-

The complexity of the migration is an opportunity to examine other elements of the payment experience, says TNS' Brian DuCharme.

August 12 TNS

TNS -

The rapid move online boosts false positives, false negatives and actual fraud, says Adara's Nguyen Nguyen.

August 12 Adara

Adara -

Many banks buy modeling tools from vendors to help detect new areas of risk, fraud and profitability without realizing their existing systems are capable of doing the same.

August 11 Regions Bank

Regions Bank -

A good security strategy is a lot like a healthy lifestyle for small businesses, says Sysnet's Sandra Higgins.

August 11 Sysnet Global Solutions

Sysnet Global Solutions -

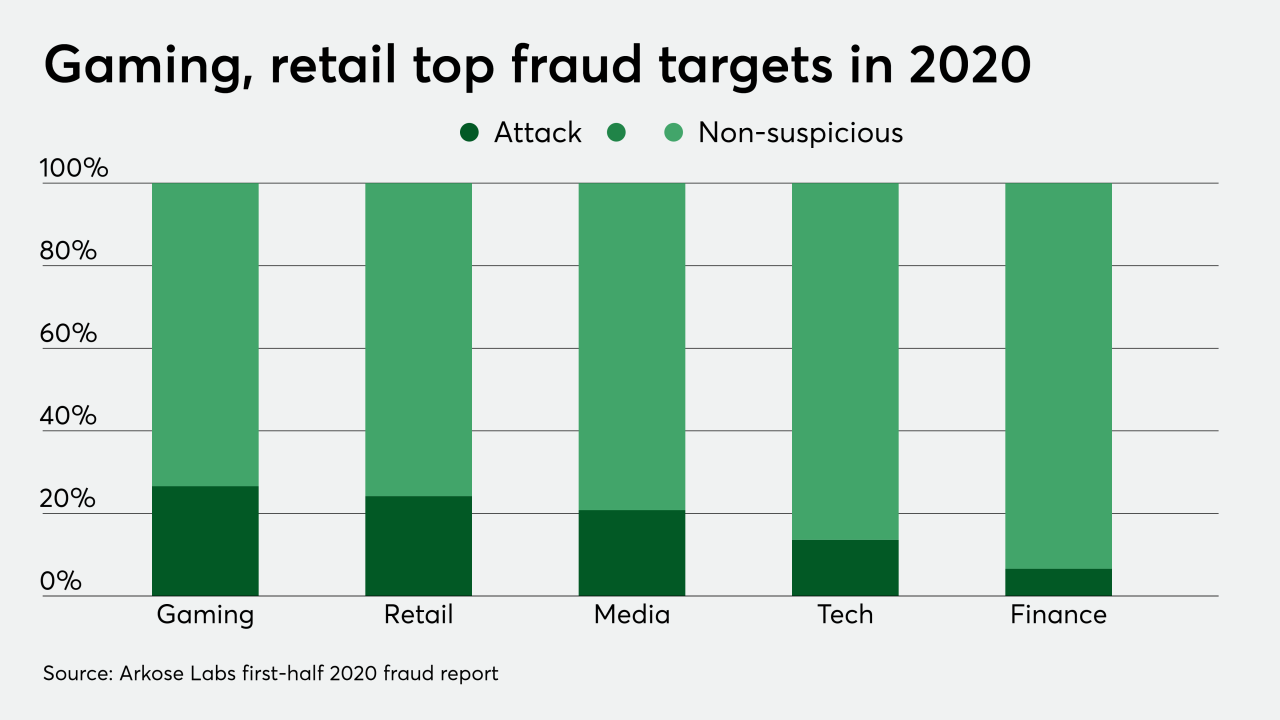

Video games provide a rare escape to locked-down consumers, and many modern games are so sophisticated that they support their own digital storefronts — with the potential for real-world losses if fraudsters find a way in.

August 7 -

One of the few clear implications from the initial two months of the lockdown with the changes to consumer behavior and the uncertainty ahead is the imperative for organizations to regain clarity on credit risk by obtaining a more complete picture of consumer creditworthiness, says LexisNexis Risk Solutions' Ankush Tewari.

August 6 LexisNexis Risk Solutions.

LexisNexis Risk Solutions. -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

It’s likely that our dependence on digital channels will have become the norm, which means that security protocols like EMV 3-D Secure should also become part of the new status quo, says Entersekt's Simon Armstrong.

August 5 Entersekt

Entersekt -

Scams have ranged from false, pseudo-scientific charities raising money for “cures” or “medical research," to fraudsters preying on individuals who want to donate to medical and emergency staff in hospitals or care facilities, says The ai Corporation's James Crawshaw.

August 4 The ai Corporation

The ai Corporation -

EventBot is a particularly frightening development since it hides in an altered version of an app that seems legitimate and steals unprotected information in banking, wallet, payment and cryptocurrency mobile apps, says Appdome's Tom Tovar.

August 4 Appdome

Appdome -

Lexicon Bank in Las Vegas, whose chairman was a professional gambler, is actively courting poker players to open deposit accounts for their tournament winnings.

July 30 -

As demand for secure and seamless digital payments increases, financial institutions must prioritize a digital-first payments strategy that incorporates the latest trends, says CSI's Matt Herren.

July 30 CSI

CSI -

Business size and payment volume all play a role in what's needed for compliance, says 2Checkout's Madalin Cojocariu.

July 29 2Checkout

2Checkout -

Realize that everyone is your customer; your members, employees, partners, vendors and the general population, says OBI Creative's Mary Ann O'Brien.

July 28 OBI Creative

OBI Creative -

Factoring in customer behavior as an element in the risk profile can provide financial institutions with better assurances in their lending practices, consultants Maria Arminio and Bo Berg say.

July 27 Avenue B Consulting

Avenue B Consulting -

Nobody likes making errors or admitting they make them, but they are a fact of life when you’re sending payments, says Nvoicepay's Deirdre Christensen.

July 24 Nvoicepay, a Fleetcor company.

Nvoicepay, a Fleetcor company. -

In this uncertain environment, companies that are nimble and adaptive are rising to the challenge, finding new ways to navigate the crisis and embracing innovative electronic solutions, says Bank of America's Daniel Stanton.

July 24 Bank of America

Bank of America -

See this crisis not as a nail in your corporate coffin but as an opportunity to move your team and members forward, said OBI Creative CEO Mary Ann O'Brien.

July 22 OBI Creative

OBI Creative -

The biggest takeaway from this hack should be large digital media companies reworking their admin controls

July 22 LunarCrush

LunarCrush -

Securities laws, in spite of their shortcomings, exist for very good reasons: to regulate the fair exchange of units of ownership, to protect individuals from fraud or exploitation and to identify bad actors and hold them accountable.

July 20