-

The credit union regulator's latest Quarterly U.S. Map Review finds that while loans are still growing, asset and share growth is beginning to slow.

December 28 -

Citigroup expects to take a noncash charge to earnings of about $20 billion if the Senate's version of the tax reform bill is enacted, Chief Financial Officer John Gerspach said.

December 6 -

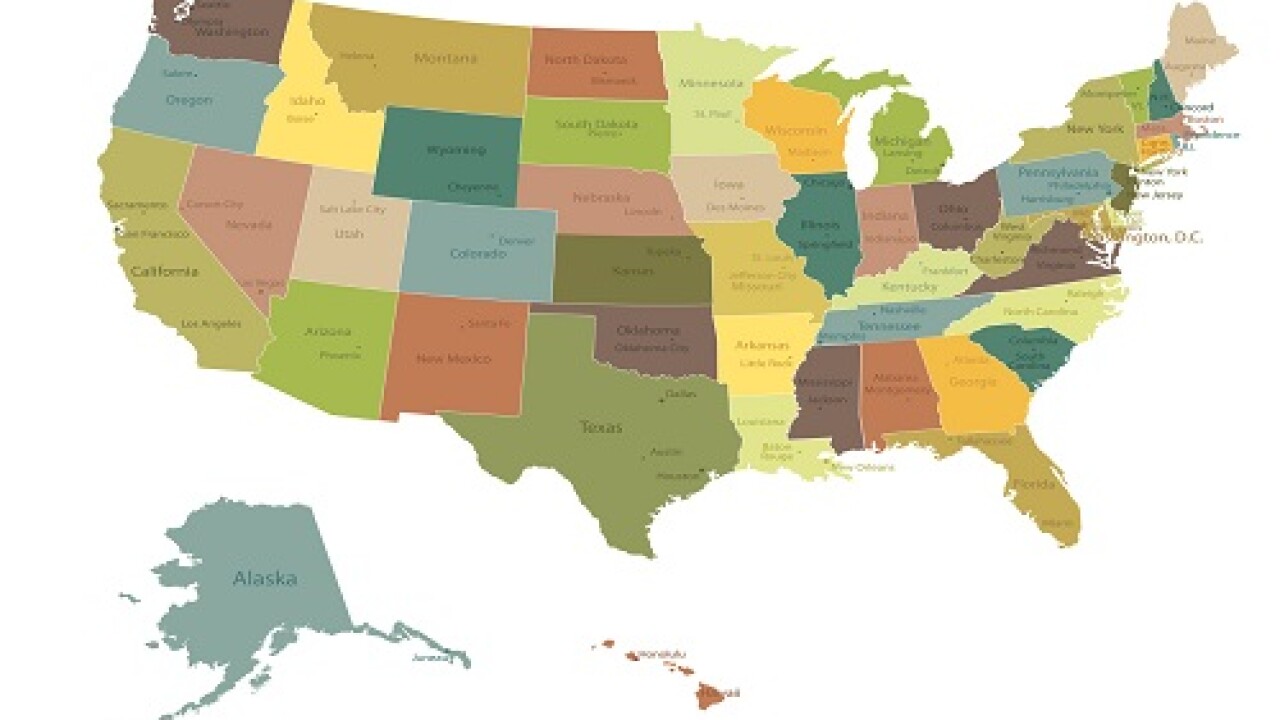

From membership and loan growth to ROA and beyond, here's how the states stack up on a variety of growth metrics.

October 17 -

Delinquency rate holds steady, number of credit unions drops again.

September 21 -

Core deposit growth might be the best indicator of which banks will have true staying power in the years ahead.

August 1 -

Credit unions in both states continue to meet or beat their national average in a variety of growth metrics, according to the League of Southeastern CUs.

July 20 -

The credit union saw assets grow by 12.6 percent at the end of May, as it climbs ever-closer to the $5 billion-asset mark.

July 3 -

New and used auto lending broke records, while HELOCs and second mortgages reached levels not seen since 2012.

July 3 -

Bank of America plans to lift its dividend above a level that Warren Buffett said would compel him to convert preferred shares into the lender's common stock.

June 29 -

How do the top-performing banks continue to post double-digit returns, despite having the same serious profit-dampening challenges as their peers? The answer isn't exactly straightforward.

May 31 Capital Performance Group

Capital Performance Group -

Want to make your bank a top performer? Spending can be a more effective strategy for success than cost cuts, if done smartly. That’s the lesson from banks with $2 billion to $10 billion of assets. ranked here by three-year average returns on equity.

May 31 -

How can banks improve performance while dealing with low interest rates and high regulatory expenses? One effective strategy is to bulk up, as shown by our annual ranking of the top 200 banks with less than $2 billion of assets.

April 26 -

Business confidence remains high, but Fed data shows commercial borrowing actually decelerated during the first quarter. Fortunately for banks, rate hikes have fattened margins.

April 7 -

JPMorgan Chase is shaking up the way it evaluates employees, introducing a mobile tool that lets workers across the sprawling organization send or receive instant critiques of their colleagues.

March 9 -

With U.S. Bancorp's leadership transition underway, the big question is whether it will deliver faster earnings growth — the one shareholder demand that has proven elusive.

February 21 -

The Louisiana company's call report also indicates that a steep fourth-quarter loss is looming

January 31 -

The French company will still have a majority stake after selling 25 million shares.

January 31 -

Barry Bekkedam was also fined $100,000 for a failed effort to bring in Tarp funds before NOVA failed in 2012.

January 30 -

Wendell Bontrager, formerly a regional president at Old National, will oversee operations, lending at strategy at Equity.

January 30 -

The Las Vegas-based credit union made $4.8 million in the fourth quarter, and $14.9 million in 2016.

January 25