Recruiting

-

Americans are changing jobs in record numbers, posing a challenge for all employers. Here's how the Best Banks to Work For are redoubling their efforts to recruit and retain talent.

November 12 -

The card network chose the majority-Black city as the site of its new operations center in part to improve the racial makeup of its workforce and create a new path to leadership for minorities.

November 11 -

A focus on getting work done more efficiently has prompted these midsize banks to rearrange responsibilities, eliminate red tape and use technology to automate repetitive or tedious tasks. Some are also enhancing leadership development and increasing employee benefits amid an increase in turnover.

November 11 -

The largest of the 2021 Best Banks to Work For, those with more than $10 billion of assets, are trying new recruiting tactics and ramping up diversity efforts.

November 9 -

The smallest of the Best Banks to Work For have figured out how to thrive in an environment where many employees are working fully or partly from home. Some are using flexibility as a tool to stave off burnout.

November 9 -

Executives at the 90 institutions that made the ninth annual ranking are boosting benefits to attract new employees, amid intense competition for talent. They're also rethinking how they approach recruiting and increasing their diversity efforts.

November 8 -

This past year has proven that traditional leadership models will not take us forward. Attracting and retaining talent, especially diverse talent, depends on how well we listen to and understand the many changes in what employees value.

October 17 -

The company has already surpassed a five-year target announced in 2018, and set a new goal of hiring an additional 10,000 by 2025.

September 30 -

Some are taking extra measures, such as forming panels with minority representation to interview job candidates, to ensure that their recruitment practices don't exclude underrepresented groups.

September 10 -

PNC Financial Services Group said it will raise its hourly minimum wage to $18 an hour from $15, joining the ranks of firms increasing pay amid labor shortages.

August 30 -

CoinFund, a blockchain-focused investment firm, hired Christopher Perkins from Citigroup as managing partner and president to help bridge the gap to the traditional finance sector.

August 12 -

KeyCorp paid out bonuses to investment bankers of as much as $25,000 in June, according to people familiar with the matter, joining other financial firms that have boosted pay to retain talent.

August 2 -

Banks are struggling to hire and retain workers in a tight labor market. To stay competitive, they are making concessions on wages and remote work that likely would have been unnecessary before the pandemic.

August 1 -

Citigroup attracted close to $15 billion in net new money across its Asia Pacific wealth management business in the first six months of 2021, as hundreds of new hires helped the lender mark one of its strongest half years on record for the unit.

July 29 -

JPMorgan Chase is planning to more than double the advisors in its traditional broker business as the Wall Street giant plots an expansion in wealth management amid intensifying competition for rich clients.

July 23 -

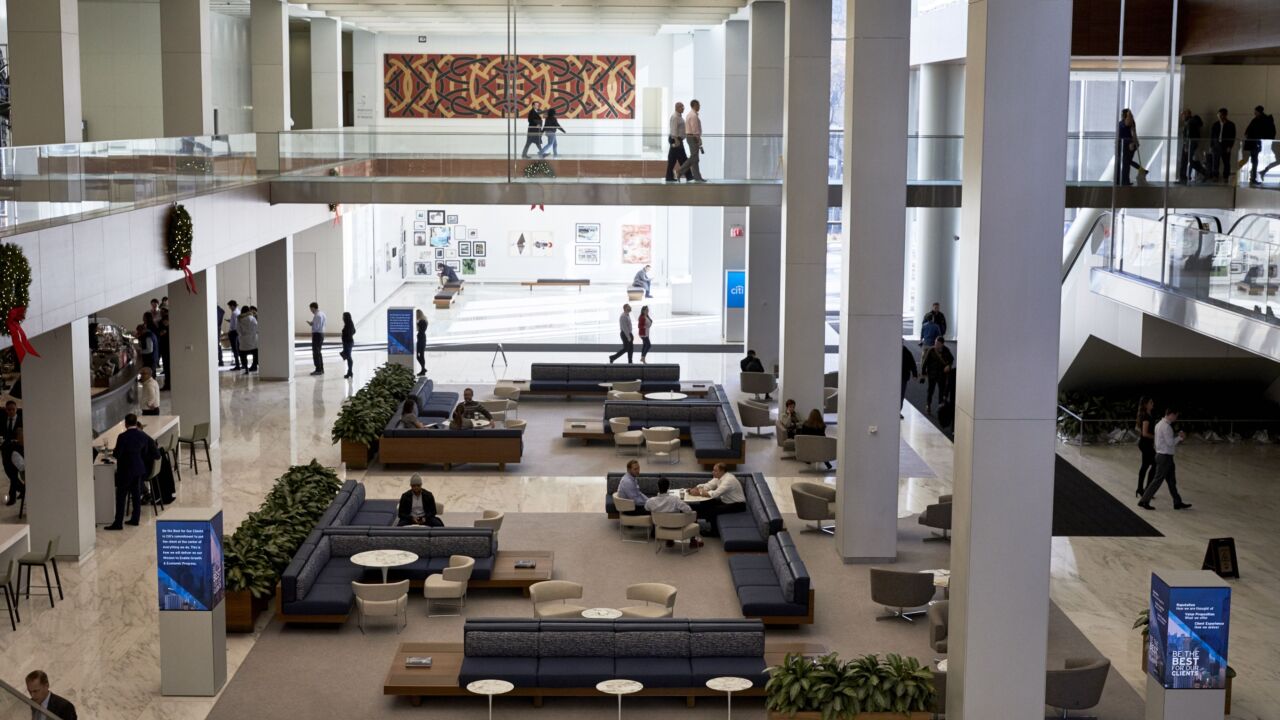

Citigroup joined rivals including UBS Group in touting its flexible work policies as a tool that will offer a competitive edge in recruiting and retaining top staff.

June 30 -

Most credit unions don’t offer planning services, and affiliating with the No. 1 IBD could help CUNA Brokerage change that, the firm’s president says.

June 22 -

JPMorgan Chase hired executives from Goldman Sachs Group and Wells Fargo to run a new arm focused on growth-equity investing and direct lending, as it seeks to give clients exposure to companies before they go public.

June 7 -

Will McLane is expected to help the London-based bank develop strategic initiatives, look for acquisition opportunities and form technology partnerships, a person familiar with the matter said.

June 1 -

The move follows four years of pay increases that brought the company’s minimum wage to an hourly $20 in 2020 from $15.

May 18