-

Recent tweaks to Reg D have blurred the line between checking and savings accounts, opening up the possibility for new innovation in those products.

May 20 -

There were few fireworks at Wells Fargo’s first annual meeting under new CEO Charlie Scharf; billionaire investor and entrepreneur Mark Cuban pitches Fed-backed overdraft protection; as hotels sit empty, loan delinquencies pile up; and more from this week’s most-read stories.

May 1 -

The central bank said customers will be able to make more transfers and withdrawals "at a time when financial events associated with the coronavirus pandemic have made such access more urgent."

April 24 -

A new survey shows more Americans are tapping into their savings as job losses rise and the pandemic's impact on the economy gets worse.

April 6 -

The insurance and research company expects the U.S. to fall into a recession as unemployment spikes and the GDP declines.

April 2 -

Bankers groups are keeping close tabs on a host of legislative and gubernatorial proposals, from prize-linked savings accounts in Iowa to rent control in Massachusetts to a slew of bills modeled after California's recently passed data privacy law.

February 11 -

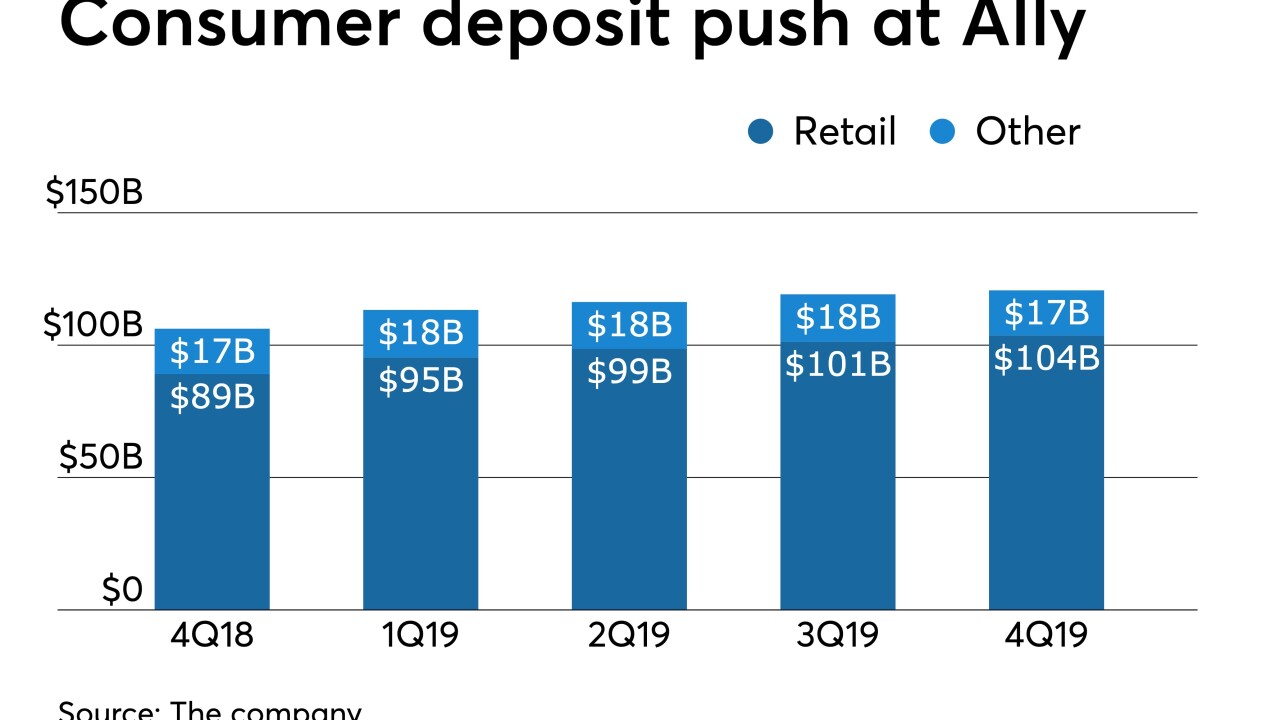

The digital-only bank found customers are anxious about their inability to set aside money, so it decided to offer automated savings tools, consumer chief Diane Morais says. It is one of the larger companies to do so.

February 7 -

The new features use automatic transfers to encourage account holders to build savings faster and with less effort.

February 5 -

Bask Bank will offer customers AAdvantage miles for every dollar saved.

January 27 -

This is the second time in five years the California-based credit union has issued a giveback, for a total of $38 million.

November 20 -

The program will be called Bucks for Buckeyes and will be offered in partnership with the Minnesota Credit Union Network.

October 30 -

BB&T-SunTrust merger closing could slip into 2020; how “the most feared freshman” is shaking up House Banking panel; consumers are split about trusting Amazon, Google with their savings; and more from this week’s most-read stories.

October 18 -

Two new surveys have found that most consumers would prefer to stash their cash in traditional banks. But there's one group of savers who would be very comfortable opening accounts with tech giants if given the opportunity.

October 11 -

Through the initiative, more than two dozen savings and credit groups have been established to serve more than 400 Venezuelans and Colombians.

August 27 -

The new products, along a 2% cash-back credit card, are aimed at helping customers build savings and reduce debt.

August 5 -

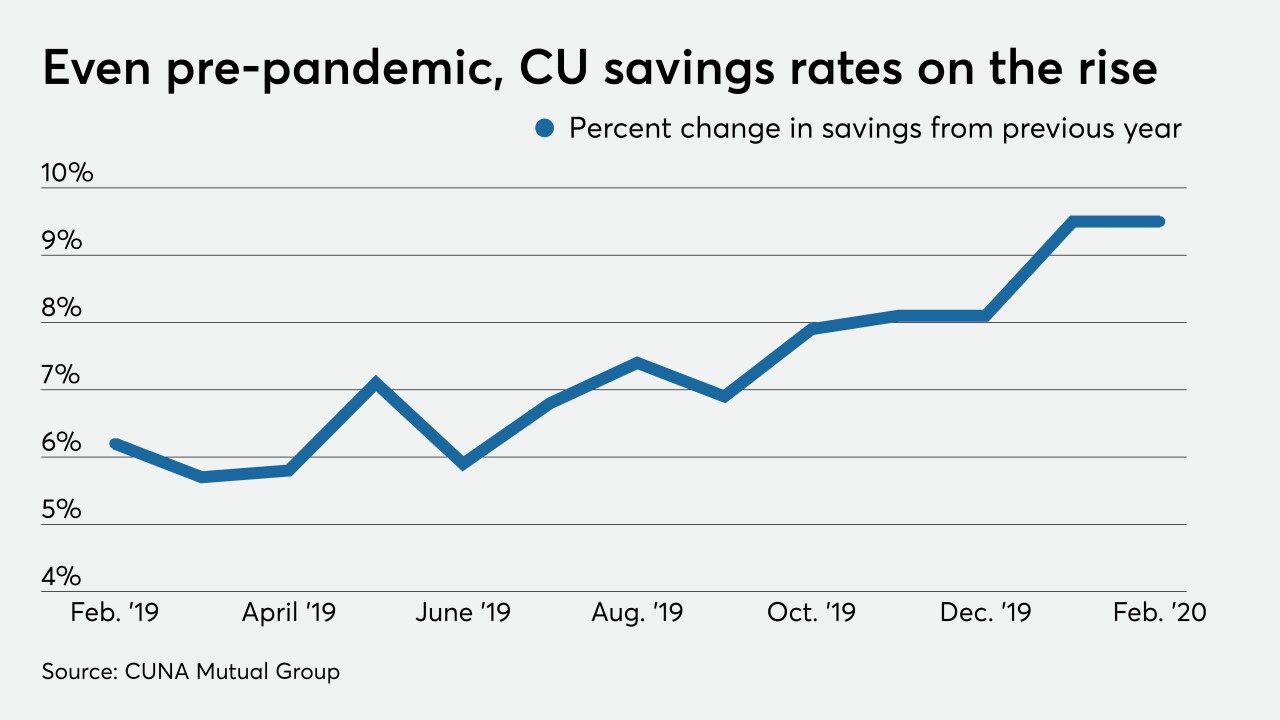

With the loan-to-savings ratio at its highest point in four decades, some CUs have limited options to boost their funding.

August 5 -

Loan balances at the end of the second quarter were up by double digits from a year earlier for the Honolulu-based institution.

August 2 -

Lending at credit unions in the Peach State increased by just 0.2%, down from 0.8% growth recorded a quarter earlier.

July 26 -

Several wealth management firms, including Marcus by Goldman Sachs and Wealthfront, have launched banking products to complement their investment services.

July 23 -

Lawmakers have just three weeks before their August recess to make a host of decisions on issues related to credit unions.

July 8