-

The race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

June 5 -

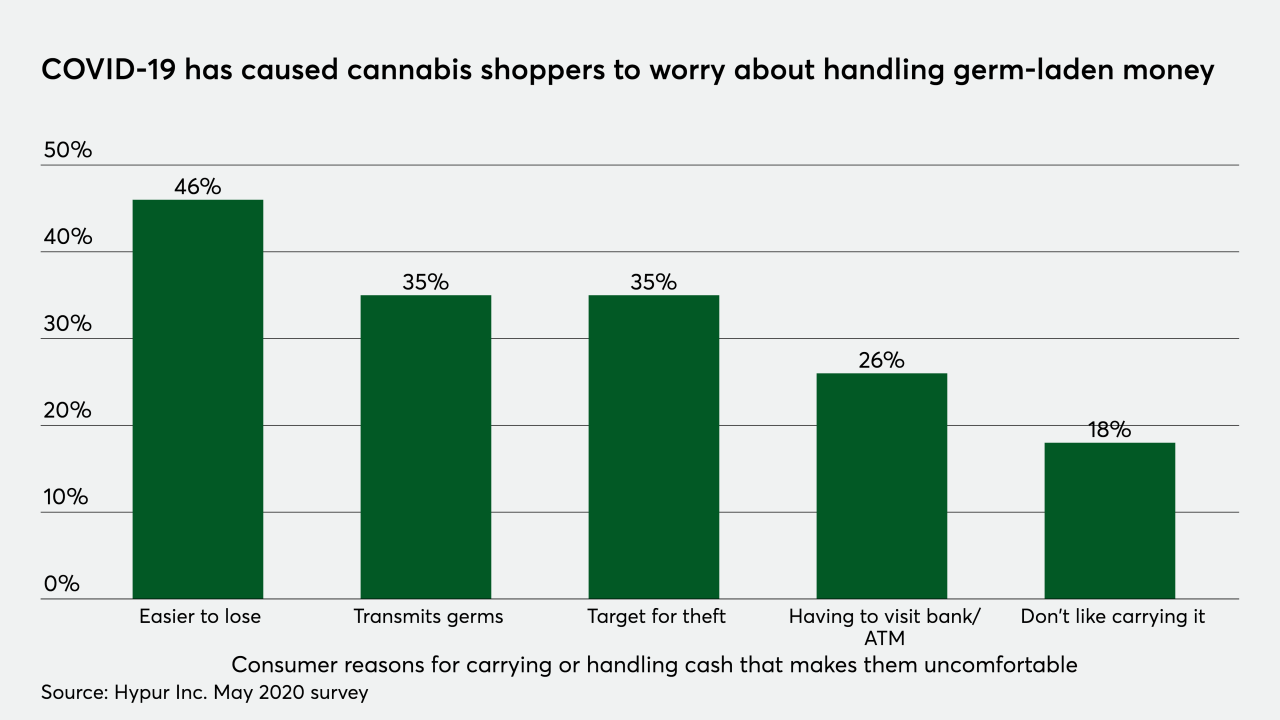

The coronavirus pandemic has changed the way many industries conduct business — and that's especially true of the legal cannabis industry, which was already struggling in the U.S. to find the best way to handle noncash payments.

June 4 -

Walt Disney Co. has at least temporarily cut several reservation and incentive features tied to its closed loop payment system, revealing the complexities of mixing health guidance with tourism.

June 4 -

The global coronavirus outbreak has up-ended daily life for many consumers, including where they shop and how they pay for things. The U.K. is no exception, as issues of health and hygiene have now been introduced as important factors when it comes to both planned and impulse shopping.

June 2 -

Starling Bank has raised £40 million (about $49 million) in its latest fundraiser as it steps up its support for small businesses, bringing its 2020 total to £100 million (about $123 million).

May 29 -

The modern mobile wallet no longer uses a card as a crutch. Instead, it sees it as an additional product that can add revenue from interchange, lending and loyalty.

May 29 -

Money transfer agent Remitly has launched a cash deposit service for its digital bank account holders on the Green Dot retailer network.

May 27 -

The coronavirus shutdowns have tossed businesses into disarray in numerous ways, most notably the tricky transactions that come with operating a restaurant as a drive-through for the first time.

May 27 -

Unlike past economic recessions where businesses and consumers have had to adjust their payment habits and debt levels over the course of months or quarters as the economy shrank, the coronavirus-induced economic crisis has forced many to make much more abrupt financial adjustments.

May 21 -

As many countries and U.S. states now begin to lift stay-at-home orders, fraudsters too are being unleashed to return to familiar targets such as bank branches, ATMs and retail stores.

May 20 -

The coronavirus pandemic has had an immediate impact on a wide swath of consumer spending habits and payment choices — some of which may remain in place for some time after the crisis subsides — as certain categories such as travel have fallen to the wayside and others such as grocery stores have risen as more consumers eat meals at home.

May 18 -

U.K. retail sales dropped in April by the most in at least a quarter of a century, according to industry figures that outline the impact of the shutdown on stores.

May 13 -

Even before the coronavirus outbreak, cybercriminals were shifting their attention away from point-of-sale terminals — but the retail industry still absorbs the most attacks seeking to compromise databases or networks.

May 13 -

The businesses that are open now are providing clues for payment hardware makers on how the retail landscape will look once the pandemic clears.

May 7 -

With the coronavirus pandemic forcing far more e-commerce transactions — and thus, more spending on cards instead of cash — loyalty and rewards are vital to creating lasting consumer habits.

May 6 -

Visa’s the first card company to push back the October deadline for U.S. gas station EMV compliance, but that’s just one of a mounting set of challenges petroleum merchants are facing because of the coronavirus.

May 4 -

The short-term coronavirus response revealed most merchants will need a more robust option for digital payments — and that’s prompting fresh investment in what was expected to be a slow period.

May 1 -

Amazon, Walmart and Facebook are using point of sale credit, deliveries and in-app payments to outflank Paytm in India, honing services that they see as vital to shaping the global economy's recovery.

April 29 -

Fintechs in the payments industry saw problems coming when the CARES Act’s SBA Paycheck Protection Program opened the floodgates for millions of coronavirus-stricken small businesses to apply for loans.

April 28 -

PayPal subsidiary iZettle is working with U.K. urban delivery platform Stuart to offer small businesses remote payment and delivery services during the coronavirus crisis.

April 22