-

Many institutions said they would close branches, operate drive-throughs only, limit lobby visits to appointments or take other protective steps. Yet others want to stay open to promote public confidence in the banking system.

March 16 -

While clients are uneasy about the spread of coronavirus, Kelly King touted the added volume his company has seen from lower rates.

March 10 -

The Fed’s decision to cut its benchmark interest rate amid growing coronavirus concerns is bound to have an impact on banks, but just how broad and how deep remains to be seen.

March 3 -

As the COVID-19 virus spreads globally, many U.S. financial institutions are said to be taking steps to protect employees and minimize disruption. But only a handful are sharing specifics, to avoid contributing to any public panic.

February 26 -

The game has changed and bank executives will have to do more homework before striking a deal.

February 19 CCG Catalyst

CCG Catalyst -

The tight labor market and public pressure to raise minimum wages are expected to nudge noninterest expenses upward in a year when the watchword is cost control.

February 13 -

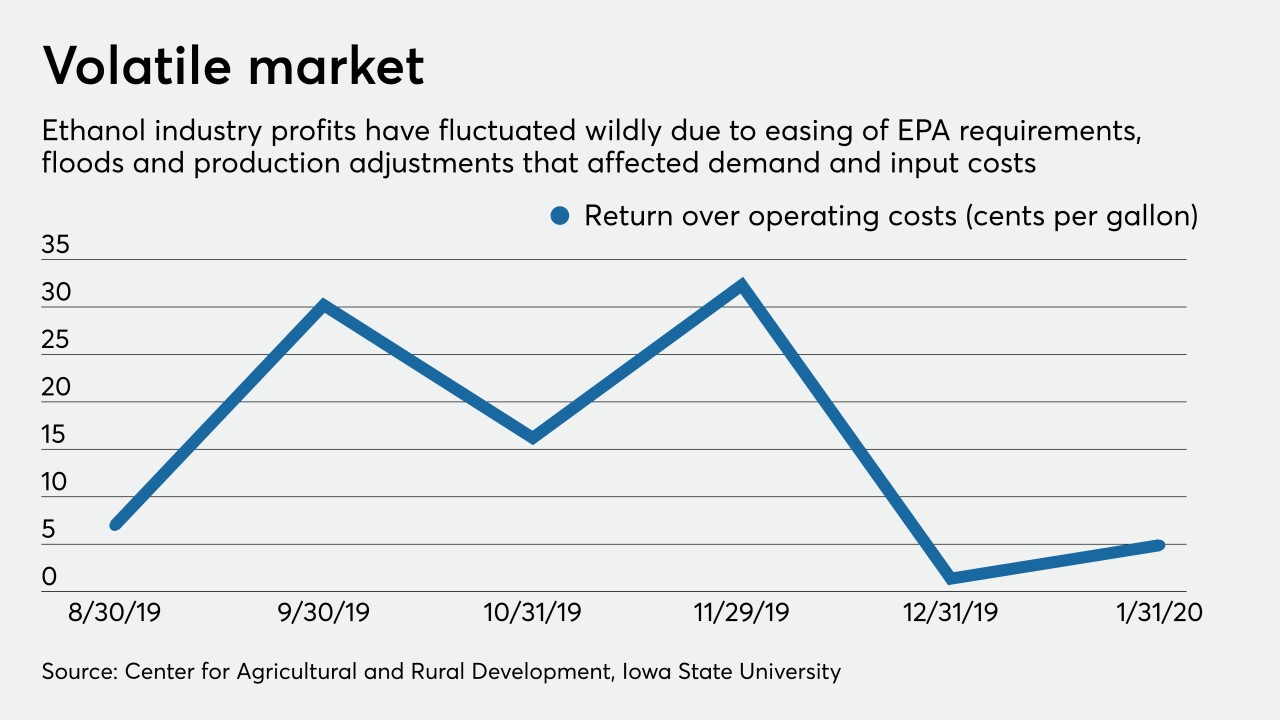

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

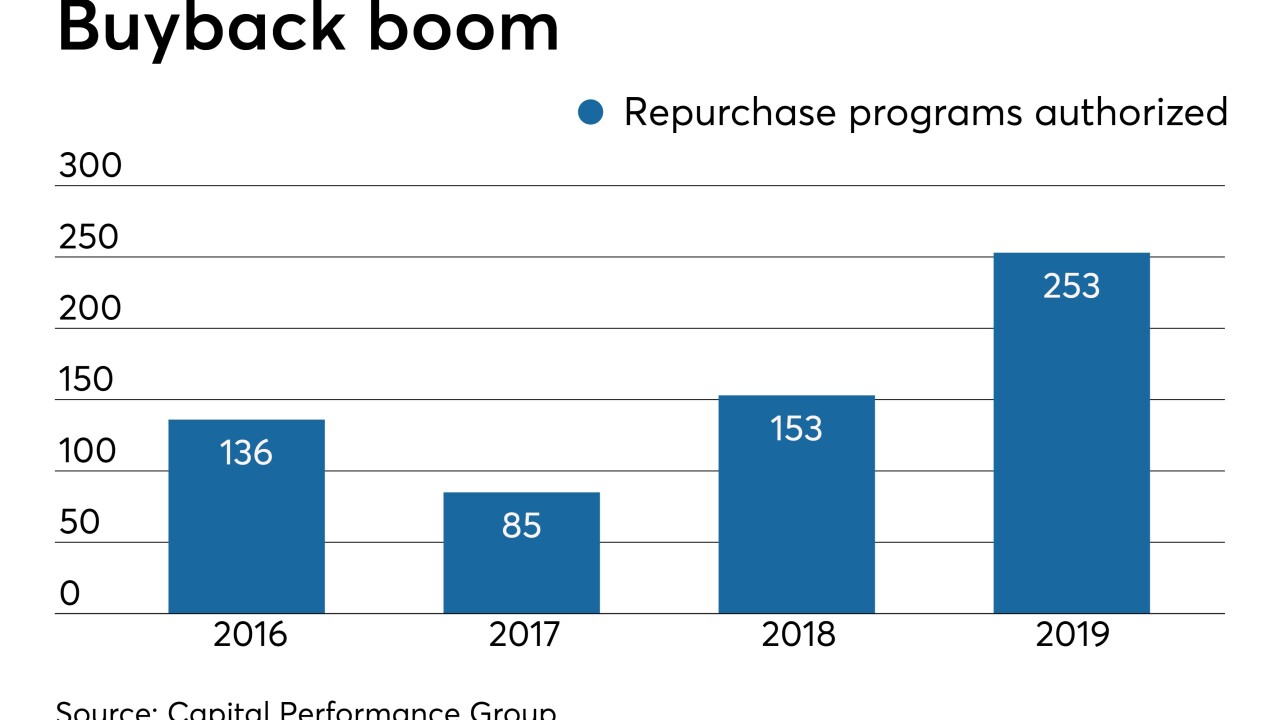

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

February 5 -

TD’s brand will appear on 80 Cardtronics machines in the New York area, while Fifth Third’s will appear on 139 ATMs in the Carolinas.

February 3 -

Newcomers Nymbus, Neocova, Finxact and Technisys and older competitors like Temenos, Infosys and Oracle are winning over community and regional banks by offering what some bankers describe as more flexible technology at fairer prices.

February 3

-

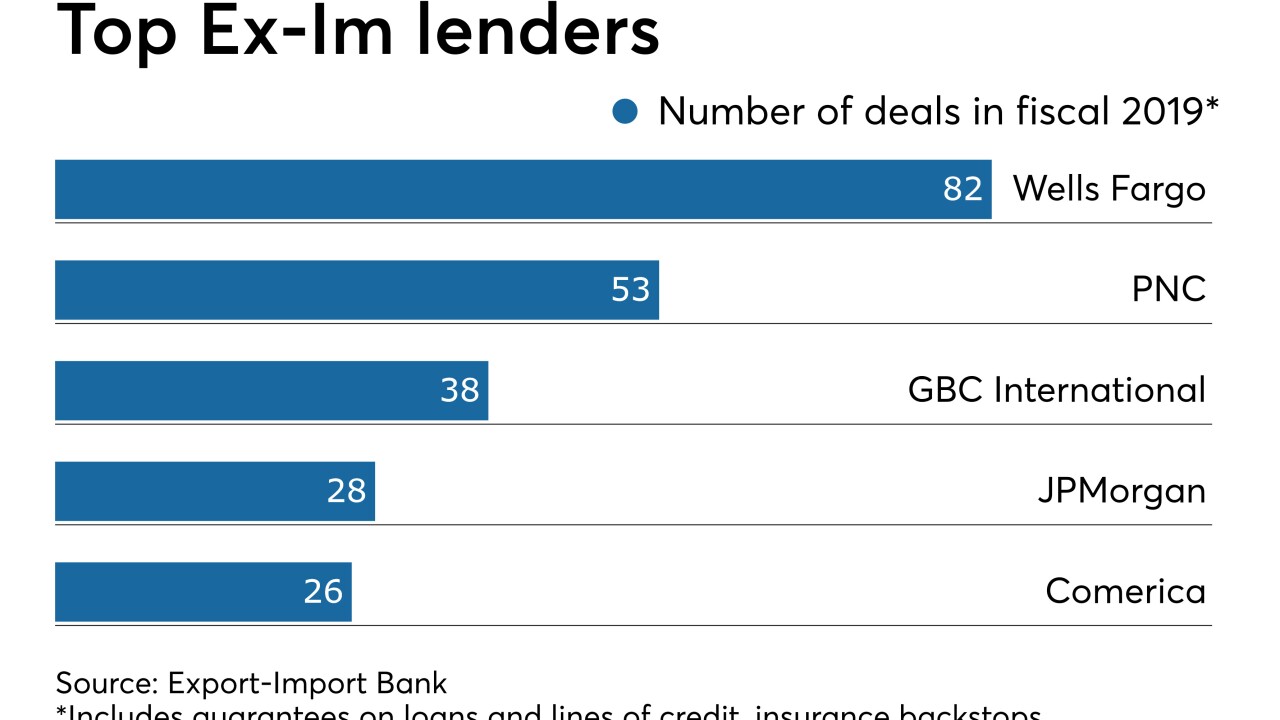

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30 -

The U.S. arm of Toronto-Dominion Bank said Matt Boss will oversee credit cards, residential loans and deposit products, among other areas.

January 27 -

As more consumers order in using such services as Uber Eats and Grubhub, restaurants are selling fewer desserts, drinks and other high-margin items, said CEO Rajinder Singh.

January 24 -

While most banks are shrinking their branch networks, the Cincinnati bank is approaching the day where its branch expansion in the Southeast will more than offset closings in its legacy markets, its CEO says.

January 22 -

The Dallas bank’s troubled energy loans reached a nearly two-year high as crude prices plummeted.

January 21 -

While the New York bank has a handle on deposit pricing, Joseph DePaolo said a new accounting standard will play tricks with how it addresses credit quality.

January 21 -

Total loans at Regions Financial fell slightly last year, but executives say a shift in consumer lending priorities and more aggressive C&I lending will start to pay off this year.

January 17 -

Citizens Financial Group’s fourth-quarter results highlight the challenges regionals face in generating top-line growth.

January 17 -

The Southeast banks expect to complete their merger by midyear, hit their savings targets and still be able to invest in growth, according to Bryan Jordan.

January 17 -

A tough fourth quarter seemed to foreshadow challenges in the year ahead for the nation’s fifth-largest bank.

January 15