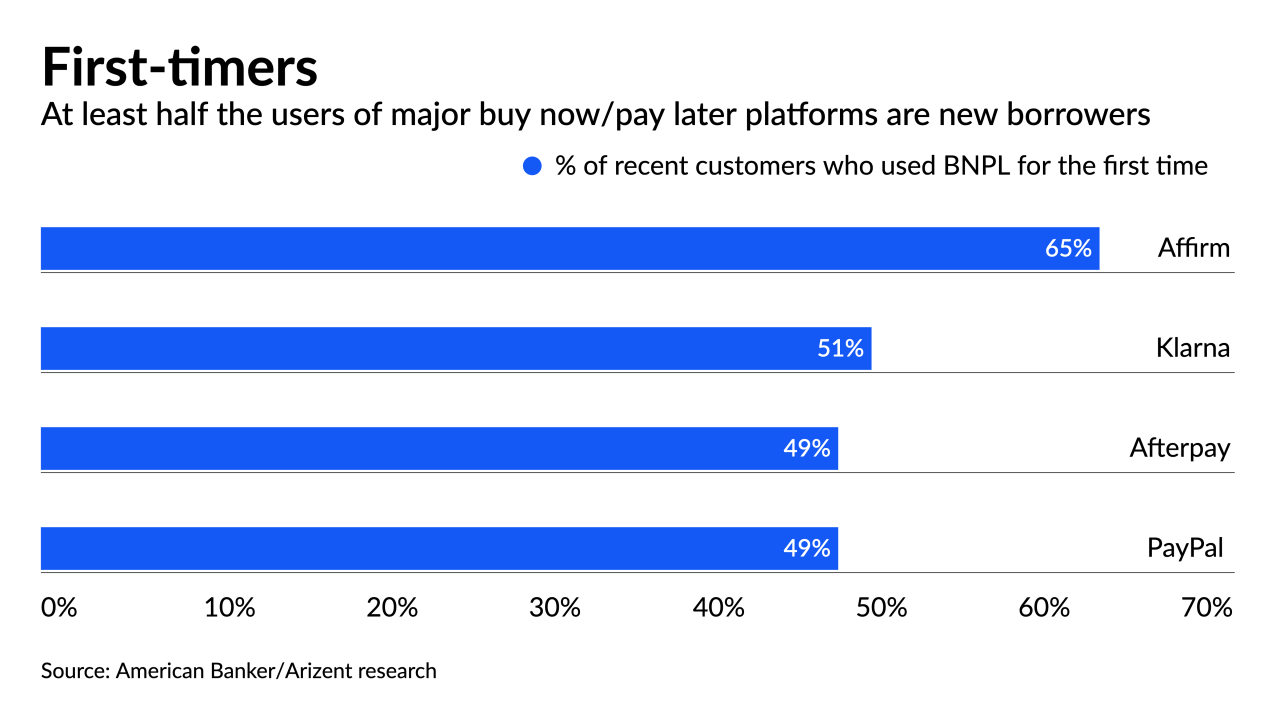

The data from these transactions could help millions of borrowers with thin or nonexistent credit files. But how the credit reporting industry collects and treats the data may matter more than the data itself.

March 9 TransUnion

TransUnion -

Tap to Pay on iPhone turns any of the tech giant's recent smartphones into a card reader, but since Apple doesn't provide its own merchant services, it stops short of becoming a direct threat to acquirers and payment facilitators.

February 8 -

The deal is the latest example of a mainstream bank buying a point-of-sale lender focused on financing home improvement projects.

January 19 -

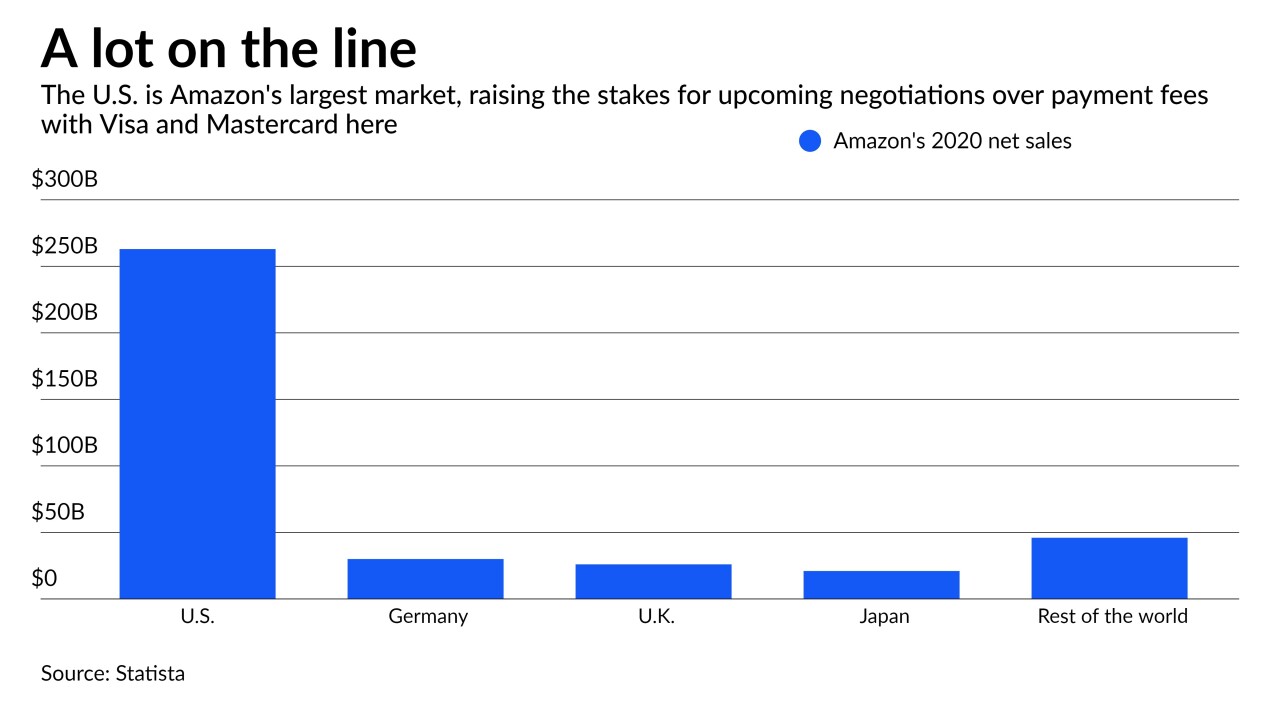

The online retailer’s plan to block certain credit card payments in Britain is seen as an opening move in likely negotiations with Mastercard and Visa ahead of the card networks' planned fee hikes in 2022.

November 17 -

Citigroup, BNY Mellon, JPMorgan Chase and PNC are each working to enable wireless providers, public utilities and other companies to instantly receive funds from the consumers they bill.

November 5 -

Best known as a website management company, GoDaddy began directly offering digital and offline payments after learning that its clients were getting those services from fintechs. The company is also now selling terminals for in-store payments.

October 18 -

The lender is building on a 20-year-old partnership with Fiserv to provide options such as revolving credit, with plans to add buy now/pay later.

October 14 -

Apple will allow developers of some apps to link from their software to external websites for payments by users, addressing a longstanding App Store complaint and settling an investigation by Japan’s Fair Trade Commission.

September 1 -

Both tech companies require developers to use the app stores' built-in payment systems and pay as much as 30% of each consumer transaction. South Korea just passed a bill that ends this practice, and U.S. lawmakers have proposed similar legislation.

August 31 -

David Marcus, Facebook's financial services chief, discusses how its Novi digital wallet and the Diem stablecoin project it's involved in can be the backbone of a platform that offers real-time digital transactions, acts as a merchant acquirer and helps commercial banks handle central bank digital currencies.

August 26 -

More than a dozen banks and credit unions in Canada are launching an instant business-to-business payments service. Here’s what U.S. banks and the Federal Reserve could learn from it.

August 24 -

The bank, which helped launch the real-time network for peer-to-peer payments, is trying to duplicate that success by helping corporate clients process certain transactions instantly with wholesale partners and, in some cases, retail customers.

August 20 -

Many customers in health care and other sectors remain resistant to new technologies. Here's how banks are trying to persuade them to adopt more efficient payments and back-office systems.

August 19 -

Most people aren't spending bitcoin in stores, but major point-of-sale terminal makers are developing technology and business relationships on the belief that demand will build fast.

August 17 -

The bank’s decision to offer home improvement loans directly will not have a material impact on profits at the Atlanta-based fintech, according to GreenSky.

August 12 -

For years mobile wallets have been a solution in search of a problem – until now. COVID-19 has reframed the retail point-of-sale (POS) and with it, how consumers want to pay, giving wallets a new relevance for safer in-store payments.

August 12 -

The acquisition of Florida-based Service Finance Co. would expand the North Carolina bank’s presence in the point-of-sale lending business.

August 10 -

As tech giants rush into point-of-sale lending, the smaller companies that built the market are counting on acquisitions and partnerships with specialized vendors to defend their turf and pull in new borrowers.

August 9