-

From falling originations to market share shifts for nonbanks and government loans, here's a look at key findings from the just-released 2017 Home Mortgage Disclosure Act data.

May 9 -

Mortgage borrowers collectively hold more equity in their homes than at any other time on record, but while some analysis shows they've been slow to borrow against this newfound wealth, credit union home equity lending was up significantly last year.

April 2 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

As interest rates go up, volume expected to drop to its lowest level since 2000; thieves can make cash machines release money “like winning slot machines.”

January 29 -

The credit union encouraged members to save on interest by converting loans they took out elsewhere to Educators Credit Union loans.

January 10 -

The U.S. is taking steps to stamp out the practice of servicemembers and veterans being pressured into taking mortgages they don't need, a move that officials say will lower consumer costs and could lead to financial penalties for lenders.

December 7 -

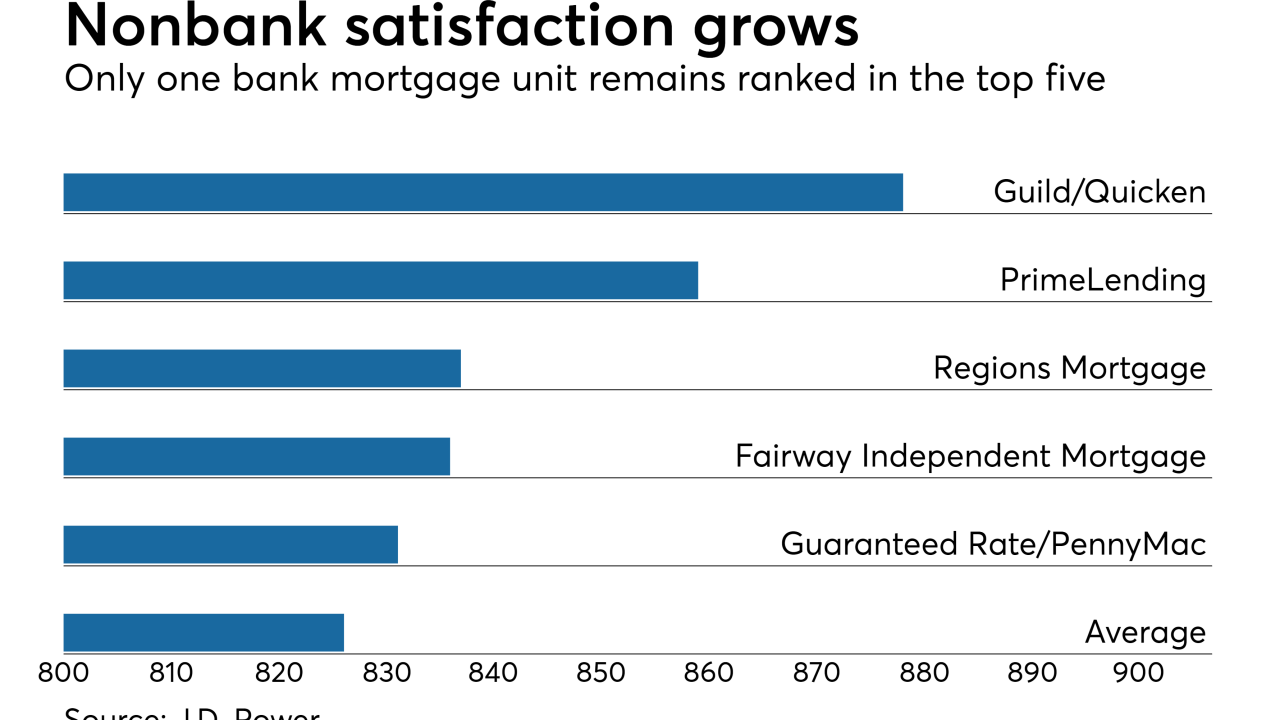

Despite digital mortgage advances, borrowers think it still takes too long to get a loan, J.D. Power finds in its annual customer satisfaction ranking of originators.

November 9 -

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 9 -

More FHA homeowners than expected are refinancing out of the program and into conventional mortgages, despite an increase in mortgage rates over the past year.

November 7 -

Taking a data-driven approach to marketing not only helped pump up originations -- it also helped save members money.

October 26 -

Navient has suspended stock buybacks to buy and expand a debt-refinancing firm that faces stiff competition from fintechs, and some shareholders aren’t happy.

October 18 -

The share of purchase and refinance loans originated by nonbanks are at their highest point since at least 1995, according to an analysis of new Home Mortgage Disclosure Act data.

September 28 -

The Home Affordable Refinance Program will now expire on Dec. 31, 2018, the FHFA said.

August 17 -

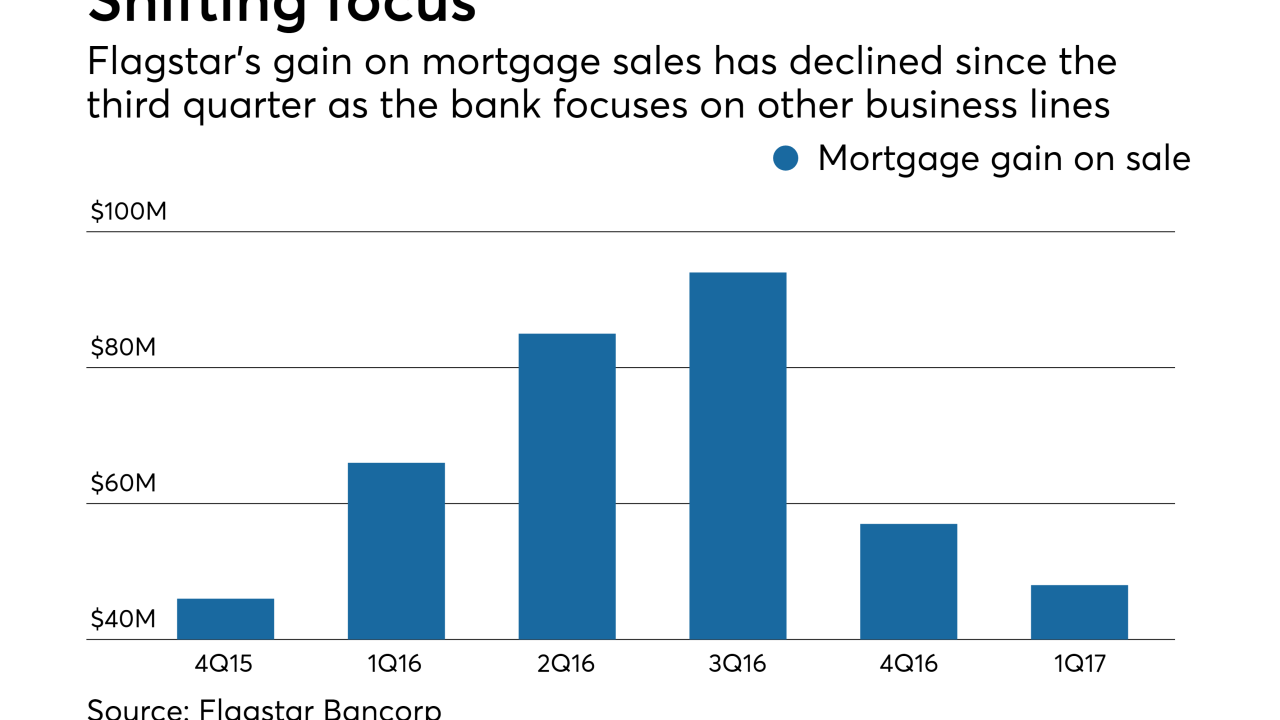

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

Fannie Mae has made three selling guide changes aimed at helping the growing number of borrowers with student debt qualify for home loans, and may begin testing similar proposals related to this goal.

April 25 -

With home values — and interest rates — rising, homeowners finally seem ready to tap into their homes' equity to fund long-delayed home-improvement projects.

January 30 -

With home values — and interest rates — rising, homeowners finally seem ready to tap into their homes' equity to fund long-delayed home-improvement projects.

January 30