-

Consumers are using their debit and credit cards less, and that's causing a decline in interchange income for credit unions and banks.

April 30 -

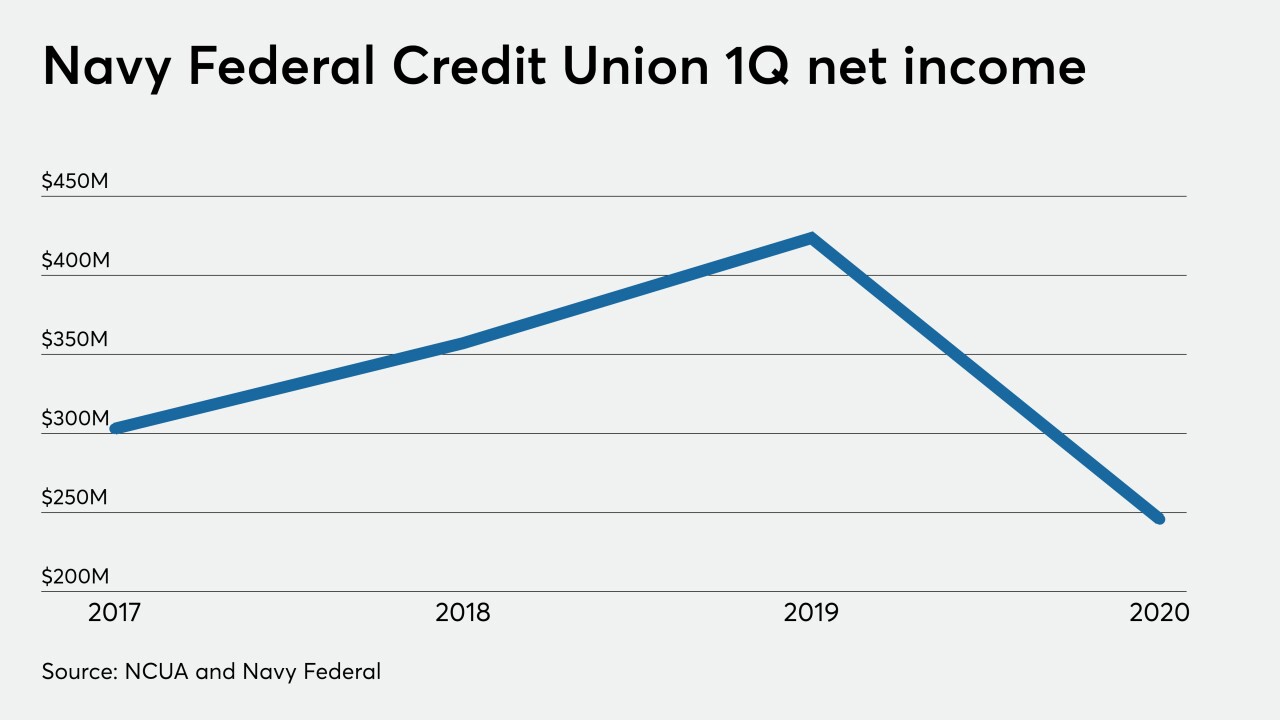

The largest credit union in the world increased its provision by 28% from a year earlier.

April 22 -

Citizens, Regions and others say business investments initiated before the COVID-19 pandemic, including technology improvements and new consumer offerings, are on track.

April 19 -

By helping borrowers now, banks hope customers can quickly catch up on payments once the coronavirus pandemic ends. If they can’t, interest income will remain low and charge-offs could pile up if the crisis drags on.

April 13 -

The Massachusetts-based credit union said its strong financial position will help it better serve members as the coronavirus crisis deepens.

April 7 -

WSFS, in an effort to catch up with bigger rivals, plans to upgrade digital channels in three years instead of five.

February 24 -

Community banks are entering the business as intermediaries to counter the pinch of low loan yields and intense competition on spread income.

February 23 -

The tight labor market and public pressure to raise minimum wages are expected to nudge noninterest expenses upward in a year when the watchword is cost control.

February 13 -

Certain loan segments are showing signs of deterioration, but consumer lending and digital banking are bright spots. Meanwhile, bankers are eyeing opportunities to improve efficiency, add scale and take advantage of M&A disruption. Here's what to expect from smaller regionals in the year ahead.

February 3 -

The company has revised its near-term forecasts for reducing expenses, citing delayed branch closings and a decision to spend more time testing systems ahead of conversion and integration.

January 30