-

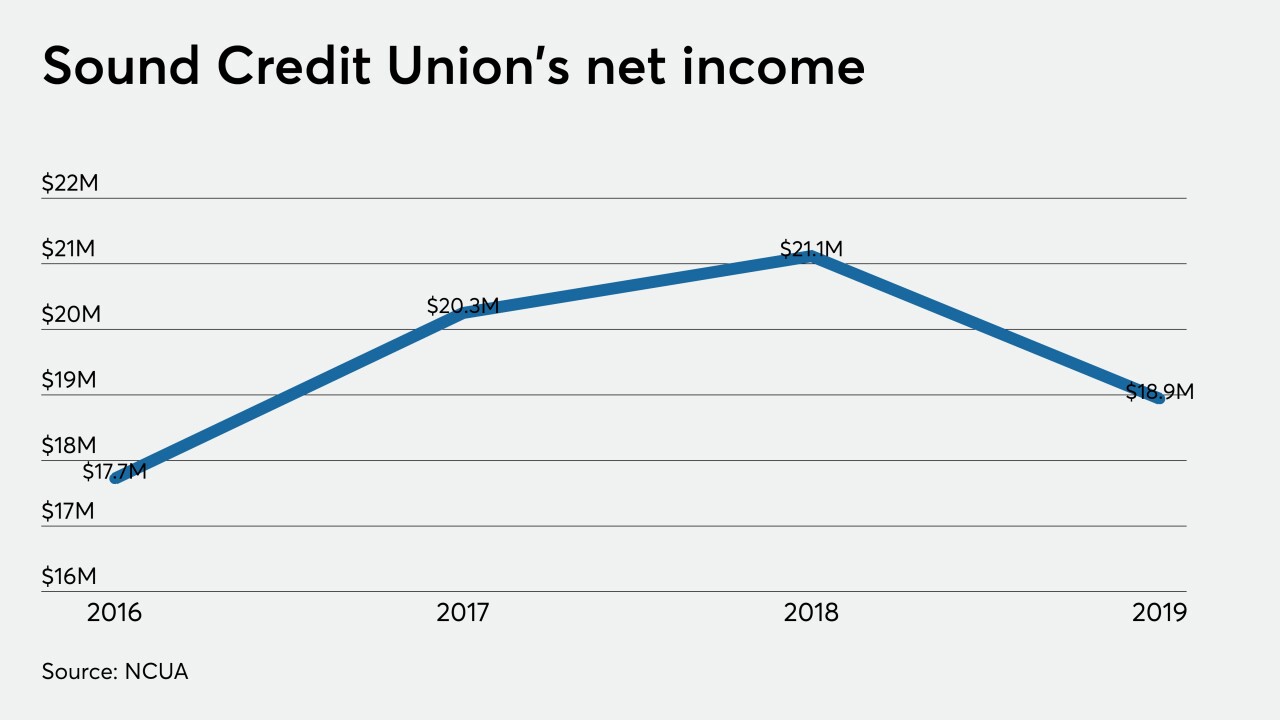

Fluke Employees Federal Credit Union has agreed to become part of Sound Credit Union and the transaction should close later this year.

March 24 -

The Fed announced several new lending facilities and virtually “unlimited” purchases of Treasury bonds; Ana Botín will donate the money to a coronavirus fund.

March 24 -

The credit union regulator's Office of Credit Union Resources and Expansion is making grants of up to $7,500 available to low-income designated institutions.

March 23 -

The coronavirus is changing how consumers interact in branches and banking online. Bank leaders should be prepared.

March 23

-

As Americans embrace social distancing, institutions may be forced to rethink board and annual membership meetings. The change could be lasting.

March 23 -

Banks cutting back on branch services — or closing stores outright — to slow spread of coronavirus; Trump administration to halt foreclosures as pandemic worsens; Wells Fargo hires TD's Ellen Patterson as general counsel; and more from this week's most-read stories.

March 20 -

The annual event is one of the industry's most high-profile sponsorships and is a major fundraiser for Children's Miracle Network Hospitals.

March 20 -

From paying $1,000 bonuses to branch employees to subsidizing child care expenses, banks are offering a slew of new perks for front-line employees still working and more paid leave for those who are ill or caring for sick family members.

March 20 -

JPMorgan Chase plans to make special payments to lower-paid employees and branch workers who don't have the ability to do their jobs from home.

March 20 -

The Fed must set up a "family financial facility" that sends billions to households and small businesses so banks don’t misdirect relief funds.

March 20

-

Institutions across the country are restricting entrance to their facilities to help curb the spread of COVID-19 but profitability issues could crop up if the pandemic drags on.

March 20 -

The voluntary agreements were meant to help the FDIC make staffing changes ahead of a wave of retirements. But concerns about the coronavirus means those plans will be put on hold.

March 19 -

The surge in online and mobile use is a high-profile test for the industry — and could foreshadow a permanent consumer shift.

March 19 -

Some institutions may rethink their sponsorship deals with professional sports teams now that several leagues have suspended their seasons because of the pandemic.

March 19 -

The Money Market Mutual Fund Liquidity Facility, established under the central bank’s emergency authority, echoes a version that was set up during the global financial crisis.

March 19 -

High-tech self-service channels can help credit unions effectively and efficiently meet members' needs during a time of social distancing.

March 18 Advanced Fraud Solutions

Advanced Fraud Solutions -

The central bank made two more moves to keep credit flowing; the Housing Policy Council plan would halt mortgage payments during the COVID-19 crisis.

March 18 -

As more states close schools and issue shelter-in-place directives, credit unions are increasingly shifting their staff to work-from-home arrangements.

March 18 -

The pandemic has upended staffing plans, sparked concerns about servicers’ capacity to handle the expected crush of missed payments, and even raised questions about their ability to stay afloat.

March 17 -

Lenders are concerned that the coronavirus outbreak will increase vacancies and add to credit risk.

March 17