-

Every week starts and ends the same way — with meetings where departments can share successes and challenges. It’s one way the payments company ensures cross-collaboration.

February 24 -

Japan’s Mizuho Bank will unveil a digital currency platform next month with an app enabling customers to pay at participating merchants with the new J-Coin Pay via a QR code.

February 22 -

Fuel payment options in the trucking industry have long relied on private-label cards from giants like Comdata and WEX, but a new challenger called Gas Pos is hoping to break in by capitalizing on new payments technology and the looming gas-station EMV migration.

February 22 -

Banks and Apple Pay have not always had easy partnerships, but a hot market for co-branded cards gives Goldman Sachs a chance to advance its consumer ambitions and Apple an opportunity to offset slumps in device sales.

February 21 -

Modern, global merchants need comprehensive, integrated frameworks that reduce costs, manage risk and exposure, provide direct connectivity and redundancy to optimize reliability and keep control over the customer experience closer to the merchant, according to Eric Rosenthal, managing director of the Americas at Rapyd.

February 21 Rapyd

Rapyd -

Battle lines are hardening in the fight against stores that eschew cash, as New York City’s Committee on Consumer Affairs plans to hear arguments Thursday on a proposal to ban cashless stores like Amazon Go.

February 14 -

Walgreens is expanding its payment options to include Alipay, Ant Financial’s mobile wallet, at most of its U.S. stores.

February 13 -

With the opportunities provided by contributions, metered paywalls and single article purchases, we have a wealth of solutions already at our fingertips, argues Cosmin Ene, CEO of LaterPay.

February 13 LaterPay

LaterPay -

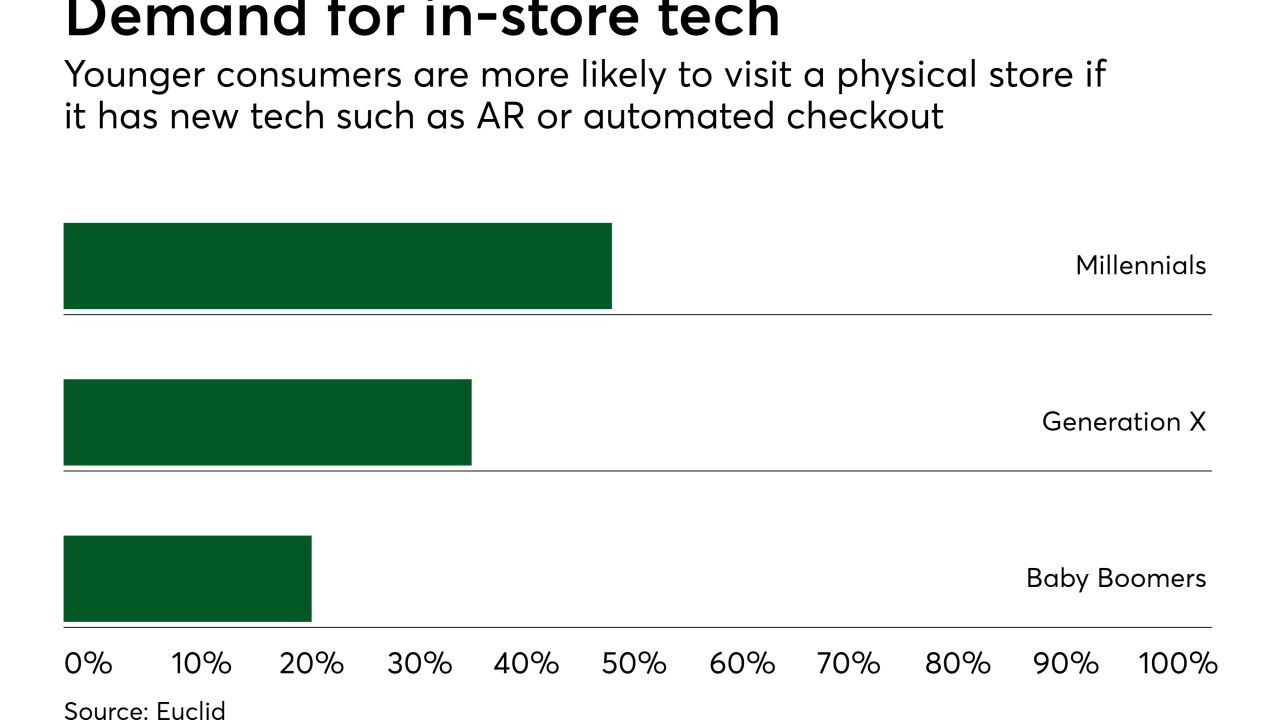

The future of payment is already drastically affecting the retail industry. While retailers will need to adapt their digital strategy yet again, this shift in consumer trends presents yet another opportunity for success, Steve Davidson, vice president of warranty products for Fortegra.

February 12 Fortegra

Fortegra -

ACI Worldwide has added new digital in-store payment capabilities for merchants as an upgrade to its current real-time, cloud-based payments software.

February 11 -

With the backing of these establishments and Federal Deposit Insurance Corporation (FDIC) protections, the cloud of uncertainty surrounding cryptocurrencies will begin to lift, writes Eric Solis, founder and CEO of MovoCash.

MovoCash

MovoCash -

It’s past time for every organization handling sensitive data to lock down their security, and to stop relying personally identifiable information to verify users, writes Ryan Wilk, vice president of customer success for NuData Security.

February 7 NuData Security

NuData Security -

The pushback on stores that don’t accept cash seems to be gaining momentum, with Philadelphia the latest municipality to consider a law that would ban cash-free shops.

February 6 -

Unattended retail, which traditionally meant vending machines, laundromats and very small mini-stores, is benefiting from the same trends that make Amazon's cashierless stores possible. But is there room in the market for both models?

February 5 -

Mobile technology is giving restaurants new ways to accept orders and payment, but largely ignores the social aspect of ordering a meal, particularly in office complexes.

February 4 -

One solution would be to move to infrastructures where card issuers can share the cost of offering rewards with the retailers — making it a win-win-win situation, according to Mehmet Sezgin, CEO and founder of myGini.

February 4 MyGini

MyGini -

Game day is a big day not just for athletes — anyone who sells pizza, chicken wings and beer will also win big if they have the capacity to handle all of the orders that come in. Many are turning to mobile and online technology to increase sales and remove friction from the payment process.

February 1 -

Cryptocurrency has struggled to be accepted for everyday payments, but it is finding opportunities in certain niches — such as gun sales.

February 1 -

The U.S. e-commerce explosion is driving about $150 billion annually in returns, and Returnly is riding the trend with a service to eliminate the waiting time for consumers to receive funds from items they plan to return to the merchant.

January 30 -

Fraudsters have evolved their strategies to focus on other flavors of fraud, and its actually encouraging to see retailers are still treating payment fraud as a top-of-mind concern as that evolution happens, according to Håkan Nordfjell, senior vice president of digital banking at Gemalto.

January 30 Gemalto

Gemalto