-

Following the lead of open banking regulation in Europe, payments technology provider Elavon is working with Nuapay in the U.K. to provide account-to-account payment setups for its merchant clients.

March 10 -

The Fed can take steps now to speed up existing networks.

March 10 Cato Institute

Cato Institute -

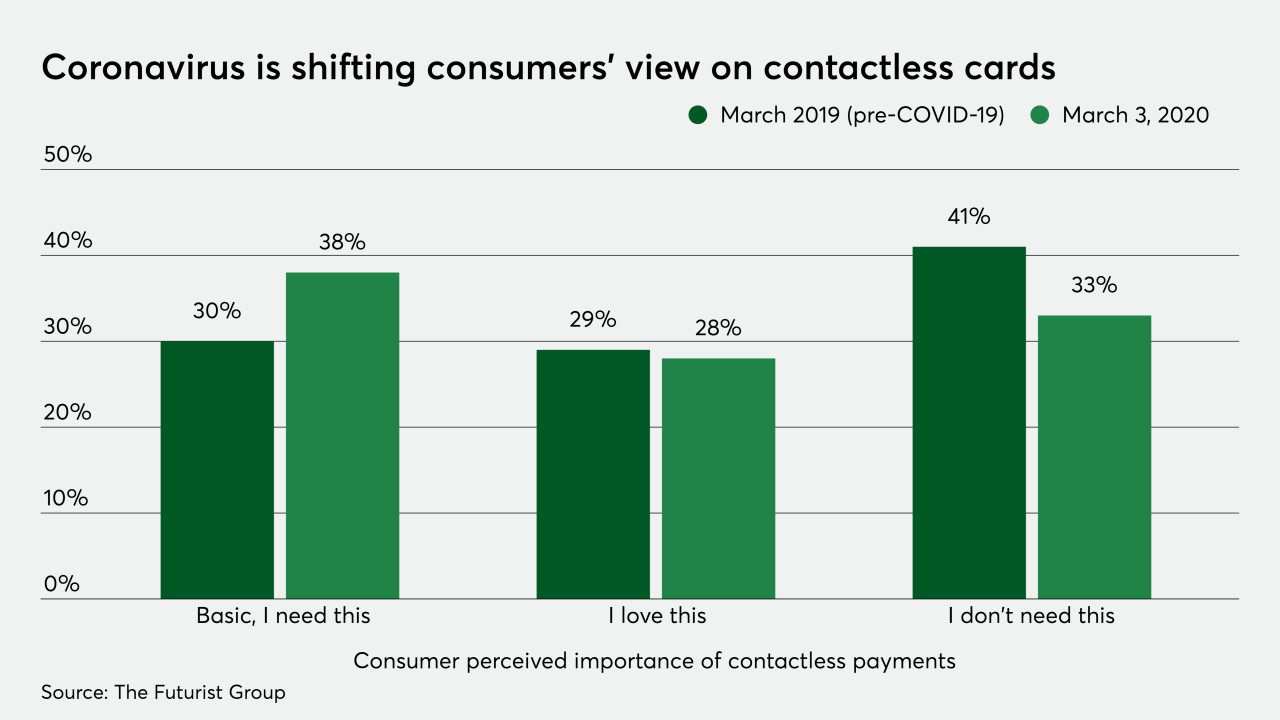

Contactless cards are a potential refuge for consumers who fear plastic and cash are carrying COVID-19.

March 10 -

Alibaba Group Holding Ltd.’s parcel and meal delivery arms have returned to pre-coronavirus outbreak staffing levels, the latest example of how China’s largest corporations are getting back to work after Beijing’s entreaty to safeguard economic growth.

March 10 -

As we launch into a new decade, today’s new workforce wants, expects and demands easy-to-use apps in the vein of what they’re used to in their day-to-day lives, says Fyle's Yash Madhusudan.

March 10 Fyle

Fyle -

In announcing plans to export Just Walk Out to other retailers, Amazon rattled the emerging autonomous checkout industry and raised questions about its ability to amass even more data than it already has about consumer consumption patterns.

March 9 -

If a checking account doesn’t come with checks anymore, can it still be called a checking account? It’s a valid question that the financial services industry should be asking itself.

March 9 -

Mobile financial network provider Rapyd is embedding its open development tools with Brazilian processors to support payments in any local method.

March 9 -

Payment firms and fintechs can use open source and the cloud for a potent innovation combo, says Asset Control's Mark Hermeling.

March 9 Asset Control

Asset Control -

Credit card issuers caught in the trap of chasing new customers with increasingly costly rewards-point programs are trying something new: letting more users redeem rewards directly with merchants instead of acting as the intermediary.

March 9 -

State Farm struggled to make its bet on banking pay off and decided like other insurers to exit the business. U.S. Bancorp swooped in to add deposits and credit card accounts at little cost or risk.

March 6 -

A handful of banks keep trying to make the customer-Alexa connection happen; banks are more worried about payments firms than other types of fintechs; how financial institutions are coping with COVID-19; and more from this week’s most-read stories.

March 6 -

Wells Fargo hopes to anchor its debit card at the top of customers’ digital wallets with a promotion offering users a $5 credit.

March 6 -

The Reserve Bank of India has temporarily halted operations at the struggling Yes Bank, leaving fintechs without a place to process payments.

March 6 -

Companies that give employees early access to earned pay don't want to be lumped in with payday lenders, so they are putting a new spin on their pitch: It's a tool to lure and retain valuable workers.

March 6 -

Even though health care payment providers have more digital payment options than ever, there still is a tough hurdle to overcome: Patients don't always trust the medical provider or insurance company to provide accurate bills.

March 6 -

As part of its financial inclusion campaign, Mastercard has partnered with Moneytrans to launch remittance-linked checking for migrant workers with a goal of obtaining 1 million users by 2025.

March 5 -

Afterpay, whose online installment loans are seeing strong growth in the U.S. apparel sector, has partnered with Oakland, Calif.-based processor Marqeta to develop additional payment products and services.

March 5 -

Advance wage access company Branch has partnered with Cardtronics’ Allpoint ATM network to provide surcharge-free cash access at all Allpoint ATMs across the U.S. to its customers.

March 5 -

The credit card issuer is seeking to rebound following a tumultuous year in which top executives departed and key retail partners declared bankruptcy.

March 4