-

This elite group of young wirehouse and regional employee representatives collectively generate more than $200 million in annual revenue.

February 1 -

The bank is working with a tech company to personalize customer communications using proprietary data. It's an alternative to cookies, which are becoming less viable as data privacy laws become stricter.

January 28 -

-

The expenses jumped 33% last quarter, which was generally in line with trends elsewhere in the credit card industry. The battle for new customers is “intense,” CEO Richard Fairbank told analysts.

January 26 -

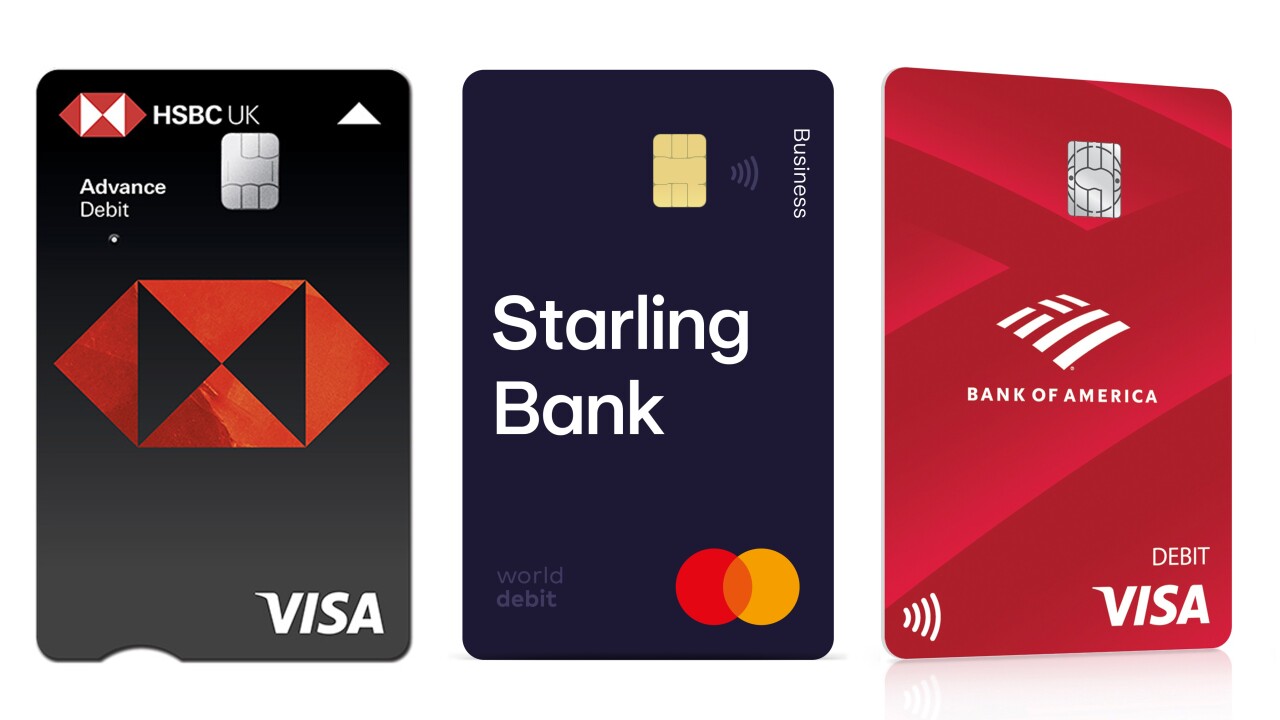

Switching from a horizontal layout — a relic of embossed account numbers — is an attempt by issuers like HSBC, Starling Bank and Bank of America to address accessibility challenges faced by customers with dementia, visual impairments and other conditions.

January 24 -

Bank of America revamped leadership across its wealth management business, placing more responsibilities on current heads Andy Sieg and Katy Knox.

January 21 -

The Tennessee bank reported an uptick in commercial lending during the fourth quarter. Executives pointed to the impact of a 2020 acquisition that allowed First Horizon to bulk up in in Florida, Georgia and Louisiana.

January 20 -

-

What else do banks need to do to achieve gender parity more quickly? What are the tech innovations that will be most impactful for the banking industry? What will the surviving banks look like a decade from now?

January 18 -

Citigroup CEO Jane Fraser is nearing the end of her organizational overhaul after deciding to cut loose retail-banking operations in Mexico. She will make the case at an upcoming investor day that the company is on the verge of producing stronger shareholder returns.

January 14 -

Following the recent resignations of the San Francisco bank’s co-CEO and chief operating officer, executives sought to project stability during an earnings call Friday. Employee morale is strong, and finding a leader who’s the right fit is more important than filling the job quickly, they said.

January 14 -

State Street Global Advisors, one of the world’s biggest asset managers, said all global companies in which it invests must have at least one woman on their boards to gain the firm’s support during the upcoming proxy season.

January 12 -

The Louisiana-based company is among a growing number of community banks that have taken on new talent in the wake of competitors' consolidation.

January 11 -

Gaye Erkan was widely seen as the front-runner to succeed founder James Herbert. Following her abrupt departure, the San Francisco bank must decide whether to find its next leader internally or recruit an outsider.

January 4 -

Hafize Gaye Erkan stepped down just weeks after the bank's founder, chairman and co-chief executive, James Herbert, announced a medical leave of absence. The San Francisco company named an interim CEO and said it will conduct a search for Herbert’s successor.

January 3 -

Branches across the country have closed temporarily, or switched to drive-thru service, as infections and quarantine rules have forced many bank workers to stay home.

December 30 -

A dispersed workforce presents added cybersecurity challenges resulting from employees accessing their organization’s networks through a home connection. This new reality reinforces the need for financial institutions to transform their digital infrastructure to guard against breaches.

December 22 ServiceNow

ServiceNow -

The central bank also signed off on Webster Financial’s acquisition of Sterling Bancorp and WSFS Financial’s purchase of Bryn Mawr Bank Corp. The moves come amid a political fight over the bank merger approval process.

December 17 -

The social network, now called Meta Platforms, is buying the South Dakota bank's name for $60 million.

December 17 -

The tax preparation company, which is building out its own financial services business, says Square's new brand "would improperly capitalize on the goodwill and consumer trust cultivated by [H&R] Block since 1955."

December 16