-

The digital lender and payments platform is tailoring its affinity banking services for a new market.

March 12 -

Credit unions need to be thinking about pressure on net interest margins and declining revenues.

March 12 Credit Union National Association

Credit Union National Association -

Two years ago, Ellen Richey became Visa's vice chairman and chief risk officer, propelled to this role by over a decade of work that fundamentally changed how the average consumer makes a payment. Richey plans to retire this summer, ending a 40-year career in law and risk management.

March 12 -

Cybersecurity is about protecting the house, the corporation, the people, process, technology and the data, writes Harley Lippman, founder and CEO of Genesis10.

March 12 Genesis10

Genesis10 -

Wells Fargo CEO Tim Sloan said that the megabank has worked to address past issues and is equally committed to preventing new problems from arising, despite reports suggesting otherwise.

March 11 -

As machine learning generally benefits from lots of examples, by the time a model can be implemented to tackle the new threat, the threat has generally moved on, so frequent updates to models are necessary, writes Oliver Tearle, head of research at The ai Corporation

March 11 The ai Corporation

The ai Corporation -

The lab works with more than 200 data scientists to create access to affordable credit and help financial firms match products to customers, the company says.

March 7 -

The CUSO will work with AffirmX, which provides compliance and risk management offerings, on product development.

March 7 -

The league will work with Quatrro Processing Service to provide member credit unions with access to emerging technologies to combat fraud.

March 7 -

Banks moving past traditional card lending to compete on POS; ; five board members plan to leave before the bank’s May meeting.

March 7 -

The Federal Reserve voted Wednesday to keep the countercyclical capital buffer at its current level of zero, ending some speculation that the board could be looking at a possible increase.

March 6 -

Maria Teresa Tejada joined the bank Monday as chief strategic enterprise risk officer.

March 4 -

Leading a credit union can be exhausting. Implementing these best practices can help ease the burden.

March 1 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

A data-driven approach, regardless of human or machine involvement, is a state that organizations need to move to in order to maximize detection in the present and to ease the transition to a more primarily machine-driven future, writes Oliver Tearle, head of research at The ai Corporation.

March 1 The ai Corporation

The ai Corporation -

Payment crooks are behaving more like organized crime syndicates, and that's putting merchants, processors and banks on the defensive, argues Yossi Geller, a vice president at Paygilant.

February 25 Paygilant

Paygilant -

Quadriga Fintech Solutions Corp. is in danger of running out of cash to cover the cost of its restructuring unless the Vancouver-based crypto exchange can retrieve money from banks and payments processors, according to the firm overseeing the process.

February 22 -

By using the dark web as a cybersecurity tool, instead of an ungovernable threat, financial institutions can intercede and interdict compromised card data post-breach, pre-fraud, writes Ted Kirk, vice president of strategic partnerships for Advanced Fraud Solutions.

February 22 Advanced Fraud Solutions

Advanced Fraud Solutions -

Crooks are using techniques that move quickly, making AI a good bet when searching through many layers of transaction data, according to Jie Wu, a director at GoodData.

February 19 GoodData

GoodData -

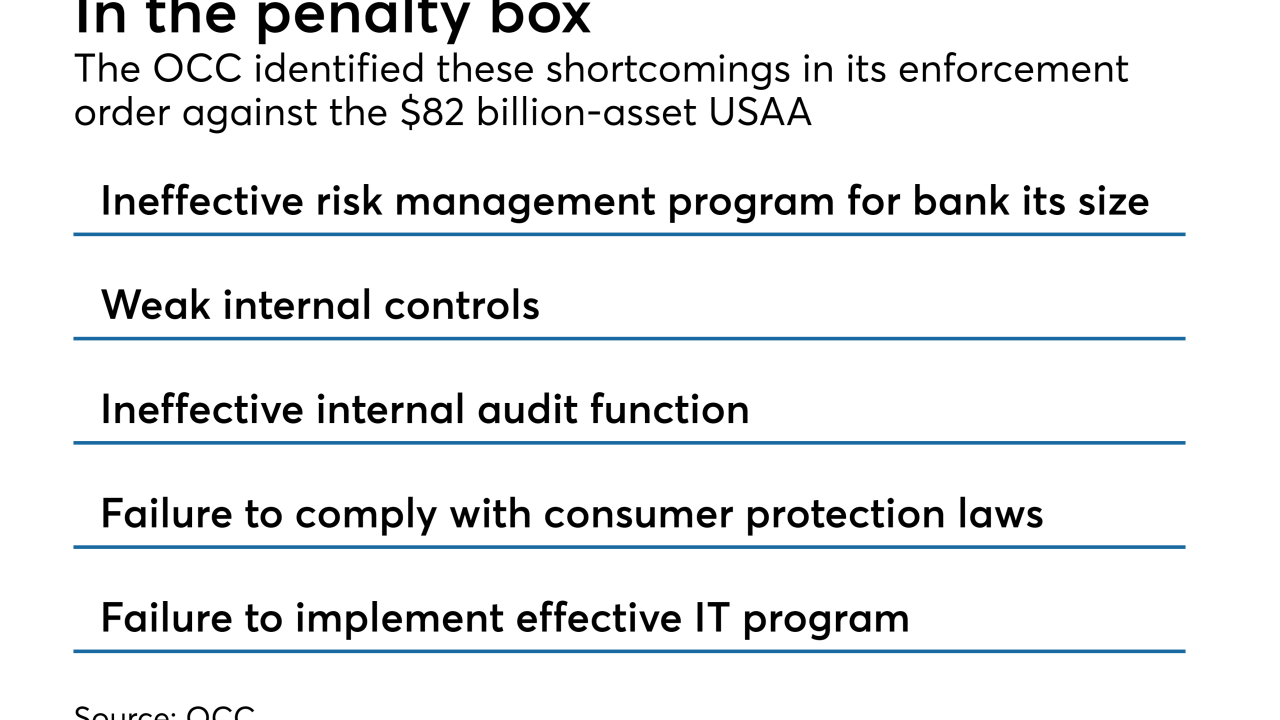

The enforcement action from the OCC comes on the heels of a CFPB consent order that said USAA reopened customers' accounts without consent and neglected stop-payment requests.

February 15 -

A security breach that left 24 million mortgage documents unprotected on a server is rekindling concerns about the risks posed by fourth parties.

February 13