-

Zelle, the big banks' answer to Venmo, is set to launch next year. But will its reach be enough to curb Venmo's momentum?

November 2 -

Samsung sees banking as a long game, and Samsung Pay is its first move. As mobile banking grows, the Korean electronics company believes financial services is ripe with opportunity.

October 28 -

Australian banks wants Apple to open up its payments system to third parties. U.S. banks are likely following the situation closely as many are looking to renegotiate their contracts.

August 31 -

Loyalty programs are likely the underpinning of the adoption of mobile payments, so banks need to make sure reward points are part of their digital offerings.

August 29 -

Banks are playing a more active role in the next phase of fintech, both as investors and partners, says David Sica, partner at venture capital firm Nyca. That change is shaping how the firm looks at new investments.

August 26 -

B of A says customers are becoming inundated with wallet options, so they are holding out on building their own.

July 25 -

Keefe Bruyette & Woods and Nasdaq have launched an index that tracks fintech companies.

July 19 -

If the financial services industry wants to avoid spending years aimlessly testing blockchain prototypes, it needs to focus on coming up with standards and working together.

July 15 -

Visa's Digital Commerce App is allowing banks to develop their own mobile wallets. Many of its clients are larger community banks that may not otherwise have the resources to develop such a product internally.

June 13 -

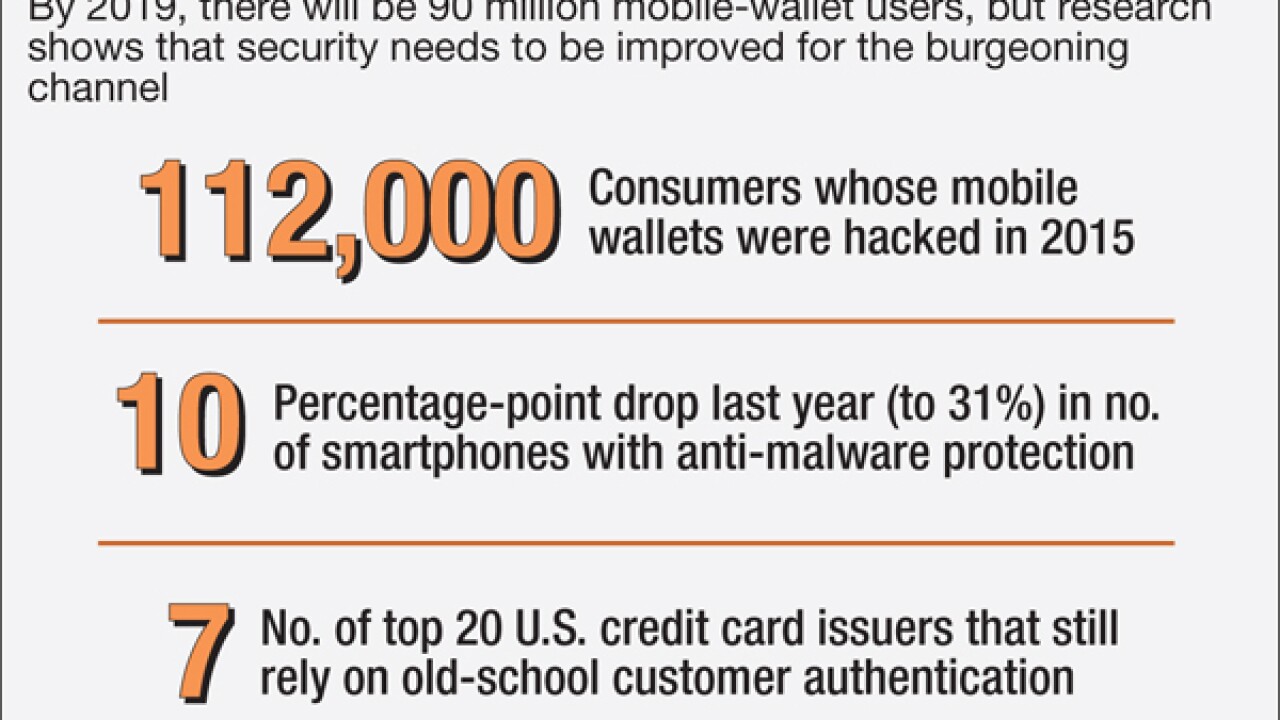

As mobile wallets become more popular they'll also become more popular targets for fraud. Banks ought to improve enrollment guidelines and other security tools in plotting their mobile-wallet strategy.

April 18 -

BMO Financial Group is looking to bring a recent consumer-facing innovation to its corporate customers.

March 23 -

Adam Draper of Boost VC talks about the rise of the blockchain, the challenges of the bitcoin world and the future of banking.

March 4 -

SunTrust is turning to fintech to help it provide better payments solutions to its business customers. The approach is novel because so much of fintech innovation centers on overhauling retail banking.

February 12 -

Developers will now be able to access much of Visa's technology and services as the card network looks for ways to meet the demands of consumers increasingly relying on connected devices to transact.

February 4 -

Banks are looking to beef up ease and convenience in P-to-P payments to avoid being reduced solely to back-end payments processors for fintech startups.

January 25 -

Union Bank & Trust Co. in Nebraska was an early supporter of Apple Pay. With that platform sputtering, the bank is now looking at additional ways to stay ahead of the mobile-wallet curve.

January 20 -

A data breach-related court case involving Wyndham hotels and new Defense Department rules governing contractors provide banks some dos and don'ts in bringing vendors' security practices into line.

August 31